[ad_1]

Do you know that processing an expense report for an in a single day lodge keep can take as much as 20 minutes and value a median of $58?

In line with a GBTA report, out-of-pocket prices an worker has paid expense reviews comprises errors or lacking info, costing an extra $52 and 18 minutes to right every.

Now take into account all of the tons of of bills and reviews workers file, and picture the useful resource drain it might be costing you.

Earlier than we discover the world of bills and reimbursements, it’s important to know expense claims.

What’s an expense declare?

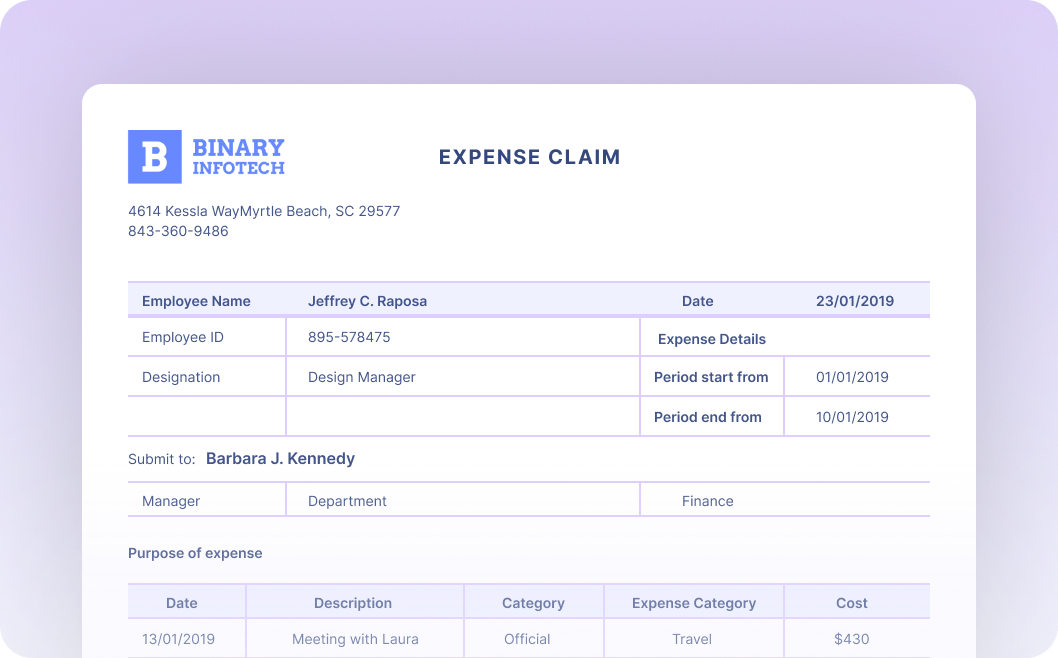

An expense declare is a proper request by an worker to be reimbursed for enterprise bills incurred by workers on behalf of the corporate.

These might be journey bills, meals, workplace provides, or every other out-of-pocket prices an worker has paid for enterprise functions.

The worker initiates the reimbursement request utilizing an expense declare type or an expense report.

What qualifies as a declare?

Whether or not the enterprise expense could be claimed or reimbursed is determined by the next components:

Compliance with IRS pointers

The IRS has a easy rule about what counts as a authentic enterprise expense.

It needs to be unusual and obligatory.

Extraordinary means it's widespread and accepted in your subject of labor, whereas obligatory means it's useful, acceptable, or appropriate for your small business. This enterprise expense doesn’t should be required to be thought of obligatory.

Adherence to the corporate’s expense coverage

An expense reimbursement coverage is a rulebook for enterprise spending. Solely bills that adhere to this coverage are thought of reimbursable.

Expense class

Every firm has a set of predefined expenditure classes that workers want to know earlier than submitting their expense claims for reimbursement.

These claims can rely on accepted expense classes, corresponding to journey bills, workplace provides, meals and leisure bills, and so forth.

Keep in mind to notice the exclusions, corresponding to private leisure (e.g., alcohol), penalties, and so forth.

