[ad_1]

Reconciliation software program is a software particularly designed to check monetary information from totally different sources corresponding to invoices, financial institution statements, common ledgers, and different monetary data. Monetary groups typically face challenges whereas performing reconciliations internally, because it includes a big quantity of guide work. To deal with this challenge, organizations desire utilizing reconciliation software program, which might automate the heavy lifting and monotonous duties whereas guaranteeing accuracy and timeliness through the month-to-month book-closing interval.

On this article we’ll cowl the next sections:

Finest Reconciliation software program fast comparability

Want a TL;DR? With automation taking up the world and time being extra crucial than ever, we have chosen the highest reconciliation software program options. These are ranked primarily based on options corresponding to pricing, user-friendly interface, workflow automation, automated information extraction, transaction matching, exception dealing with capabilities, and their means to combine with different accounting instruments

- Finest Automated Reconciliation Software program: Nanonets

- Most Common Reconciliation Software program: Quickbooks

- Finest Account Reconciliation Software program: Xero

- Finest Monetary Shut Reconciliation Software program: Blackline

- Finest Enterprise Reconciliation Software program: Netsuite

Selecting the perfect reconciliation software program is dependent upon your organisational wants and objectives.

Need automated information extraction capabilities when you add your paperwork (which means no information entry or creating templates) and transaction matching powered by ML algorithms (which means AI matching) throughout paperwork you both add, obtain from an e mail or present connection to the database ?

We have now developed Nanonets Reconciliation AI software only for you!

Are you a spreadsheet wizard who will not again down towards probably the most daunting and time consuming transaction duties? Use CubeSoftware. If Pricing is a matter chances are you’ll attempt to use Energy Question to reconcile in excel.

If you happen to already are utilizing Quickbooks as an accounting platform and do not wish to look anyplace else for the added options and performance – Quickbooks Assertion Reconciliation is the best way to go.

Xero is tailor-made for small and medium enterprise who wish to maintain their data paperless and human error free. Quickbooks customers might use Xero if they aren’t fairly happy with the skills of the previous.

Blackline is usually sought out to be one of many high account reconciliation software program. With means to combine throughout totally different accounting instruments and importing paperwork into predefined templates it occurs be a steep studying curve with nice performance. There are a number of tutorials obtainable on-line that can assist you get began.

Netsuite Reconciliation is appropriate for organizations that must automate core monetary matching by providing extremely scalable and strong account reconciliation options.

Why is Account Reconciliation Necessary?

Preserving your accounts spick and span might help you to get out of economic jiffy. Poor monetary e book maintaining results in misinterpretation of your organization’s monetary well being which can result in frauds and errors going undetected. Well timed completion of the monetary shut course of helps stakeholders in resolution making and reporting. Sustaining an correct audit path is essential to your firm to keep away from potential penalties which auditors might flag. With common reconciliations finance groups are capable of keep away from money circulate discrepancies, timing variations, and lacking transactions in order that all the firm stay compliant with obligatory regulatory necessities.

Forms of Reconciliations Software program

Software program instruments for Financial institution Account Reconciliation

Financial institution reconciliation is the method of matching financial institution statements to inside e book data so as to guarantee monetary accuracy. A Financial institution Reconciliation Software program goals in matching firm’s inside transactions with those recorded by the financial institution. It helps generate experiences relating to money circulate, excellent checks and reconciled quantity. Financial institution reconciliation softwares sometimes have integrations to instantly pull firm’s information and match transactions to generate experiences for higher monetary reporting.

Account Reconciliation Software program

Account Reconciliation ensures that the corporate’s common ledgers align completely with different monetary data. These imply matching throughout ledgers, financial institution statements and different Third Get together monetary statements. A software program like Nanonets which might extract information robotically throughout a number of templates proves to be the only option right here. Account Reconciliation Softwares ought to centralised information repository to retailer, entry and evaluate firm extensive monetary statements.

Steadiness Sheet Reconciliation Software program

Steadiness Sheet Reconciliation Software program goals at reconciling stability sheet accounts with the supporting monetary documentation. Monetary information is usually saved between totally different account instruments and spreadsheets, typically making it troublesome to reconcile. A terrific stability sheet reconciliation software program must be simply be built-in into current instruments.

