[ad_1]

Environment friendly monetary administration is essential for enterprise and private success. As expertise continues to evolve, synthetic intelligence has emerged within the accounting business, providing modern options to streamline processes, scale back errors, and supply useful insights.

This text explores the highest AI accounting instruments which can be altering how companies deal with their funds. From automating routine duties to offering real-time analytics, these cutting-edge platforms are designed to boost accuracy, save time, and empower monetary decision-making. Whether or not you are a small enterprise proprietor, a freelancer, or an accounting skilled, these AI-powered instruments provide a variety of options to fulfill numerous wants and rework monetary administration practices.

Vic.ai is a sophisticated AI-powered accounting device that revolutionizes accounts payable processes. By leveraging refined machine studying algorithms, Vic.ai automates and streamlines numerous finance duties, with a specific deal with accounts payable. The platform’s clever system can robotically ingest, classify, and course of invoices with distinctive accuracy, considerably lowering the necessity for handbook knowledge entry and nearly eliminating human errors within the course of.

One in every of Vic.ai’s standout options is its potential to imitate human decision-making, enabling it to handle your entire accounts payable workflow from begin to end autonomously. This functionality permits finance groups to shift their focus from routine duties to extra strategic actions resembling monetary evaluation, money circulate forecasting, and vendor relationship administration. Vic.ai’s steady studying mechanism ensures that the AI adapts to every group’s distinctive processes and necessities over time, resulting in more and more environment friendly and correct operations.

Key options:

- Autonomous bill processing that reinforces productiveness by as much as 355%

- AI-driven PO matching that detects discrepancies and ensures exact matching

- Streamlined approval workflows that scale back handbook effort and speed up bill approvals

- Clever cost processing that identifies early cost reductions and minimizes fraud dangers

- Actual-time analytics and insights on invoices, workforce efficiency, and enterprise developments to help data-driven determination making

Invoice is a complete cloud-based accounting software program designed to optimize accounts payable and accounts receivable processes for companies of all sizes. The platform harnesses the ability of AI and machine studying to simplify bill administration, streamline approval workflows, and automate cost processing. By doing so, Invoice considerably reduces the time spent on monetary duties whereas minimizing errors that usually happen in handbook processes.

One in every of Invoice’s main strengths lies in its seamless integration capabilities with fashionable accounting techniques, guaranteeing real-time knowledge synchronization and offering enhanced visibility into monetary operations. The platform’s user-friendly interface, coupled with its customizable choices, makes it a sexy alternative for companies trying to modernize their monetary processes. Invoice empowers organizations to realize higher management over their money circulate, strengthen vendor relationships, and allocate extra assets to strategic initiatives moderately than routine monetary duties.

Key options:

- Streamlined bill administration that automates bill seize, knowledge entry, and categorization

- Customizable approval workflows that permit setup of multi-level approval processes

- Versatile cost choices supporting numerous strategies together with ACH, EFT, digital playing cards, and checks

- Worldwide cost processing enabling transactions in over 130 international locations

- Seamless integration with fashionable accounting software program like QuickBooks, Xero, and NetSuite