Proof of expense

Each expense declare should be substantiated with proof of expense within the type of a receipt, bill, or every other related doc.

This proof ought to take into account all of the related particulars, such because the expense date, quantity of expense, vendor/service provider particulars, and so forth.

Kinds of bills that may be claimed

The widespread expense classes that may be claimed are:

Journey bills

Staff on enterprise journeys should spend on airfare, motels, rental vehicles, toll fees, fuel, and so forth. These all fall below journey bills.

Meals and leisure bills

These embrace bills like meals with potential shoppers or on-site workers and tickets to a networking occasion.

Workplace bills

Operational bills, like day by day workplace provides, stationery, web payments, and so forth, fall below this class.

Miscellaneous bills

Whereas the most typical classes of bills are journey, meals and leisure, and office-related operational bills, different prices are included below miscellaneous bills.

These embrace unexpected prices like emergency repairs or authorized charges, which aren’t a part of the common operations however are obligatory for the enterprise.

Right here is an exhaustive record of expense classes employers can use to categorise worker bills for enterprise functions.

Methods to generate an expense declare

Firms can permit workers to say reimbursements for business-related bills utilizing totally different modes:

Receipts

In essentially the most conventional expense declare course of, workers who make out-of-pocket bills save expense receipts from business-related purchases and submit these as proof. The claimant is ultimately credited with an equal quantity of their expense account.

Bank card statements

If the corporate gives a enterprise bank card, bills could be tracked instantly from the cardboard assertion. Such company bank cards show handy and are sometimes given to solely sure workers, corresponding to gross sales representatives and workers in management positions.

