[ad_1]

Introduction

Accounts Payable (AP) are short-term obligations that an organization owes to its collectors or suppliers, however firm has not but paid for them. On an organization’s stability sheet, payables are recorded as a present legal responsibility.

Understanding Accounts Payable: Is it a debit or a credit score?

To higher perceive AP, we should first know the fundamental idea of debits and credit.

What are debits and credit?

Debit and credit score are the 2 important accounting phrases you will need to know to grasp the double-entry accounting system. A double-entry accounting system information every transaction as a debit or a credit score. This ensures that the books are all the time balanced.

In easy phrases, debits are quantities owed to somebody and credit are quantities somebody owes you.

Debit and credit score are phrases utilized in finance to point modifications in account balances. Debiting an account includes recording an quantity owed or subtracted, which decreases the account stability.

Conversely, crediting an account includes recording an quantity added or deposited, which will increase the account stability. In essence, debiting reduces the stability whereas crediting will increase it.

Journal Entries for Debits and Credit

Journal entries are created in accounting techniques to file monetary transactions. Debits and credit have to be recorded in a sure order in an accounting journal entry. Debits and credit in an accounting journal will all the time seem in columns subsequent to at least one one other. As regular, debits will likely be proven on the left and credit on the proper. When recording a transaction, it’s all the time vital to place information within the correct column.

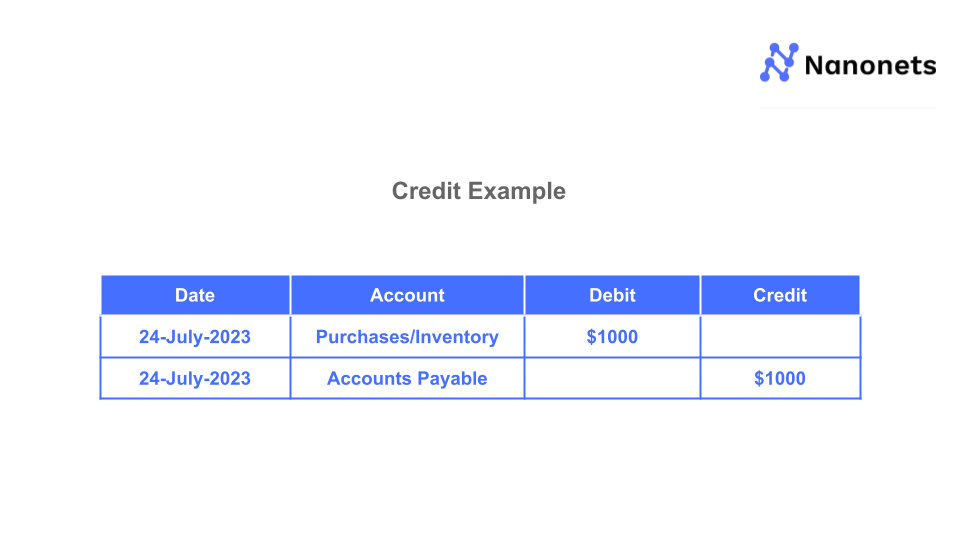

Credit score Instance:

If the corporate buys a laptop computer for its staff for $1000, following is how will probably be recorded:

1. Purchases or Stock account will likely be debited by $1000

2. Accounts Payable will likely be credited with $1000

Right here is the double entry for getting something on credit score:

Corporations typically seek advice from the identify of the seller from whom they’ve made purchases relatively than the “Account payable” account when recording monetary transactions. As a substitute of protecting all of the balances beneath a single account, it allows them to handle their Accounts Payable balances extra effectively.