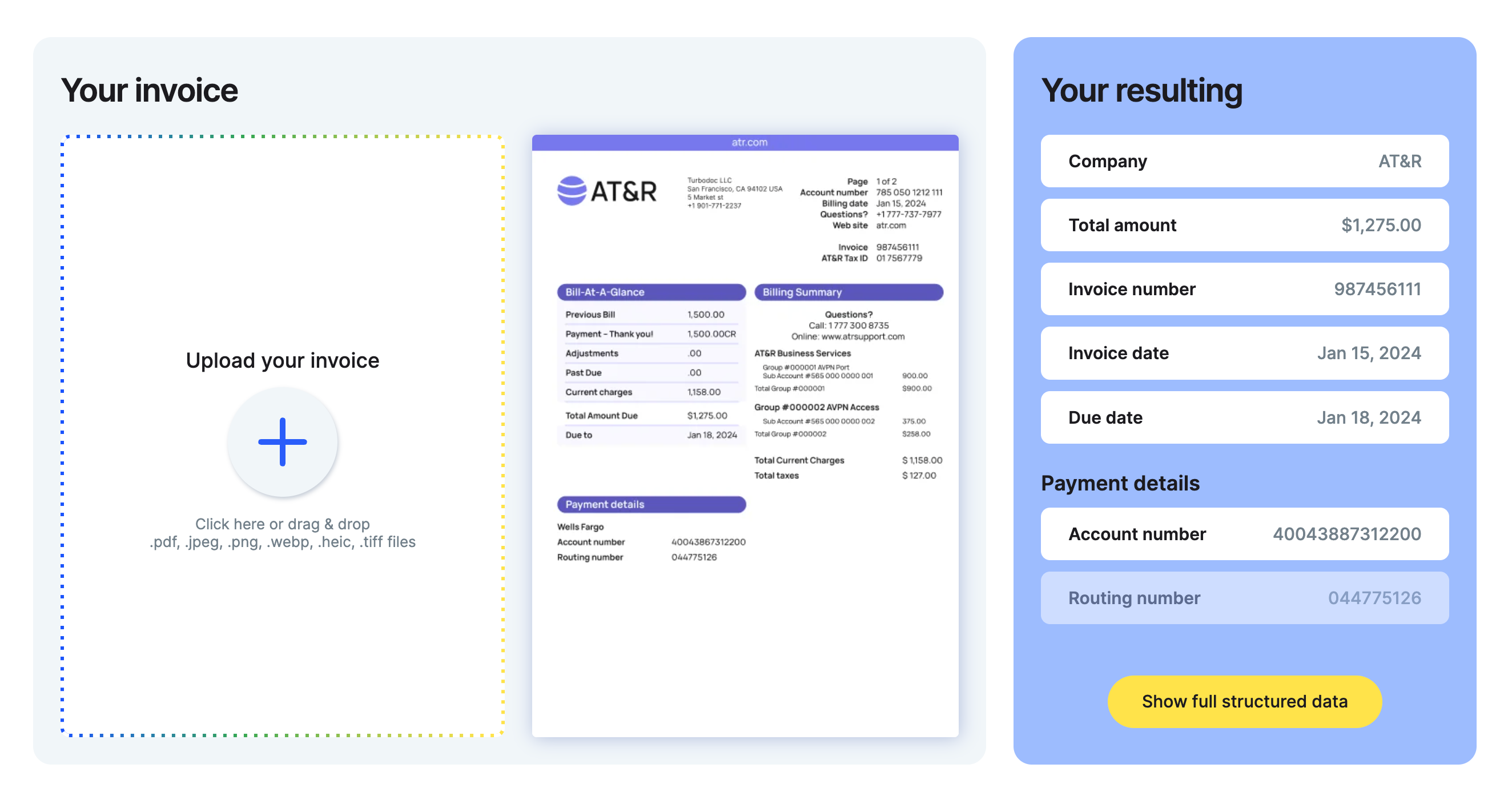

TurboDoc is an modern AI-powered accounting device that focuses on automating bill and receipt processing. The platform leverages cutting-edge optical character recognition (OCR) expertise to precisely extract knowledge from paperwork in numerous codecs. This superior functionality eliminates the necessity for handbook knowledge entry, considerably lowering the effort and time required for processing monetary paperwork whereas concurrently minimizing the danger of human error.

Past its core OCR performance, TurboDoc affords a user-friendly interface that organizes extracted info in an intuitive method. This function permits companies to effortlessly analyze knowledge, assemble reviews, and examine monetary info throughout totally different intervals or classes. TurboDoc’s emphasis on knowledge safety is obvious in its use of enterprise-level encryption to guard delicate monetary info. Moreover, the platform’s seamless integration with fashionable electronic mail providers like Gmail permits customers to automate doc processing instantly from their inboxes, streamlining workflow and enhancing total productiveness.