What’s an Account Reconciliation Software program?

A terrific account Reconciliation software program ought to adhere to the next options and functionalities that can assist you keep a terrific monetary reporting administration system by bridging the hole between your inside e book maintaining and exterior experiences. Verifying and aligning transactions to make sure correctness and accuracy are of the upmost significance.

- Automated Matching:

Reconciliation softwares ought to match transactions between each the information units (on this case your ledger and statements) with utmost accuracy. Totally different reconciliation instruments attempt to do an actual match my noting down the time, quantity and different particulars from the transactions. Nanonets AI trains the label names utilizing NLP strategies which assist in predicting the perfect match for the next transaction entries. - Centralised Information:

The power to generate experiences and dashboards on monetary information is essential for finance groups to maintain monitor of the standing of the corporate’s monetary well being. By figuring out which transactions have matched, to manually assign crew members to un-matched entries might help in well timed bookkeeping and guarantee monetary regulatory compliance. - Audit Trails:

Keep a element document of reconciliations up to now, guaranteeing transparency into the well being of your monetary processes. Entry to retailer and anonymise your essential monetary information is key’s sustaining privateness and well being of your e book maintaining system. - Integrations:

Since account reconciliation contain a number of third celebration programs to check your monetary information on, it ought to have the ability to entry your information saved inside these programs by means of consumer pleasant integrations. Capability to load the information contained in the software program, evaluating transactions, triggering alert workflows are key ought to haves involving any reconciliation software program.