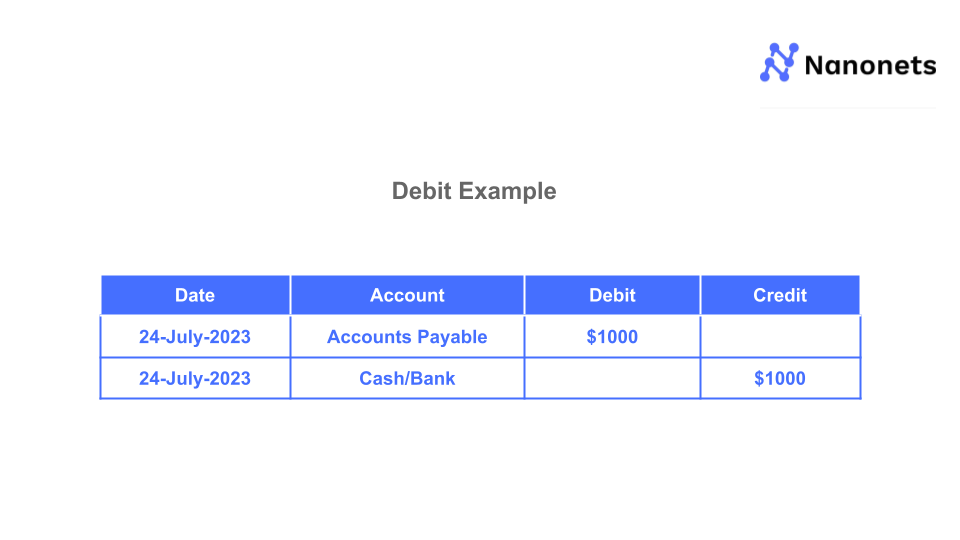

Debit Instance:

After the enterprise has settled its debt of $1000 to the seller, it’s required to file the transaction as follows:

1. Accounts Payable account will likely be debited by $1000

- Money or financial institution transfers are the 2 most typical strategies that companies use to make a debit to Accounts Payable. That account will likely be credited with $1000

Consequently, the double entry for the payback of Accounts Payable ought to seem like this.

What’s Account Payable?

Merely put, An organization’s Accounts Payable contains any excellent payments for buy of products or companies from its distributors. Accounts Payable is a legal responsibility since it’s a debt.

A credit score stability in a payable account signifies that the corporate owes cash, whereas a debit stability signifies that the corporate has settled its money owed to a selected vendor. Subsequently, the conventional stability of Accounts Payable is adverse.

Is Accounts Payable debit or credit score?

To reply the query, Accounts Payable are thought-about to be a sort of legal responsibility account. Because of this when cash is owed to somebody, it’s thought-about to be credit score. However, when somebody owes you cash, it’s thought-about to be a debit. On this case, Accounts Payable can be categorized as a debit.

Relying on the character of the transaction, Accounts Payable could also be recorded as a debit or a credit score. Accounts Payable is a legal responsibility; therefore any progress in that quantity is usually credited. Accounts Payable are sometimes credited when an entity receives cost however debited when the corporate is launched from its authorized obligation to pay the debt.

Accounts Payable are a sort of legal responsibility, that means they’re a debt your organization owes. Liabilities are often recorded as a credit score in your stability sheet. Nonetheless, Accounts Payable will also be thought-about a debit, relying on the way you construction your chart of accounts.

Credit score purchases are probably the most frequent supply of credit score in AP. When a enterprise makes use of credit score to purchase provides, the transaction is recorded in Accounts Payable.

Conversely, a debit in Accounts Payable typically outcomes from money being refunded to suppliers, lowering liabilities. Debits in Accounts Payable may also consequence from reductions or product returns.

Accounts Payable are thought-about a legal responsibility, which implies they’re sometimes recorded as a debit on an organization’s stability sheet. Nonetheless, the account could also be recorded as a credit score if an organization makes early funds or pays greater than is owed.

Automate information seize, construct workflows and streamline the Accounts Payable course of in seconds. No code is required. Ebook a 30-min reside demo now. Automate bill funds with AI.

Recording Account Payable – Examples

The next examples ought to make it clearer how the entries within the journal are to be made for the Account Payable.