Key options:

- Superior OCR expertise that processes paperwork in a median of 1.2 seconds per web page

- Excessive-accuracy knowledge extraction with a 96% accuracy price

- Seamless Gmail integration for automated doc processing from inboxes

- Person-friendly dashboard for simple knowledge evaluation and report meeting

- AES256 enterprise-level encryption for safe knowledge storage on USA-based servers

Indy is a complete productiveness platform meticulously designed to cater to the distinctive wants of freelancers and impartial professionals. Whereas not solely an accounting device, Indy affords a strong suite of economic administration options alongside different important enterprise capabilities. This all-in-one strategy permits freelancers to handle numerous features of their enterprise, together with proposals, contracts, invoicing, time monitoring, job administration, and shopper communication, all from a single, user-friendly interface.

One in every of Indy’s most compelling attributes is its affordability, making it an accessible possibility for freelancers at numerous phases of their profession. The platform affords a free plan with important options, in addition to competitively priced paid plans that present entry to extra superior instruments. Indy’s intuitive design and ease of use make it a sexy alternative for freelancers who need to effectively handle their enterprise funds with out the necessity for intensive coaching or a steep studying curve. By consolidating a number of enterprise capabilities into one platform, Indy helps freelancers save useful time and keep organized, permitting them to focus extra on their core enterprise actions and shopper relationships.

Key options:

- Customizable proposal and contract templates with authorized vetting

- Built-in invoicing and cost processing by way of fashionable gateways

- Time monitoring device for recording billable hours

- Venture administration options for job group

- Constructed-in shopper communication and file sharing capabilities

Docyt is a state-of-the-art AI-powered accounting automation platform designed to enhance monetary administration for small companies and accounting professionals. By harnessing the ability of superior generative AI capabilities, Docyt automates a variety of accounting processes, together with knowledge seize, workflow administration, and real-time reconciliation. This complete strategy gives companies with unprecedented visibility and precision of their monetary operations, enabling extra knowledgeable decision-making primarily based on up-to-date and correct monetary insights.

On the core of Docyt’s performance are its clever algorithms, which possess the flexibility to learn and perceive bills with human-like comprehension. This superior expertise precisely extracts info from receipts and invoices, categorizing transactions with a excessive diploma of confidence. Docyt’s cutting-edge platform permits true real-time accounting, a function that units it aside from many conventional accounting options. Moreover, Docyt seamlessly integrates with current accounting techniques, guaranteeing a easy transition and minimal disruption to established processes. The platform’s user-friendly interface, mixed with its highly effective automation options, positions Docyt as a game-changer in the way in which companies handle their accounting capabilities.

Key options:

- AI-driven knowledge seize from receipts, invoices, and different monetary paperwork

- Automated accounting workflows for duties like bill processing and approval routing

- Actual-time monetary knowledge reconciliation for up-to-date info entry

- Complete monetary insights and reporting capabilities

- Seamless integration with current accounting techniques and enterprise instruments