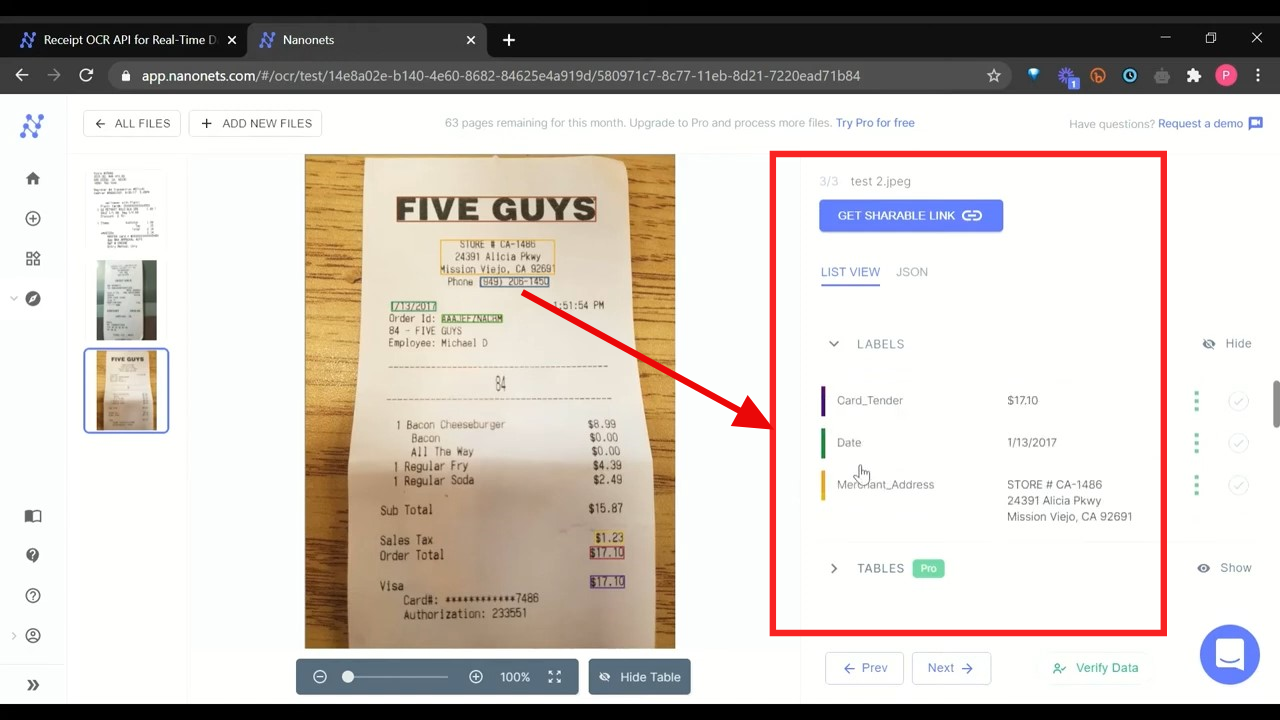

OCR-enabled cell apps

Many companies now use OCR-enabled expense administration apps that permit workers to snap an image of their receipt and submit it immediately.

Per diem allowances

In some circumstances, companies might present a per diem day by day allowance for workers to cowl their meals and commuting bills. Any spending past this allowance would must be claimed individually.

All of the above strategies have execs and cons, and your best option usually is determined by the scale and desires of your small business.

Expense declare course of

The expense declare course of can look totally different for various firms. Sometimes, it includes the next steps:

Expense incurrence

An worker incurs an expense. It might be an out-of-pocket expense for which the worker wants to save lots of the bill or proof of buy.

Producing an expense declare

Smaller firms often ask workers to make use of an worker expense declare type for reimbursement.

Enterprises sometimes use an expense administration system that permits workers to generate periodic expense reviews and submit them for approval.

Getting approval

As soon as the expense declare type/expense report is submitted, the supervisor approves or denies the declare, relying on its legitimacy. Solely the reimbursable bills are despatched to the finance division for additional processing.

Finance verification

As soon as the supervisor approves the worker expense declare, it’s additional despatched to the finance crew for verification.

Reimbursement

As soon as the expense declare is verified and accepted by all obligatory stakeholders, the finance division initiates the reimbursement relying on the mode of fee as per the corporate’s expense reimbursement coverage.

Bookkeeping and documentation

The finance crew additionally ensures the info entry of all such bills and retains monitor of all such expense reviews. All such reviews, together with proofs, are recorded.

