[ad_1]

What Is a Financial institution Reconciliation Assertion?

A financial institution reconciliation assertion is a monetary doc that compares an organization”s checking account stability to the transactions recorded on its basic ledger, typically known as the “money books.” The aim of performing the financial institution reconciliation is to establish discrepancies and modify entries in order that the transactions are aligned with one another. They make sure the monetary accuracy of the statements and are an important course of for the accounting groups concerned in money movement administration.

How you can carry out a Financial institution Reconciliation?

Listed below are the steps concerned in performing financial institution reconciliation.

Step #1

Acquire your financial institution assertion for the present interval and evaluate it to your bookkeeping data or your organization’s money account data from the accounting system. The money stability reported towards each data may be totally different. We have to establish why these variations exist and make changes accordingly.

Step #2

Determine objects that match each data. We will single out the unreconciled transactions by eliminating the entries that may be traced on each data.

Step #3

Determine objects which have hit the corporate data however are missed on the financial institution assertion. Money that has been obtained and recorded by the corporate however has not but been recorded on the financial institution assertion known as “deposits in transit.” We have to add these to the financial institution assertion.

“Excellent Checks” are checks issued by the corporate however have not but been cleared by the financial institution, that means the funds haven’t but been deducted from the corporate’s checking account stability. We have to deduct these from the financial institution assertion.

Step #4

Now, search for objects which are mirrored on the financial institution assertion however don’t present up on the corporate’s bookkeeping data. These are usually points like financial institution service charges, the place banks deduct fees for companies rendered, or financial institution errors and different points. We have to deduct these fees from the accounting data.

Determine any curiosity earned by the corporate. These shall be added to the accounting data.

Step #5

After adjusting each data, the financial institution assertion stability ought to equal the adjusted money document stability. Report the reconciliation by categorizing every discrepancy into one of many above varieties recognized in steps 3 and 4 and grouping every class by combination values. Mainly, you’re recording a change to the money accounts in your basic ledger.

After noting the discrepancies flagged by the final ledger and the financial institution assertion, notice how the checking account stability adjustments over the following few days. Confirm the impression and notice any unnoticed entries that hit the checking account.

Reconciliations are carried out on the finish of the month, with companies with extra transactions performing the method extra continuously. Common financial institution reconciliation is a key inner management measure that measures the accuracy of the corporate’s money data and identifies any points and discrepancies in a well timed trend.

Financial institution Reconciliation Instance

Think about you might be working for a corporation, ABC, within the retail business. It’s essential carry out financial institution reconciliation on the finish of the month (which may be daunting). Nonetheless, in the event you take the steps listed within the financial institution reconciliation instance, you may make sure the monetary accuracy of the data.

Report the balances registered for the checking account stability and the corporate’s money account.

- Financial institution Assertion Steadiness on the finish of June 2024: $15,000

- Firm’s Money Account Steadiness in Data: $14,500

The corporate’s financial institution assertion reveals $15,000, however the firm’s data present $14,500. This discrepancy must be resolved.

Step 1: Examine Financial institution Assertion and Firm Data

| Financial institution Assertion | Firm Data |

|---|---|

| $15,000 | $14,500 |

Objects that match each data are highlighted. For instance, a deposit of $5,000 on June 1st and a examine #123 for $1,000 on June third.

Step 2: Determine Matching Objects

| Date | Description | Financial institution Assertion Quantity | Firm Data Quantity |

|---|---|---|---|

| 01/06/2024 | Deposit | $5,000 | $5,000 |

| 03/06/2024 | Verify #123 | -$1,000 | -$1,000 |

Objects just like the deposit in transit and excellent checks are recognized. These have to be adjusted within the financial institution assertion.

Step 3: Determine Objects in Firm Data however Not in Financial institution Assertion

| Date | Description | Quantity | Motion |

|---|---|---|---|

| 04/06/2024 | Deposit in Transit | $1,500 | Add to Financial institution Assertion |

| 05/06/2024 | Excellent Verify #124 | -$500 | Deduct from Financial institution Assertion |

Objects like financial institution service charges and curiosity earned are recognized. These have to be adjusted within the firm’s data.

Step 4: Determine Objects in Financial institution Assertion however Not in Firm Data

| Date | Description | Quantity | Motion |

|---|---|---|---|

| 06/06/2024 | Financial institution Service Price | -$50 | Deduct from Firm Data |

| 07/06/2024 | Curiosity Earned | $25 | Add to Firm Data |

After changes, the financial institution assertion and firm data ought to be reconciled and match.