High 5 Reconciliation Software program

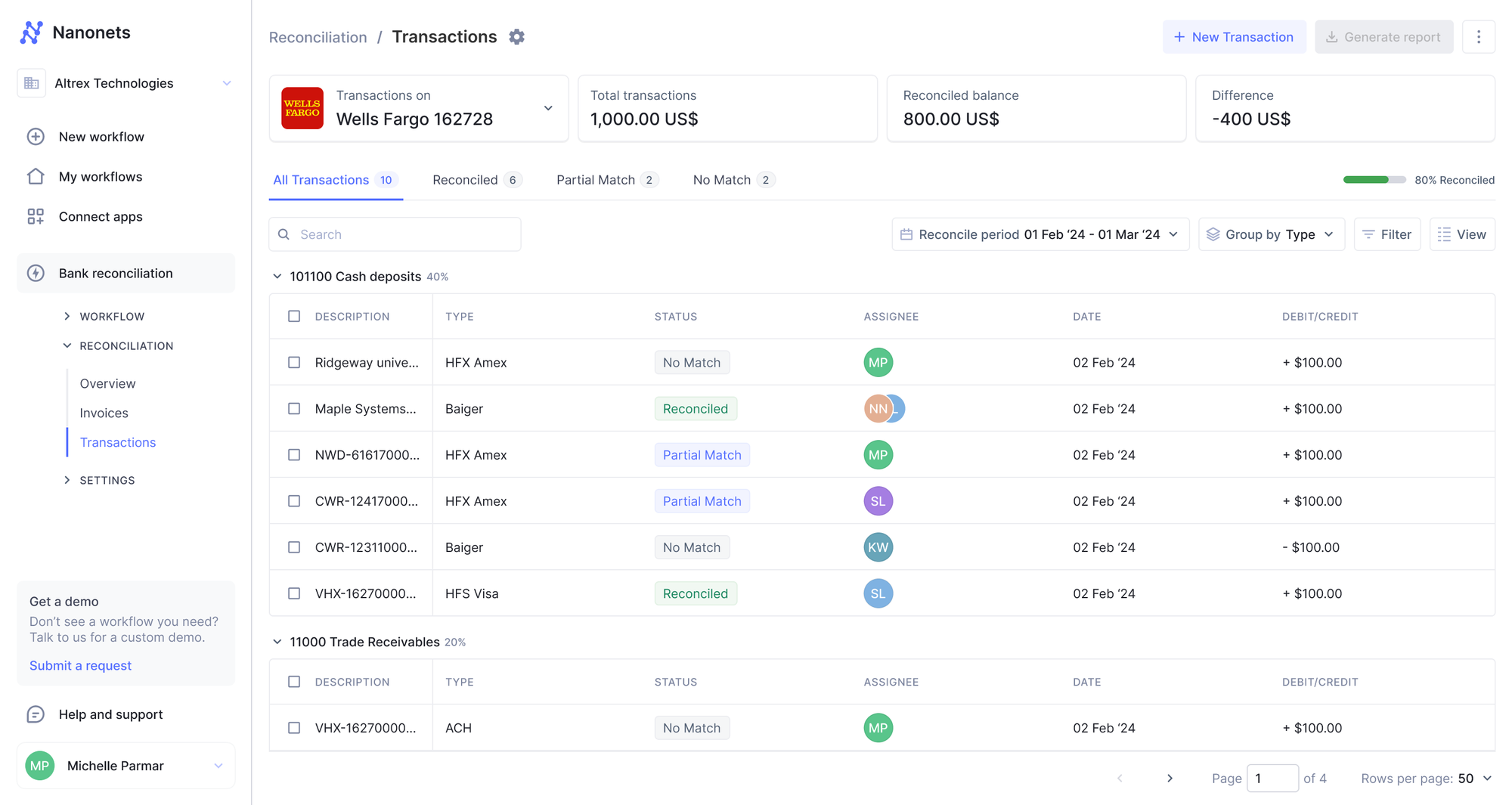

1. Nanonets

Nanonets is an AI-powered resolution that may vastly simplify and streamline the account reconciliation course of. It automates varied steps, reduces guide effort, and will increase effectivity.

Nanonets integrates information from a number of monetary sources, extracts related information from paperwork, and matches information throughout totally different sources. It additionally facilitates automated evaluate and approval workflows and supplies a central repository for supporting documentation.

Listed below are a number of the key options of Nanonets that make it a beneficial software for account reconciliation:

- Automated doc processing: Nanonets can robotically course of paperwork from a number of sources, corresponding to financial institution statements, invoices, and receipts. This eliminates the necessity for guide information entry, which might save time and scale back errors.

- Information extraction: Nanonets makes use of optical character recognition (OCR) to extract related information from paperwork. This information can then be used to match transactions throughout totally different programs.

- Information matching: Nanonets makes use of rule-based matching to determine and reconcile transactions throughout totally different programs. This helps be sure that all transactions are accounted for, and there aren’t any errors.

- Workflow automation: Nanonets can automate the account reconciliation course of, from information entry to approval. This could release time for accountants to give attention to different duties.

- Centralized repository: Nanonets supplies a central repository for supporting documentation. This makes it simple to search out and entry paperwork when wanted.

If Nanonets meets what you are promoting necessities, you will get in contact for a

personalized quote.

2. Xero

Xero is a cloud-based accounting software program for small companies, startups, and rising firms. It affords a wide range of options, together with bookkeeping, accounting, invoicing, and stock administration.

Xero could be prolonged by means of third-party integrations for added functionalities. It’s a scalable resolution that may develop with what you are promoting.

Listed below are a number of the key options of Xero:

- Cloud-based: Xero is a cloud-based software program, which suggests you’ll be able to entry it from anyplace with an web connection.

- Scalable: Xero could be scaled to fulfill the wants of what you are promoting, whether or not you are simply beginning out or have a whole lot of staff.

- Consumer-friendly: Xero is simple to make use of, even when you have no accounting expertise.

- Safe: Xero is safe, with information encryption and two-factor authentication.

Pricing: Plans begin at $13 per thirty days.

3. QuickBooks

QuickBooks is a widely known accounting software program that caters to companies of all sizes. Identified for its user-friendly interface, complete function set, and seamless integration with third-party purposes, QuickBooks simplifies monetary administration duties and is very appropriate for SMEs searching for a easy, seamless resolution for his or her monetary accounting wants.

- Well known accounting software program

- Consumer-friendly interface

- Complete function set

- Seamless integration with third-party purposes

- Reasonably priced pricing and in depth assist ecosystem

- Pricing: Plans begin at $25 per thirty days.

4. BlackLine

BlackLine is a cloud-based software program platform that automates and streamlines the monetary shut course of. It could assist companies save money and time, scale back errors, and enhance compliance.

Listed below are a few of its key options:

- Scale back errors: BlackLine might help to cut back errors by automating the reconciliation of accounts and making ready monetary statements.