Challenges within the expense declare course of

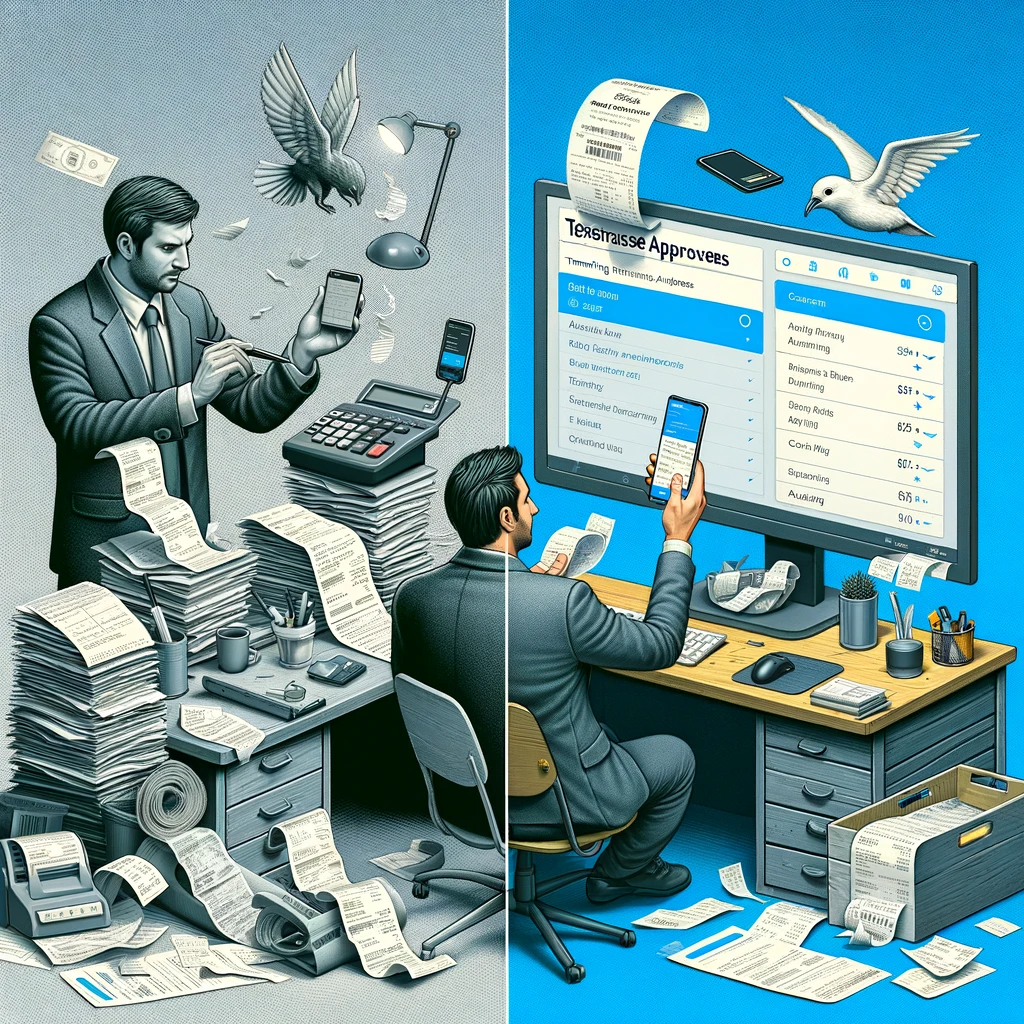

Time-consuming handbook information entry

The tedious and prolonged information entry course of is an enormous problem for firms that comply with the normal expense declare course of.

Staff waste valuable time finding and manually coming into particulars of every buy, which regularly results in many inaccuracies.

Monitoring proofs of buy

Throughout enterprise journey, workers are pressured to save lots of paper receipts. Many misplaced receipts can hinder bookkeeping. With out such proof, workers can’t declare reimbursements, which ends up in a poor worker expertise.

Generally, workers deliberately inflate prices by submitting misguided or duplicate receipts. With out correct checks in place, expense monitoring can turn out to be pricey for firms.

No real-time spend analytics

Conventional handbook expense declare processes don’t precisely give real-time visibility of worker spend. Consequently, finance groups can’t monitor spending patterns and optimize prices on the proper time.

Lack of workflow automation

A clean expense declare course of requires fast approvals. With out delegation and workflow automation, workers and managers get caught in limitless loops of e mail trails and follow-ups, resulting in lengthy reimbursement cycles.

Coverage non-compliance

Adherence to expense coverage is essential for efficient spend administration. With out compliance checks, situations of expense and fee fraud enhance.

Making certain such coverage compliance is troublesome and infrequently results in auditory challenges when firms comply with handbook, paper-based expense declare processes.

10 steps to simplify the expense declare course of

Leaky expense declare processes is usually a sluggish, silent killer to your firm funds. Listed here are some methods you may streamline your declare course of.

Construct an organization expense coverage

An organization expense coverage is the rulebook of expense reimbursements and is a should for a clean declare course of.

Set up clear pointers and point out the eligibility for reimbursement requests within the coverage. Guarantee this coverage is periodically revisited and up to date to align with tax rules and your workers’ wants.

Talk this coverage successfully to your workers by way of emails, worker onboarding processes, coaching periods, and bulletins. This can decrease potential and future disputes and save everybody time.

Categorize your worker bills

Categorize all your small business bills clearly in your organization expense coverage and pointers.

Earlier, we noticed the 4 broad classes of bills: journey, meals and leisure, workplace bills, and miscellaneous bills.

Learn extra about find out how to categorize enterprise bills.

Digitize and arrange receipts

Staff should arrange and monitor receipts and proofs of bills for a hassle-free expense declare.

Digitization of this course of utilizing receipt scanner apps or expense administration instruments with OCR-based functionalities can scale back workers' workload. This additionally ensures correct documentation and minimizes the danger of dropping receipts.