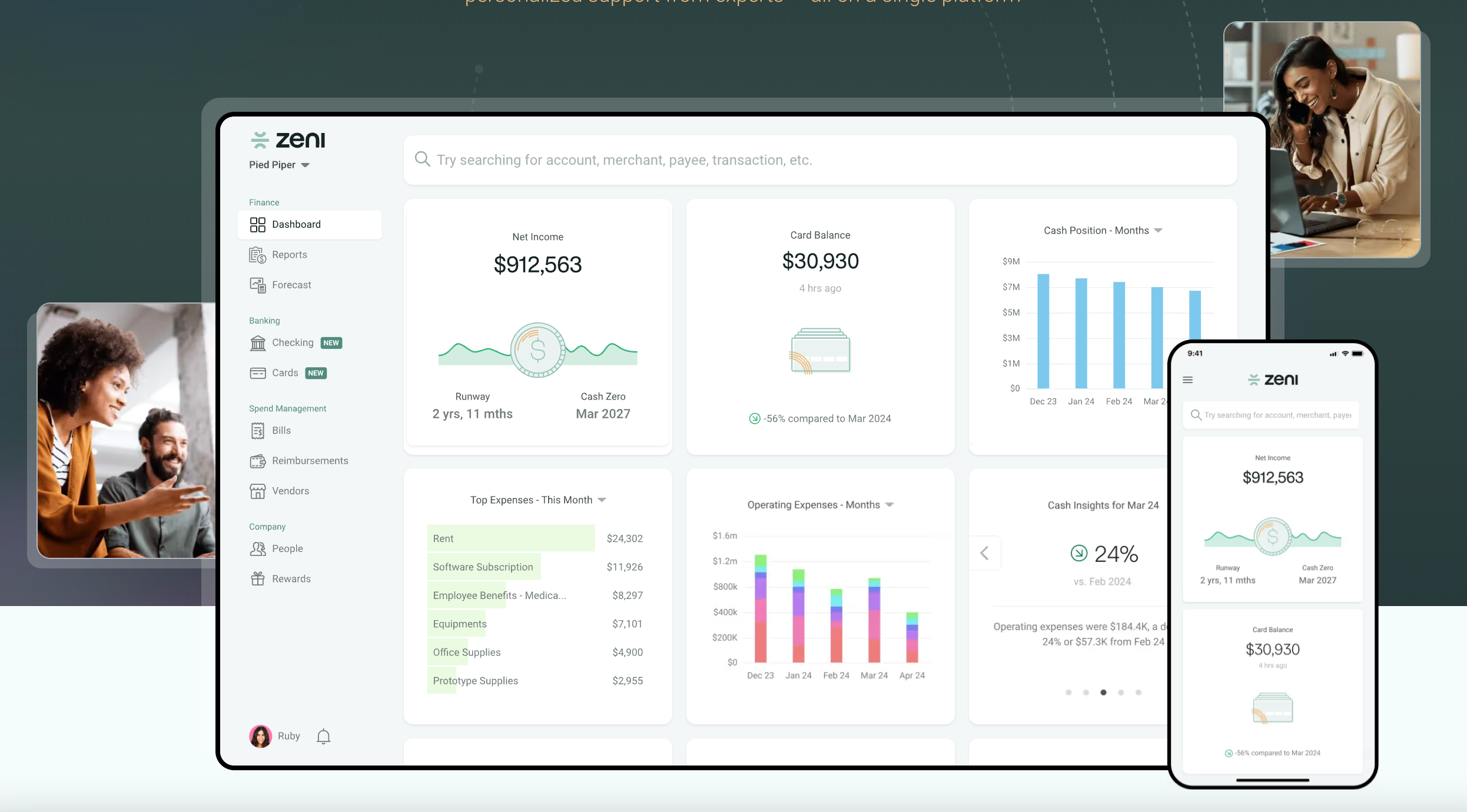

Zeni is an modern AI-powered finance platform that mixes clever bookkeeping, accounting, and CFO providers to streamline monetary operations for startups and small companies. By leveraging superior AI expertise, Zeni automates a wide selection of handbook processes, offering real-time insights and providing personalised help from a devoted workforce of finance consultants. This complete strategy permits companies to replace their books day by day, entry real-time monetary knowledge, and make knowledgeable selections primarily based on correct, up-to-date info.

One in every of Zeni’s key strengths lies in its potential to offer an entire monetary answer on a single platform. From invoice pay and invoicing to expense administration and monetary planning, Zeni affords a variety of providers to fulfill the various wants of rising companies. The platform’s user-friendly interface, coupled with skilled help from a devoted finance workforce, makes it a sexy alternative for entrepreneurs and enterprise house owners trying to optimize their monetary operations and deal with progress. By consolidating a number of important instruments into one package deal, Zeni helps companies get monetary savings and simplify their expertise stack, offering a cheap answer for complete monetary administration.