Step 5: Adjusted Balances

| Class | Quantity |

|---|---|

| Adjusted Financial institution Assertion Steadiness | $16,000 |

| Adjusted Firm Data Steadiness | $16,000 |

By following these steps and utilizing the supplied tables, Firm ABC can precisely carry out a financial institution reconciliation, guaranteeing its data are up-to-date and mirror the true monetary standing. Common reconciliation helps establish discrepancies, forestall fraud, and guarantee monetary accuracy.

Why is Financial institution Reconciliation Vital ?

Financial institution reconciliation is essential for companies for a number of causes:

Error Detection:

Financial institution reconciliation helps establish errors in an organization’s monetary data. Points like duplicate funds, missed funds, or incorrect transaction quantities may cause these errors. This ensures that buyer funds have been made, which is crucial when operating a profitable enterprise.

Fraud Detection:

After carefully scrutinizing each data, reconciliation can reveal unauthorized transactions and fraudulent exercise. This enables companies to take proactive measures, cease fraud, and get well any misplaced funds instantly.

Insights into money movement:

With well timed reconciliations in place, enterprise can spot issues with money movement by noticing how the inflows and outflows of money are altering with time. This helps with money movement administration and higher forecasting of the companies’ funds.

Correct Monetary Reporting:

By guaranteeing the integrity of the corporate’s stability sheets, earnings statements, and different monetary paperwork by way of common reconciliations, companies might help depend on the info and make knowledgeable enterprise selections.

Audit Compliance protocols:

Correctly reconciled financial institution statements are required for correct tax reporting and might help keep away from penalties or points throughout audits.

In abstract, common and thorough financial institution reconciliations are important for companies to detect errors, forestall fraud, handle money movement, guarantee correct monetary reporting, adjust to tax necessities, and strengthen inner controls. It’s a crucial part of sound monetary administration.

Challenges confronted With Financial institution Reconciliations

Companies can acquire many benefits by guaranteeing their accounting course of’s monetary integrity by way of common financial institution reconciliations. Financial institution reconciliations assist companies detect anticipated funds that have not been made but, detect fraud, and correctly handle money movement.

Nevertheless the character of financial institution reconciliation is extraordinarily guide. Accounting groups can encounter a number of erros and inconsistencies dirung the guide comparision between the final ledger and the financial institution assertion. Human made errors, managing a number of currencies and complicated relationships between disaparte information sources can result in extra time being consumed and error inclined monetary reporting;.

Lets checklist down a number of the frequent mismatches that accountants come throughout whereas attempting to do guide financial institution reconciliation:

“Excellent Checks”:

These are funds that the corporate has despatched out and recorded however has not but cleared through the financial institution. Equally checks which have been recieved by the enterprise however have not but hit the account need to be adjusted accordingly.

“Money-In Transit”:

The money may not instantly mirror within the checking account when funds are transferred through bank card funds or wire transfers. We have to make the correct changes right here as properly.

“Financial institution curiosity and repair charges“:

Banks deduct fees for companies rendered (sometimes comparatively small), however they should be adjusted accordingly for correct reconciliation. Equally, banks pay curiosity in financial institution accounts, which should be accommodated accordingly.

“Acquiring crucial information“:

Managing excessive quantity of transactions may be daunting and problematic on account of disparate information sources that have to be recognized and consolidated throughout the reconciliation course of. As soon as an bill is obtained we have to examine whether or not the mentioned items have arrived towards the related buy order. As soon as confirmed, there must be an entry within the accounting system which must be reconciled towards the acquisition receipt. To consolidate all these paper receipts and nobody place for digitising and a central database to checklist, it may be very time consuming to do the method towards every entry within the accounting system.

“Quite a few financial institution accounts and currencies”:

Firms typically use a number of banks and accounts in numerous currencies. Reconciling transactions throughout these varied accounts and currencies provides complexity to the method.