Go for paperless expense reporting

Staff submit paper-based expense declare types with bodily payments and receipts within the conventional expense declare course of.

Transfer away from paper-based processes to digital-based reporting or superior expense reporting instruments and streamline your expense reporting course of.

Analyze worker spending patterns

Recurrently analyze your workers’ spending patterns. Many cost-optimization alternatives lie hidden and infrequently go unnoticed as firms ignore worker expenditures.

By reviewing expense information utilizing analytical instruments, CFOs can enhance budgeting and achieve a chicken' s-eye view of missed financial savings. Analyzing this information is essential to setting the proper benchmarks and targets.

Have sturdy authorization and approval workflows

Set strict deadlines for expense approvals relying on the authorization required. These guarantee a seamless and well timed reimbursement course of for workers.

Properly-defined approval workflows additionally guarantee no fraudulent claims cross by way of the cracks. Cowl all grounds by contemplating all approvers primarily based not solely on groups, grades, and quantities but in addition on deviations and exceptions.

This may be simply arrange utilizing workflow automation instruments that give real-time updates and reminders.

Implement fast reimbursements

Guarantee fast and well timed reimbursements to your workers by permitting totally different modes of funds and reimbursements.

Whereas some employers present up-front per diem allowances for journey meals, others select to reimburse workers at a later date. Whatever the mode of fee, well timed reimbursements are important for a clean declare course of.

Tax compliance

Keep up to date with IRS pointers and different regional tax rules and authorized necessities. Firms usually face penalties for failing to adjust to rules associated to worker expense claims.

Go for expense administration instruments

Leveraging fashionable expense administration instruments is usually a sport changer to your group. They’ll enhance your small business effectivity and accuracy and your backside line.

Assume sooner reimbursements, correct monetary information, 100% tax, and coverage compliance!

These instruments can automate totally different processes, corresponding to information seize, expense reporting, approval workflows, reimbursements, and so forth.

When and find out how to automate your expense declare course of

Every enterprise has distinctive wants and necessities. A small enterprise would possibly solely want an OCR instrument to seize receipt information. The remaining might be managed utilizing a spreadsheet.

A mid-sized firm would possibly want a extra complete resolution. One which handles all the things from information seize to approval workflows to integration with accounting software program.

Ensure you perceive your necessities clearly earlier than you concentrate on automation.

Right here’s a fast rundown of the steps you may comply with to automate your expense declare course of:

1. Establish your wants

Decide what you need to obtain with automation — sooner processing instances, lowered errors, higher compliance, or all three.

Additionally, take into account components corresponding to:

- The dimensions of your organization

- Your expense coverage

- The amount of expense claims you deal with

- The technical capabilities of your crew

- Your funds

- Hurdles within the present workflow

2. Consider obtainable options

Analysis the marketplace for obtainable expense administration options. Search for options that align along with your wants:

- OCR for information seize and processing

- Rule-based approvals for sooner processing

- AI-powered anomaly flagging

- Self-learning algorithms for categorizing bills

- Integration along with your accounting software program

- On-the-go expense submission

- Customizable approval workflows

- Compliance checks and alerts

- Detailed reporting and analytics

3. Select an expense administration resolution and implement it

When selecting an answer, take into account user-friendliness, coaching required, scalability, safety measures, price, and buyer help.

Slim down your choices. Request a demo or a trial interval. This gives you hands-on expertise with the software program and enable you to decide whether or not it fits your small business.

When you've discovered the proper resolution, you may implement the answer in your group. This will contain:

- Practice your workers

- Defining the eligible bills, approvers, approval limits, and workflows

- Establishing the roles and system to conform along with your expense coverage and rules

- Integrating it along with your present techniques (accounting, payroll, HR, and so forth.)

4. Monitor and optimize the efficiency

Verify the accuracy of information seize, approval instances, and reimbursement instances.

Learn how usually handbook intervention is required and whether or not the system appropriately flags anomalies. Replace the roles and guidelines as obligatory.