Key options:

- AI-powered bookkeeping that robotically categorizes transactions and reconciles accounts

- Complete monetary providers together with invoice pay, invoicing, and expense administration

- Actual-time monetary insights and customizable reporting capabilities

- Entry to a devoted workforce of finance consultants, together with bookkeepers, accountants, and CPAs

- Seamless integration with fashionable enterprise instruments and platforms

Blue dot is an AI-driven tax compliance platform designed to handle the complexities of recent worker spend administration. With the rise of hybrid work environments, decentralized buying, and on-line consumption, employee-triggered transactions have grow to be more and more prevalent, posing challenges for finance groups coping with unstructured monetary knowledge. Blue dot’s platform tackles these points by offering complete protection in each VAT and taxable worker profit areas.

The platform’s expertise leverages superior AI algorithms and machine studying to digitize tax compliance, automating numerous monetary processes whereas lowering handbook effort and guaranteeing accuracy. Blue dot affords optimized VAT outcomes by figuring out eligible and certified VAT spend in compliance with nation tax laws and firm insurance policies, guaranteeing correct home VAT posting and international VAT refunds. Moreover, the platform automates the evaluation of consumer-style spend topic to taxable worker advantages, guaranteeing compliance with wage taxation and pay-as-you-earn reporting necessities. By combining these options with an robotically up to date tax data base and configurable rule engines, Blue dot gives a strong answer for contemporary tax compliance challenges.

Key options:

- Good automation of economic processes for enhanced accuracy and audit preparedness

- Optimized VAT outcomes by way of AI-driven identification of eligible spend

- Automated evaluation of taxable worker advantages for wage taxation compliance

- Repeatedly up to date tax data base with configurable rule engines

- Superior AI and ML capabilities leveraging deep studying and pure language processing