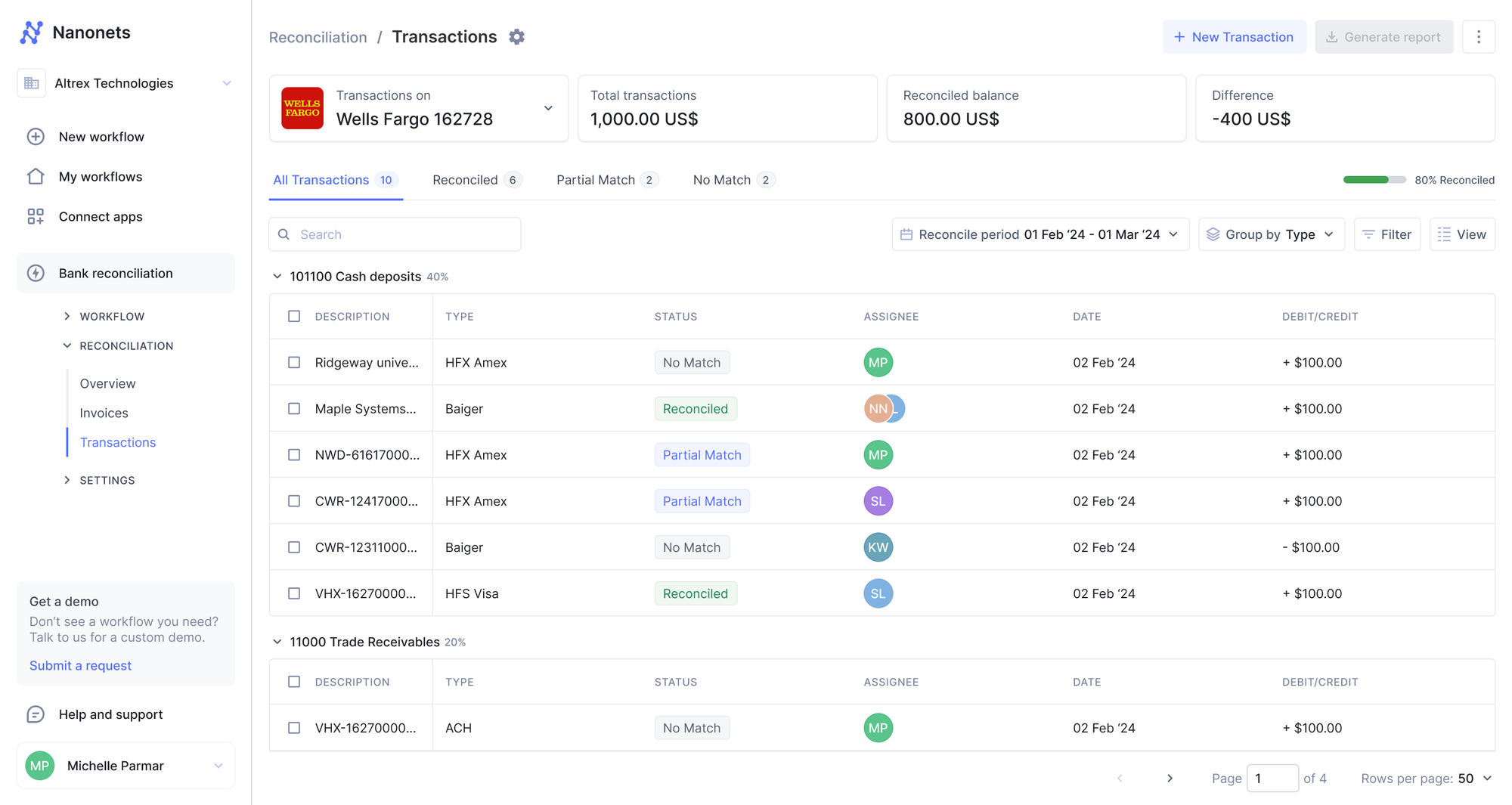

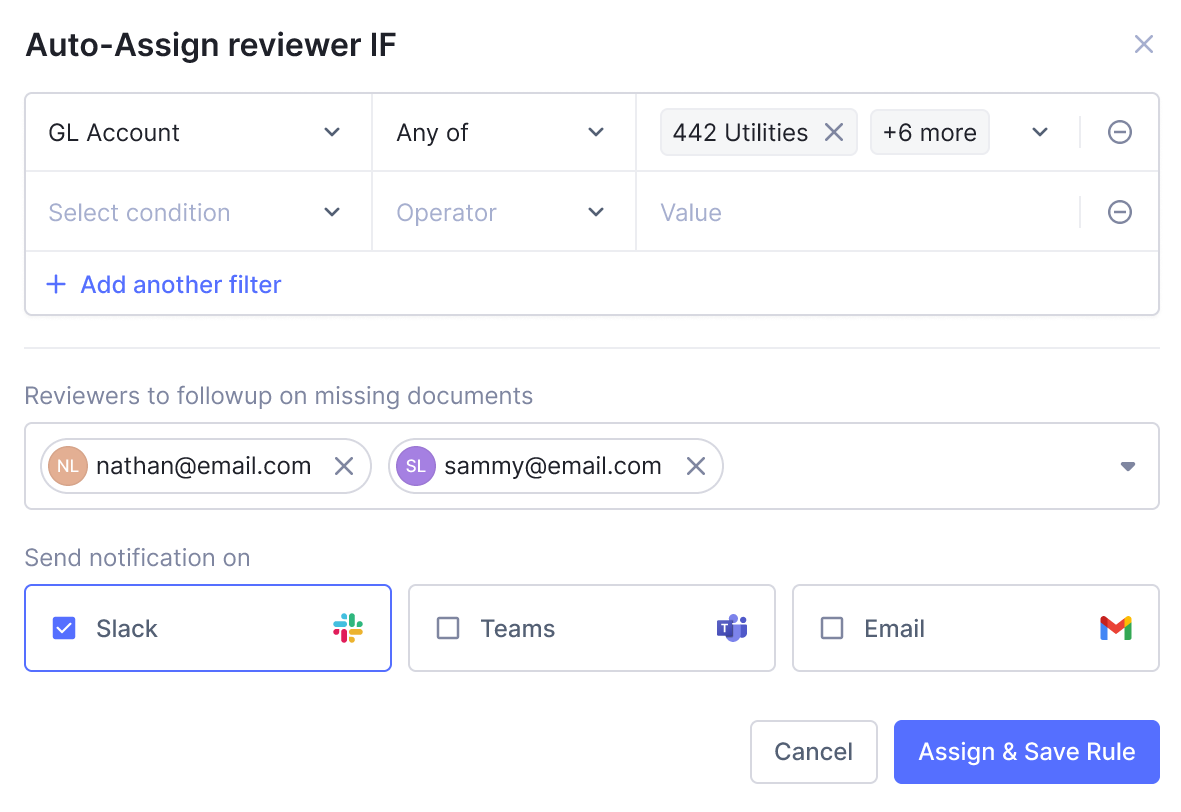

Handle Financial institution Reconciliations With Nanonets

Utilizing Nanonets in your financial institution reconciliation duties might help streamline the method by eliminating time-consuming, error-prone, and resource-intensive duties when accomplished manually. Nanonets presents an automatic reconciliation software program resolution to method this important process.

“Automated information extraction”:

Nanonets’ Pretrained OCR fashions are higher than huge information generative AI fashions for information extraction. Generative AI options should not educated on labeled information, whereas Nanonets AI is continually being educated on annotated information to extract information with greater accuracy. Nanonets AI learns how one can map enter options (just like the fields you need to extract) to the output labels (identify, date, stability) to realize greater accuracy and scale with greater volumes of transformation information with ease.

.png)

“Clever transaction matching”:

Nanonets AI leverages superior algorithms, corresponding to NLP strategies and fuzzy matching, to quickly evaluate transactions between financial institution statements and accounting data. This reduces time taken for guide reconciliation from hours to simply minutes.

“Centralised Knowledge Repository“:

By consolidating all reconciliation information, supporting paperwork, approvals, and reporting right into a single platform, Nanonets creates a complete, auditable document of the financial institution reconciliation course of. This centralized repository streamlines the reconciliation workflow, improves visibility, and enhances compliance.

“Exception Administration“:

Nanonets Reconciliation software program can flag any unmatched and suspicious transactions, alerting the related members of the accounting workforce to analyze. Utilizing Nanonets workflow automation capabilities, customers can set off and assign motion objects to the remainder of the workforce for proactive decision and obtain transparancy within the course of.

“Scalability with excessive transaction volumes“:

Nanonets can deal with excessive transaction volumens with velocity and precision. Organizations attempting to do guide reconciliation on the finish of the month would possibly want to rent extra personals to take care of the excessive and fluctuating volumes of transactions. Nanonets frees up finance professionals to deal with extra strategic duties.

“Reporting and audit trails“:

Detailed reconciliation experiences are generated mechanically, offering a full course of audit path. This improves compliance and visibility.

.png)

By adopting Nanonets, companies can save important money and time, enhance information accuracy, strengthen inner controls, and improve general monetary administration. It’s a highly effective device for streamlining the crucial financial institution reconciliation course of.

[ad_2]