- Enhance compliance: BlackLine might help companies guarantee compliance with accounting requirements and laws by offering visibility and management over all the monetary shut course of.

- Enhance visibility and management: BlackLine might help companies monitor progress, collaborate with groups, and guarantee compliance with accounting requirements and laws.

- Streamline processes: BlackLine might help companies streamline their monetary shut course of by automating guide duties and offering visibility and management.

Pricing: Obtainable on customized quote.

5. Oracle Netsuite

Oracle Netsuite affords a cloud-based suite of economic administration options designed to streamline accounting processes and drive enterprise progress. With options like real-time monetary reporting, automated billing, and customizable dashboards, Netsuite supplies companies with the instruments they should handle their funds successfully.

Its integration capabilities, scalability, and industry-specific options make it a compelling possibility for companies throughout varied sectors.

- Cloud-based suite of economic administration options

- Actual-time monetary reporting

- Automated billing processes

- Customizable dashboards

- Trade-specific options

- Pricing: Custom-made pricing primarily based on enterprise necessities.

Advantages of Account Reconciliation software program

Using account reconciliation software program affords quite a few benefits for companies aiming to boost their monetary processes and decision-making capabilities. Listed below are a number of the key advantages:

- Enhanced Effectivity by means of Automation: These instruments considerably scale back the necessity for guide intervention by automating the reconciliation course of, thereby streamlining duties which can be repetitive and time-consuming. This not solely saves beneficial time but in addition will increase the general effectivity of economic operations.

- Empowered Strategic Planning: By liberating finance and monetary planning & evaluation (FP&A) groups from the clutches of guide processes, account reconciliation software program permits them to focus on extra crucial duties. This give attention to strategic initiatives relatively than routine information entry helps in driving the corporate’s monetary technique ahead.

- Elevated Reporting Accuracy: The software program ensures the accuracy and reliability of economic experiences by offering an in depth and complete view of all transactions. This precision aids in shortly figuring out and rectifying any account discrepancies, thereby sustaining the integrity of economic data.

- Actual-Time Monetary Insights: One of many standout options of account reconciliation software program is its means to ship real-time insights into an organization’s money circulate. This functionality permits enterprise house owners and monetary managers to make knowledgeable selections primarily based on present monetary information, enhancing the agility and responsiveness of the enterprise to altering monetary landscapes.

Why Your Organisation Wants an Automated Reconciliation Software program

Automated reconciliation software program like Nanonets might help companies save time, scale back errors, and enhance compliance. Listed below are some the explanation why it is best to think about using automated reconciliation software program:

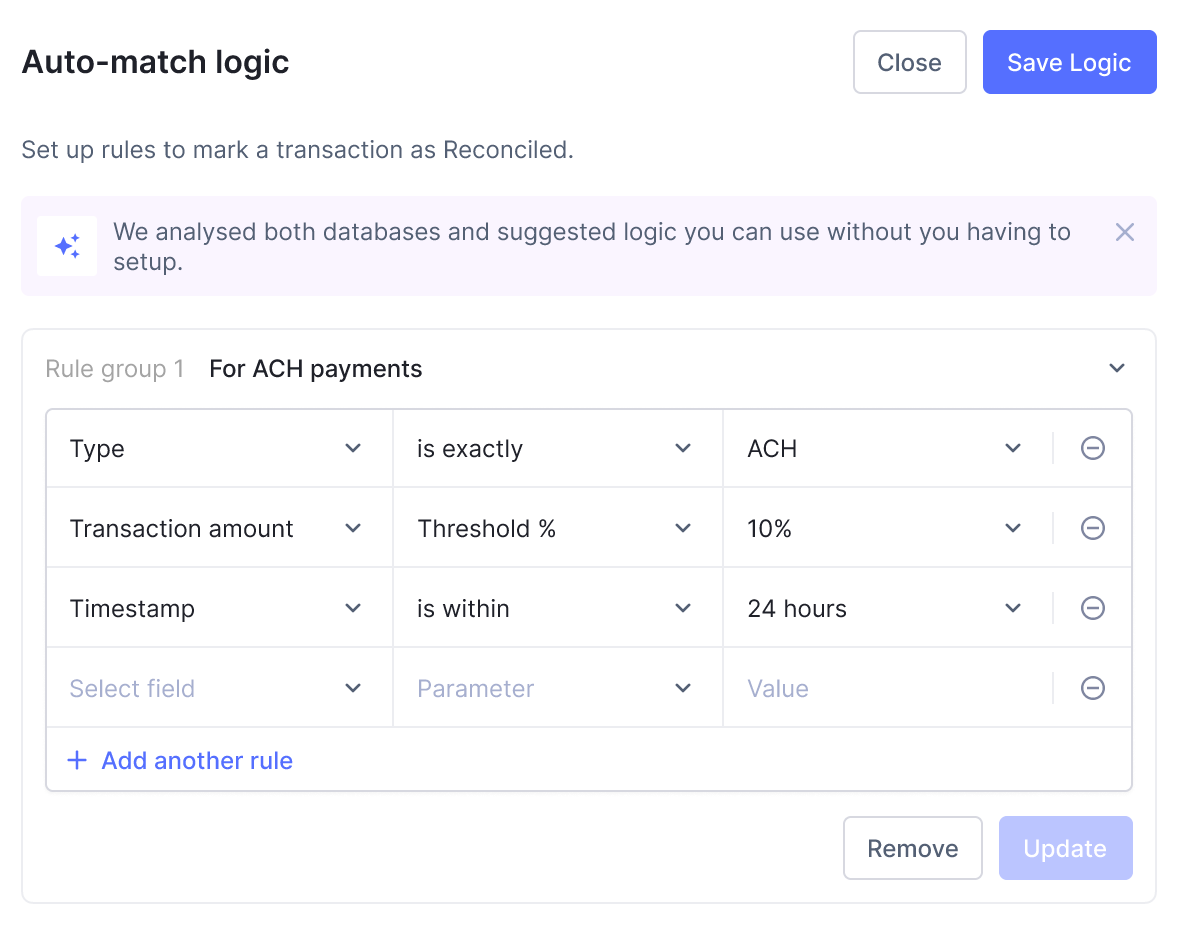

- Automated Transaction Matching:

On Nanonets, you’ll be able to leverage Nanonets’ Clever Doc Processing educated on 1M+ paperwork to leverage automated matching of transaction entries. This imply these transactions are recognized as the perfect match primarily based on column names, date, quantity and many others guaranteeing 95% accuracy. When these algorithms fail Nanonets tries to make a match utilizing fuzzy matching capabilities as a failsafe. You possibly can all the time setup customized guidelines as matching logic.