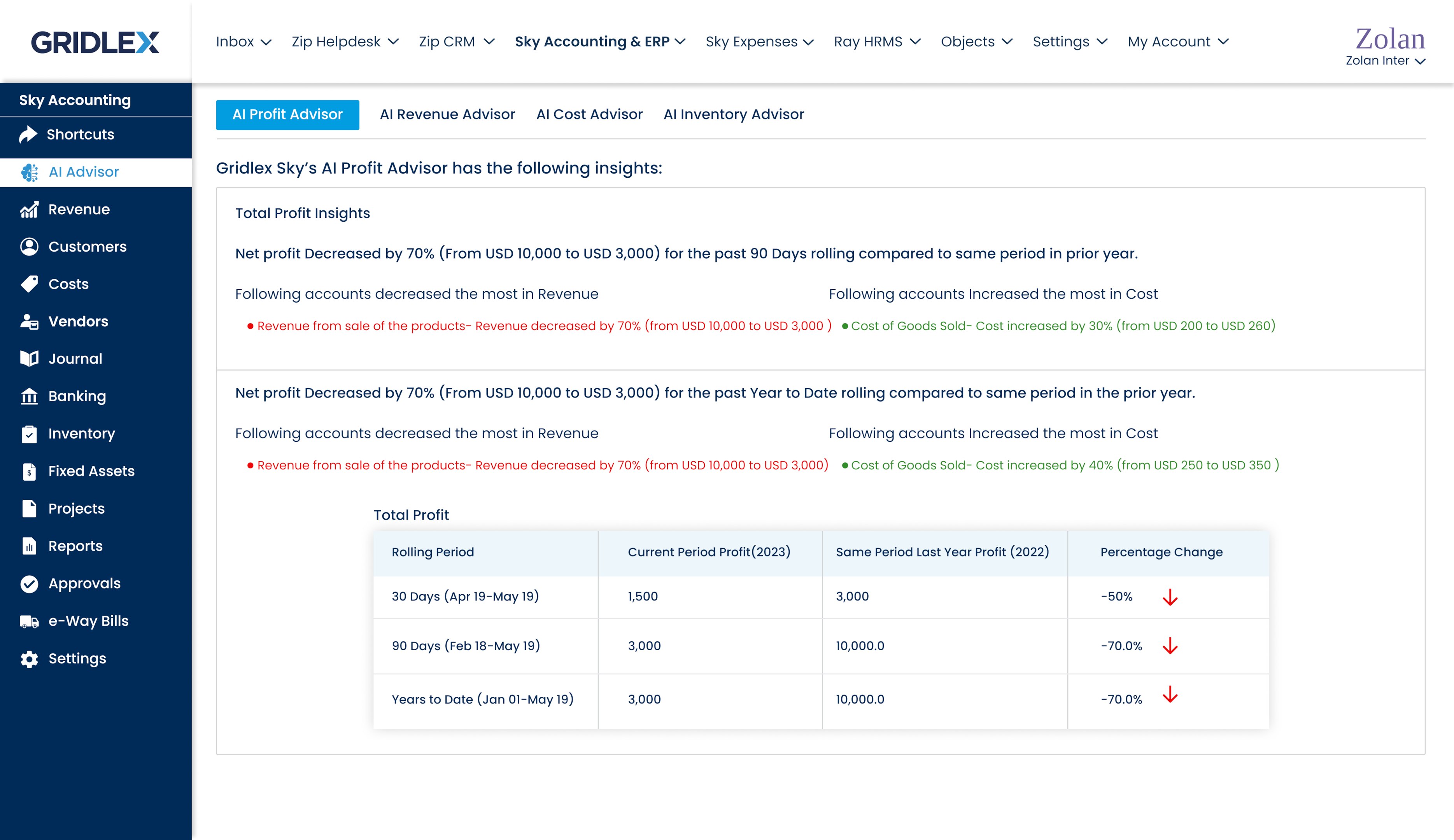

Gridlex is a flexible, all-in-one app builder designed to streamline operations and enhance productiveness throughout numerous industries. Whereas not solely an accounting device, Gridlex affords a complete suite of options that features CRM, customer support, assist desk ticketing, grasp knowledge administration, and operations administration. The platform’s ultra-customizable nature permits organizations to configure the app builder to fulfill their particular wants, guaranteeing a tailor-made answer that addresses distinctive enterprise challenges.

One in every of Gridlex’s standout options is its accounting and ERP module, Gridlex Sky. This element permits companies to handle their funds successfully, providing capabilities resembling invoicing, invoice administration, and financial institution reconciliation. By automating monetary processes, lowering handbook calculations, and simplifying expense claims, Gridlex Sky considerably enhances accounting effectivity. The platform’s AI-driven insights assist companies analyze their monetary knowledge, facilitating knowledgeable decision-making and strategic planning. Moreover, Gridlex’s potential to consolidate a number of important instruments right into a single, cost-effective package deal helps companies get monetary savings and simplify their expertise stack, making it a sexy possibility for organizations trying to streamline their operations.

Key options:

- Complete accounting and ERP performance by way of Gridlex Sky module

- AI-powered monetary insights for knowledge evaluation and strategic planning

- Multi-currency transaction dealing with for world enterprise operations

- Built-in stock administration for environment friendly monitoring and optimization

- Constructed-in timesheet and HR software program for streamlined workforce administration

Truewind is an AI-powered accounting and finance platform particularly designed to streamline bookkeeping and monetary administration for startups and small to medium-sized companies (SMBs). By harnessing the ability of generative AI applied sciences, Truewind automates routine accounting duties, delivers correct and well timed monetary reviews, and affords strategic insights to help enterprise progress. The platform’s strategy combines AI-driven processes with skilled human oversight, leading to a complete, environment friendly, and dependable monetary administration answer.