Additionally, preserve a monitor of person suggestions.

Are your workers discovering the system simple to make use of? Are they in a position to submit their bills and get reimbursed shortly? You need to use their suggestions to make enhancements.

Additionally, monitor the system's influence in your backside line. Are you saving money and time? Is the instrument serving to you management prices and scale back fraud?

How Nanonets may also help automate your expense declare course of

Expense declare processing will get quite a bit simpler with Nanonets. You may automate the expense declare course of, from receipt seize to expense approvals and fee processing.

Here’s a fast overview of how Nanonets may also help:

1. Automate information seize

Staff can add their receipts in bulk, and all the data is mechanically extracted and categorized. There is no such thing as a want to fret about formatting or handbook information entry errors.

2. Centralize expense administration

All expense claims are saved in a single place, making monitoring, managing, paying, and auditing simple. You may simply export the parsed information as CSV or Excel recordsdata for additional evaluation or reporting.

3. Work with an clever mannequin

Our expense declare processing mannequin learns out of your actions over time. This helps enhance the accuracy of information extraction and categorization, making the method extra environment friendly over time.

4. Customise the workflows

You may arrange approval workflows that align along with your firm's insurance policies, making certain that each one expense claims endure the mandatory checks and balances earlier than approval.

5. Routinely flag anomalies

Establish uncommon expense claims primarily based on historic information and flag them for evaluate. This helps stop fraud and keep compliance with firm insurance policies.

6. Combine with present techniques

Seamlessly combine with finance, accounting, and different instruments like Google Drive, Zapier, Xero, Sage, Gmail, QuickBooks, and extra. Overlook about limitless information migration and luxuriate in a clean transition.

7. Entry real-time analytics

Get insights into your spending patterns, determine tendencies, and make data-driven choices. Monitor your expense claims in real-time and take immediate motion when obligatory.

8. Guarantee compliance

With built-in compliance checks and alerts, you may be sure that all expense claims adhere to your organization's insurance policies and rules. Sustaining an audit path turns into easy, and you’ll keep away from any potential authorized points.

Last ideas

Managing expense claims is important to any enterprise. Nonetheless, it’s simple to lose monitor of bills, particularly once you’re chasing progress and growth.

The excellent news is that automating the expense declare course of helps. It not solely saves you money and time but in addition retains your operations operating easily.

It reduces handbook errors, ensures compliance, improves budgeting accuracy, and gives a transparent view of your organization's spending. This isn't nearly price management — it's about making clever, knowledgeable enterprise choices.

Nanonets can help you on this journey by offering an clever, dependable, safe, and environment friendly resolution for expense declare processing. Our platform is designed to adapt to your small business wants, making the shift to automated expense administration clean and painless.

Schedule a demo with Nanonets at the moment and allow us to enable you to streamline your expense administration.

Often Requested Questions (FAQs)

Q. What are expense claims examples?

A. Journey bills (airfare, meals, in a single day motels, cabs, and so forth), workplace bills, fuel and mileage, networking bills, meals, and leisure bills are a number of the expense declare examples.

Q. What do you want for an expense declare?

A. Sometimes, you want an expense declare type to generate an expense declare. This way captures the main points of all bills, such because the date of expense, quantity, vendor/service provider particulars, and the aim of the expense. You will need to additionally connect all obligatory paperwork, like receipts and invoices, as proof of prices.

In some firms, you need to use expense reviews as an alternative to generate a reimbursement request.

Q. What’s expense declare administration?

A. Expense declare administration is the end-to-end means of expense seize, expense declare technology, approval, verification, and reimbursing the workers for these bills.

Q. Can I deduct unreimbursed worker bills?

A. In line with the IRS pointers, solely a choose team of workers can deduct unreimbursed worker bills. This group consists of Armed Forces reservists, certified performing artists, educators, fee-basis state or native authorities officers, or workers with impairment-related work bills.

They have to use Kind 2106 to calculate and report such deductible unreimbursed bills.

[ad_2]