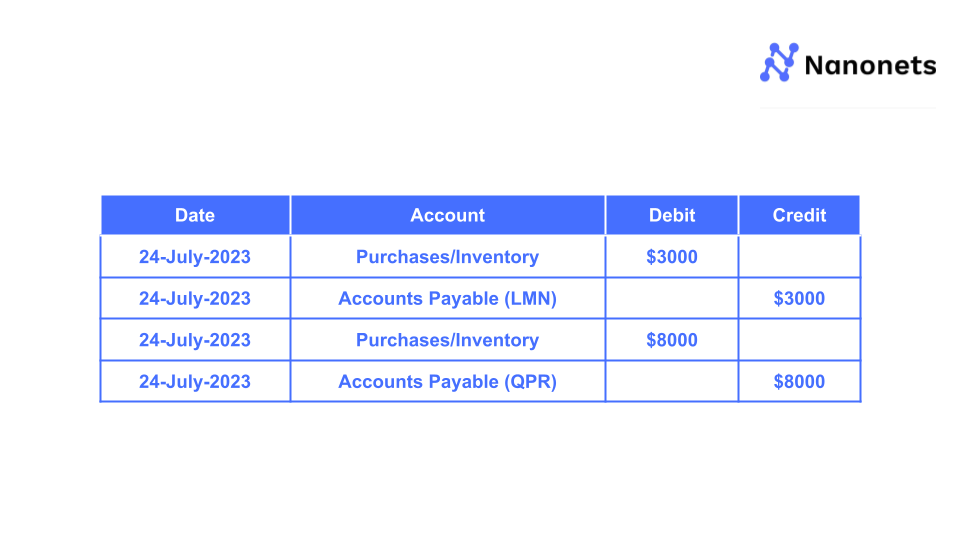

Instance 1:

One enterprise, XYZ Firm, purchases from one other firm, LMN Co., for a complete of $3000 price of merchandise. Moreover, it purchases from a unique provider, QPR Co., totalling $8,000 price of things. These two purchases are being made utilizing credit score for one month. The next are the double entries that must be accomplished for the acquisition that was constituted of LMN and QPR Firm:

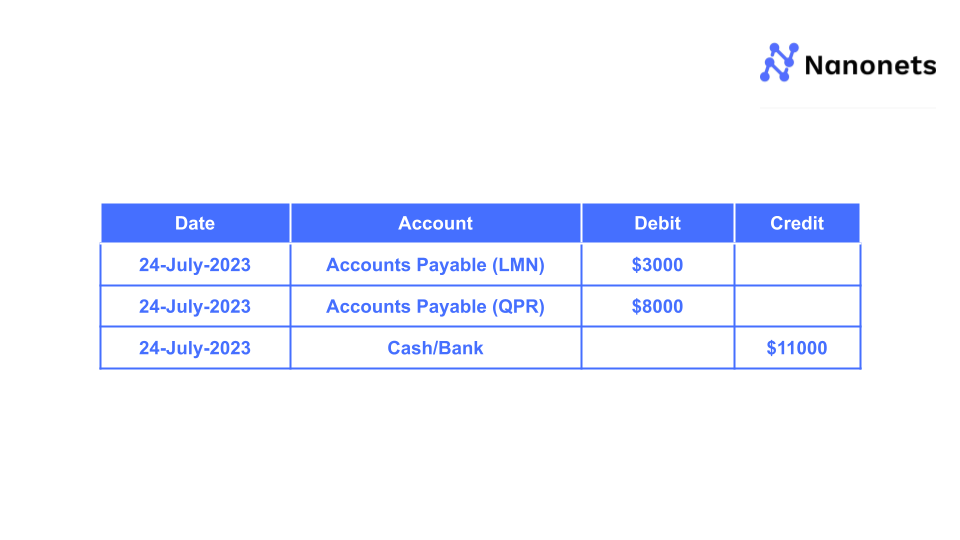

After a month has handed, XYZ Firm makes a reimbursement to LMN and QPR Corporations for the acquisition made above. The financial institution or money supply of XYZ Firm is used to make a debit to Accounts Payable. The next is the compound accounting entry that ought to be made to each Accounts Payable ledgers.