On the core of Truewind’s choices are AI-powered bookkeeping, month-end shut automation, and CFO providers. The platform seamlessly integrates with fashionable accounting software program resembling QuickBooks, NetSuite, and Xero, guaranteeing a easy transition and minimal disruption to current processes. Truewind’s dedication to knowledge safety and privateness is obvious in its adherence to the very best requirements, together with SOC 2 certification and strict knowledge privateness insurance policies. This mix of cutting-edge AI expertise, human experience, and strong safety measures positions Truewind as a robust device for companies looking for to optimize their monetary operations and drive progress.

Key options:

- AI-powered bookkeeping for sooner and extra correct monetary record-keeping

- Automated month-end shut course of to speed up monetary reporting

- CFO providers offering strategic insights and forecasting for enterprise progress

- Seamless integration with fashionable accounting software program platforms

- SOC 2 licensed knowledge safety and strict privateness insurance policies

Booke is an modern AI-powered bookkeeping automation platform designed to streamline monetary processes for companies and accounting professionals. By leveraging superior AI applied sciences resembling Robotic Course of Automation (RPA) and Generative AI, Booke automates time-consuming duties like transaction reconciliation and categorization, considerably lowering handbook workload and enhancing accuracy. The platform’s clever algorithms excel at extracting knowledge from monetary paperwork in real-time, guaranteeing that monetary information are all the time up-to-date and exact.

One in every of Booke’s key strengths lies in its seamless integration capabilities with fashionable accounting software program resembling Xero, QuickBooks, and Zoho Books. This integration ensures a easy workflow and minimizes disruption to current processes, making it a perfect answer for companies trying to improve their monetary operations with out overhauling their complete system. Booke’s user-friendly interface, mixed with its highly effective automation options, considerably improves effectivity and accuracy in monetary administration. By automating day by day and month-end bookkeeping processes, together with categorizing and matching financial institution feed transactions with corresponding payments, invoices, and receipts, Booke permits finance professionals to deal with extra strategic duties, in the end resulting in improved shopper satisfaction and enterprise progress.

Key options:

- AI-driven automation of transaction reconciliation and categorization

- Actual-time knowledge extraction from monetary paperwork for up-to-date information

- Seamless integration with fashionable accounting software program platforms

- Automated day by day and month-end bookkeeping processes

- Enhanced effectivity and accuracy in monetary administration duties

Why Use an AI Accounting Instrument?

The speedy evolution of AI accounting instruments has reworked the panorama of economic administration, providing unprecedented benefits to companies of all sizes. These modern options streamline accounting processes, lowering the effort and time required for routine duties resembling knowledge entry and transaction categorization. By automating these mundane actions, AI instruments unencumber accounting professionals to deal with extra strategic features of economic reporting and evaluation, in the end including extra worth to their organizations or shoppers.

Some of the vital advantages of AI accounting instruments is their potential to offer real-time monetary insights. Not like conventional strategies that usually depend on periodic reporting, these superior platforms provide up-to-the-minute knowledge on an organization’s monetary well being. This instant entry to correct monetary knowledge empowers decision-makers to reply swiftly to market adjustments, establish potential points earlier than they escalate, and capitalize on rising alternatives. Furthermore, the improved accuracy of AI-driven monetary reviews minimizes the danger of errors that may result in pricey errors or compliance points.

Because the accounting business continues to embrace technological developments, AI instruments have gotten indispensable for sustaining a aggressive edge. These platforms not solely enhance effectivity and accuracy but additionally improve the general high quality of economic providers supplied by accounting companies. By leveraging AI of their day by day operations, accountants can provide extra complete and insightful monetary evaluation, strengthening their function as trusted advisors to their shoppers. Finally, the adoption of AI accounting instruments represents a strategic funding in the way forward for monetary administration, promising to ship long-term advantages by way of productiveness, accuracy, and decision-making capabilities.

[ad_2]