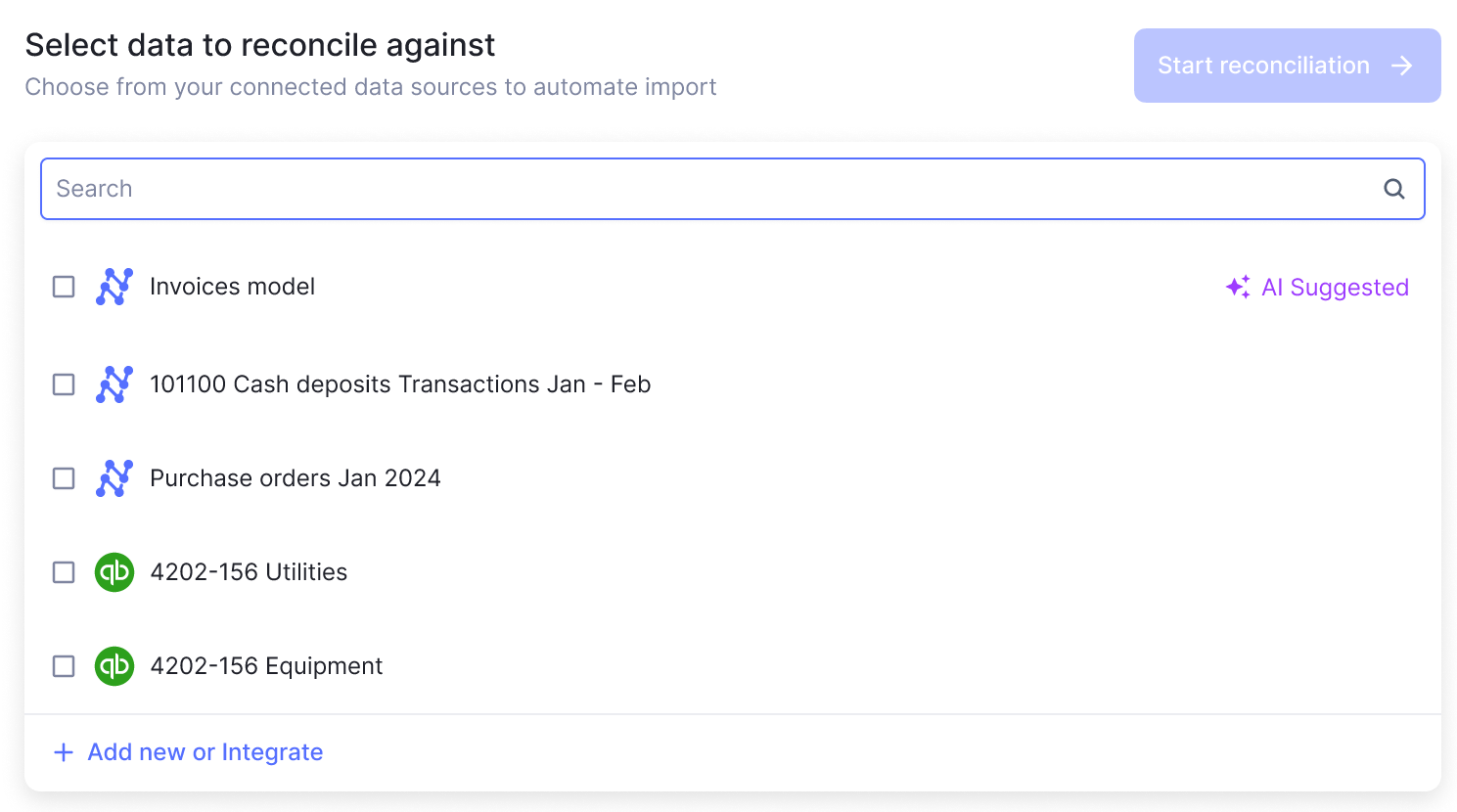

- Information Ingestion and Administration:

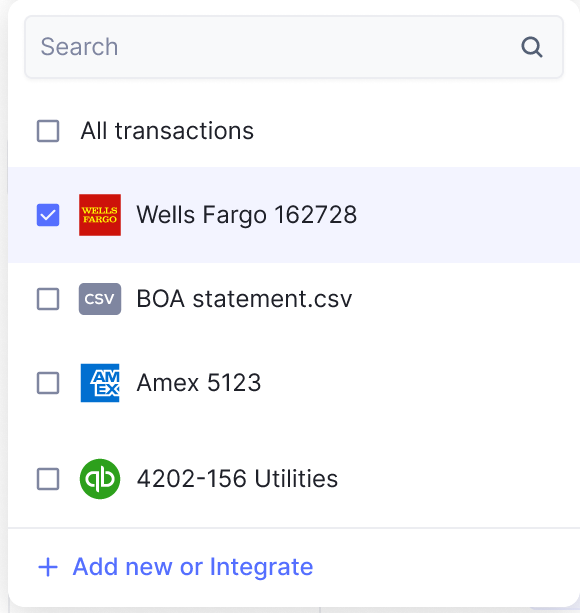

As soon as your ledger entries are extracted with 99% accuracy utilizing zero shot information extraction fashions it is possible for you to to selected between a number of monetary sources to reconcile from. These integrations are doable since Nanonets positions itself as a workflow automation platform specialising in monetary information managements.

- Clever Matching Guidelines:

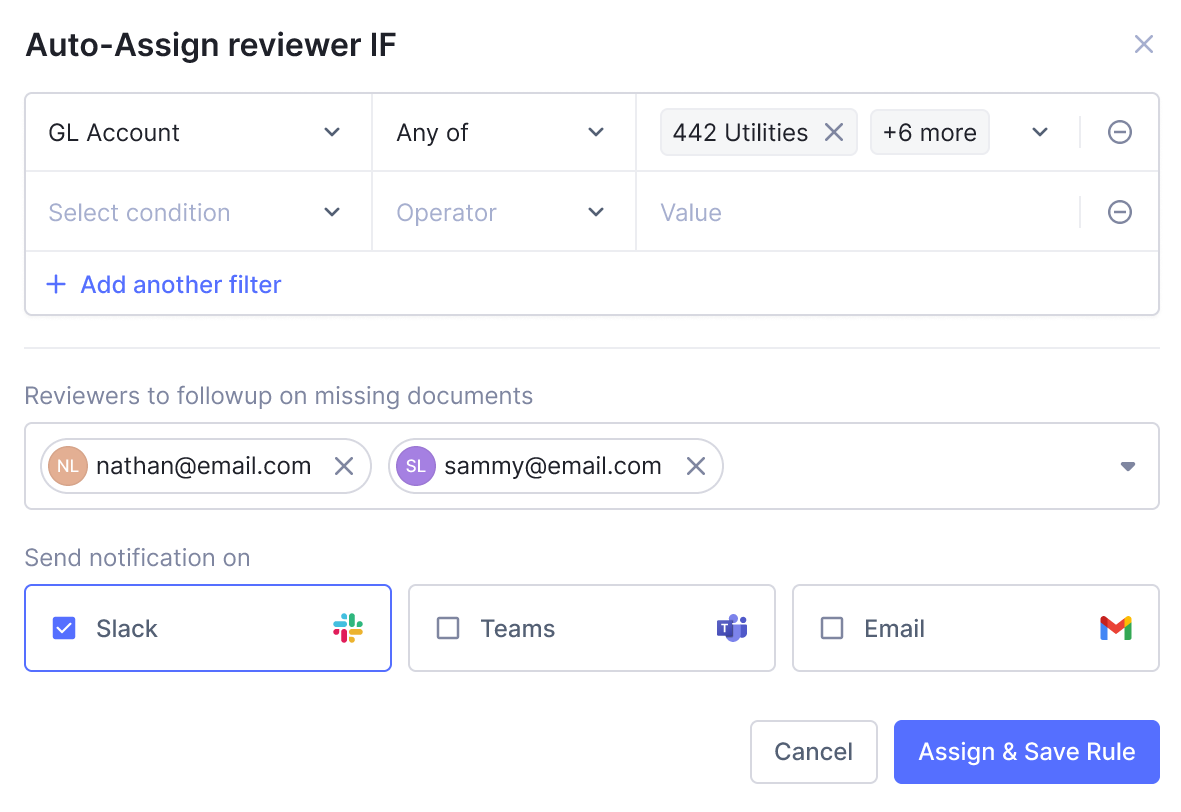

You possibly can arrange your personal customized matching logic primarily based on particular guidelines so as to handle particular use circumstances successfully. These act as failsafes in order to cut back the quantity no match transaction entries. Nanonets AI makes use of transferred studying to constantly be taught from these customized guidelines outlined to automate matching with larger accuracy over time.

Utilizing Nanonets Workflow Automation capabilities to alert exceptions throughout your automated transaction matching course of might help end in quicker and well timed reconciliations. That is achieved by alerting the related stakeholders in taking immediate actions and recording audit trails all through the journey.

- Integration with Accounting Programs:

Leverage streamlining your information flows and keep away from guide entry by integrating Nanonets with all of your accounting instruments. By automating the reconciliation course of end-to-end, automated reconciliation software program like Nanonets improves accuracy, reduces errors, and supplies beneficial insights into an organization’s monetary well being

FAQs for Reconciliation software program

What’s account reconciliation software program?

Account reconciliation software program is a software that automates the method of evaluating and verifying monetary data from totally different sources, corresponding to financial institution statements, common ledgers, and accounting programs. It helps determine and proper discrepancies to make sure the accuracy and integrity of economic information

How does account reconciliation software program work?

Account reconciliation software program works by robotically matching transactions between inside monetary data and exterior statements. It could import information from varied sources, apply customizable matching guidelines, spotlight exceptions, and generate detailed experiences.

When ought to a enterprise think about investing in account reconciliation software program?

Companies ought to think about investing in account reconciliation software program once they expertise rising transaction volumes, a number of financial institution accounts, or complicated reconciliation wants. As a enterprise scales, guide reconciliation turns into more and more difficult and error-prone, making software program a beneficial software for sustaining monetary accuracy and effectivity

[ad_2]