This entry nullifies the stability in suppliers’ ledgers, i.e., Accounts Payable (LMN) and Accounts Payable (QPR). The closing stability on the finish of the monetary 12 months will likely be zero per these two transactions.

Whenever you pay your hire, you debit your account with the cash you owe. So, when monitoring transactions in a double-entry accounting system, consider debits as cash flowing out of an account and credit as cash flowing into an account. This would possibly initially appear complicated, however it is going to develop into clear when you begin working with examples. Let’s take a more in-depth take a look at what these phrases imply and the way they work collectively within the accounting system.

Instance 2:

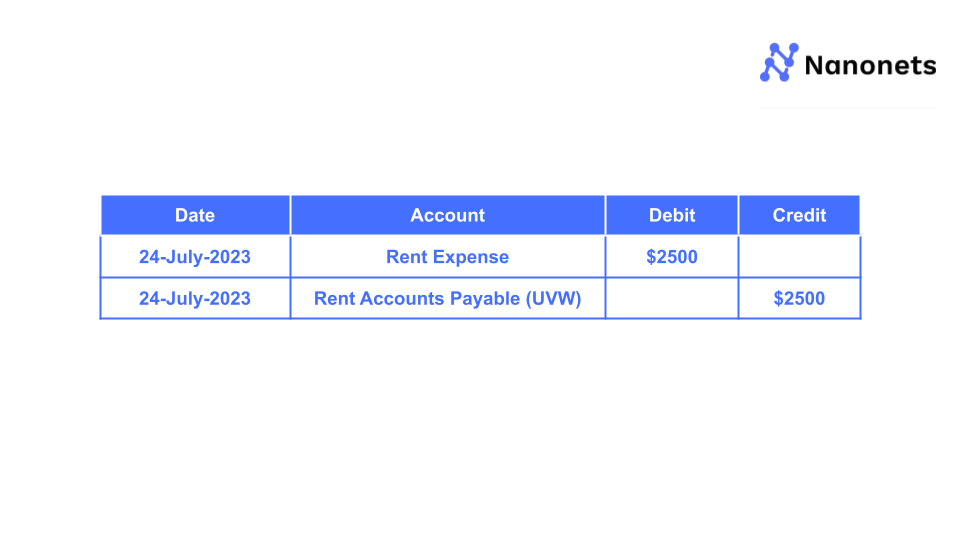

XYZ agency has moved its day-to-day enterprise actions right into a location rented from UVW firm at the price of $2,500 monthly for the house. XYZ Firm is paying hire to UVW Firm.

On an accrual foundation, the cost of the overdue quantity takes place after the rental service has been accomplished. This suggests that first, the service is loved, after which the cost for it’s made after it has been offered for a month.

The next is how the double entry for the rental service seems for the corporate that was purchased from UVW:

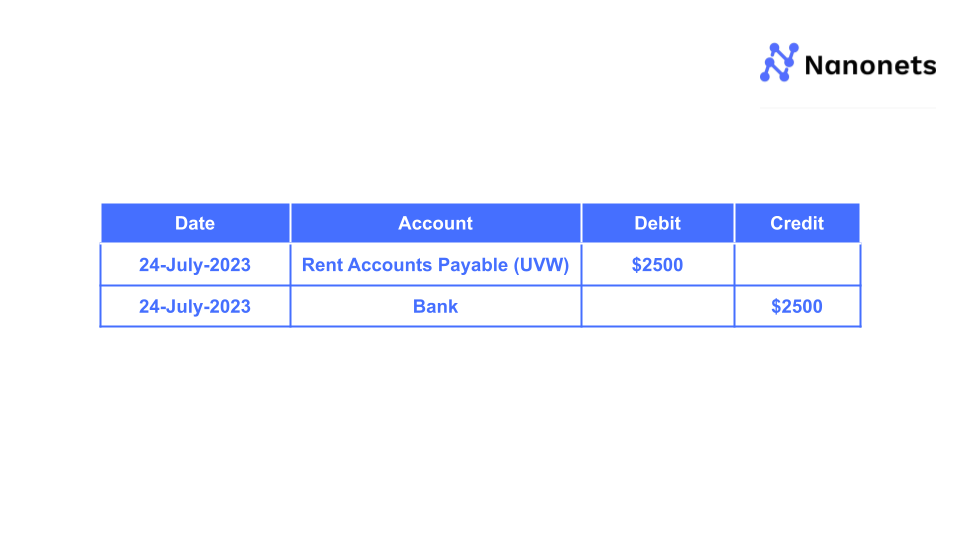

After a month, UVW will obtain the overdue sum of $2,500 in cost. The submission have to be made within the following format:

What is supposed by a “Turnover Ratio” for Accounts Payable?

An organization’s short-term liquidity could also be evaluated by calculating a ratio often called Accounts Payable turnover. This ratio represents the typical tempo at which a enterprise pays again its suppliers. The Accounts Payable turnover ratio is a statistic companies use to gauge how nicely they’re clearing off their short-term debt.

The next is the method that ought to be used to calculate the Accounts Payable turnover ratio:

AP Turnover Ratio = Internet Credit score Purchases/Common Accounts Payable

In sure calculations, the numerator won’t embrace internet credit score purchases; relatively, it is going to utilise the price of items bought. The entire Accounts Payable at first of an accounting interval and Accounts Payable after the interval are added collectively after which divided by 2.

Find out how to gauge the monetary well being primarily based on Turnover Ratio?

Collectors can gauge the corporate’s short-term liquidity and, by extension, its creditworthiness primarily based on the Accounts Payable turnover ratio. If the proportion is excessive, patrons pay their bank card distributors on time. Suppliers could also be pushing for sooner funds, or the agency could also be attempting to benefit from early cost incentives or increase its creditworthiness if the determine is excessive.

A low share suggests a sample of late or nonpayment to distributors for credit score transactions. This is likely to be due to good lending circumstances or a sign of money move points and a deteriorating monetary state of affairs. Though a falling ratio may counsel monetary hassle, that isn’t all the time the case. The enterprise might have negotiated extra beneficial cost circumstances that may allow it to delay funds with out incurring any extra charges.

Suppliers’ credit score phrases typically decide an organization’s Accounts Payable turnover ratio. Corporations that may negotiate extra beneficial lending preparations typically report a decrease ratio. Massive firms’ Accounts Payable turnover ratios can be decrease as a result of they’re higher positioned to barter beneficial credit score phrases (supply).

Corporations ought to use the credit score phrases prolonged by suppliers to their benefit to obtain reductions on purchases, despite the fact that a excessive Accounts Payable turnover ratio is mostly fascinating to collectors as signaling creditworthiness.

When analyzing an organization’s turnover ratio, you will need to accomplish that within the context of its friends in the identical business. If, for example, nearly all of an organization’s rivals have a payables turnover ratio of not less than four-figure, the two-figure determine for the hypothetical firm turns into extra worrisome.

Arrange touchless AP workflows and streamline the Accounts Payable course of in seconds. Ebook a 30-min reside demo now.

Automating the Accounts Payable course of

Automating the Accounts Payable course of might be a good way to avoid wasting time and cut back errors. By automating the method, companies can keep away from manually inputting information and be certain that all invoices are paid on time. Moreover, AP automation will help companies hold monitor of spending, as all transactions will likely be recorded in a single place.

As a enterprise proprietor, you already know that probably the most vital — and time-consuming — process is paying your payments on time. However what if there have been a technique to automate this course of?

Enter Nanonets. Nanonets is an AI-powered Accounts Payable answer that makes it simple to automate your invoicing and funds. With Nanonets, you possibly can take a picture of your invoice and have it mechanically processed — from extraction of important information to scheduling funds and updating your accounting software program — that means you possibly can spend much less time on paperwork and extra time operating your enterprise.

Nanonets on-line OCR & OCR API have many fascinating use circumstances that would optimize your enterprise efficiency, save prices and increase progress. Discover out how Nanonets’ use circumstances can apply to your product.

[ad_2]