[ad_1]

Apple is a colossus. A few of us may bear in mind again when it was doomed and almost bankrupt, however lately, it generates a whole lot of billions of {dollars} in income each day and has a market capitalization of greater than three trillion {dollars}.

And but even essentially the most highly effective corporations are fallible. Usually they’ve a hubris that implies that their success in a single space means they’ll simply prolong it to others–typically with disastrous outcomes.

This week, Apple obtained one other reminder that even its mighty energy won’t be capable to make it succeed in any respect its ambitions. Don’t be embarrassed, Apple. Even the world’s most stunning fashions nonetheless get pimples every so often.

Cash isn’t banking

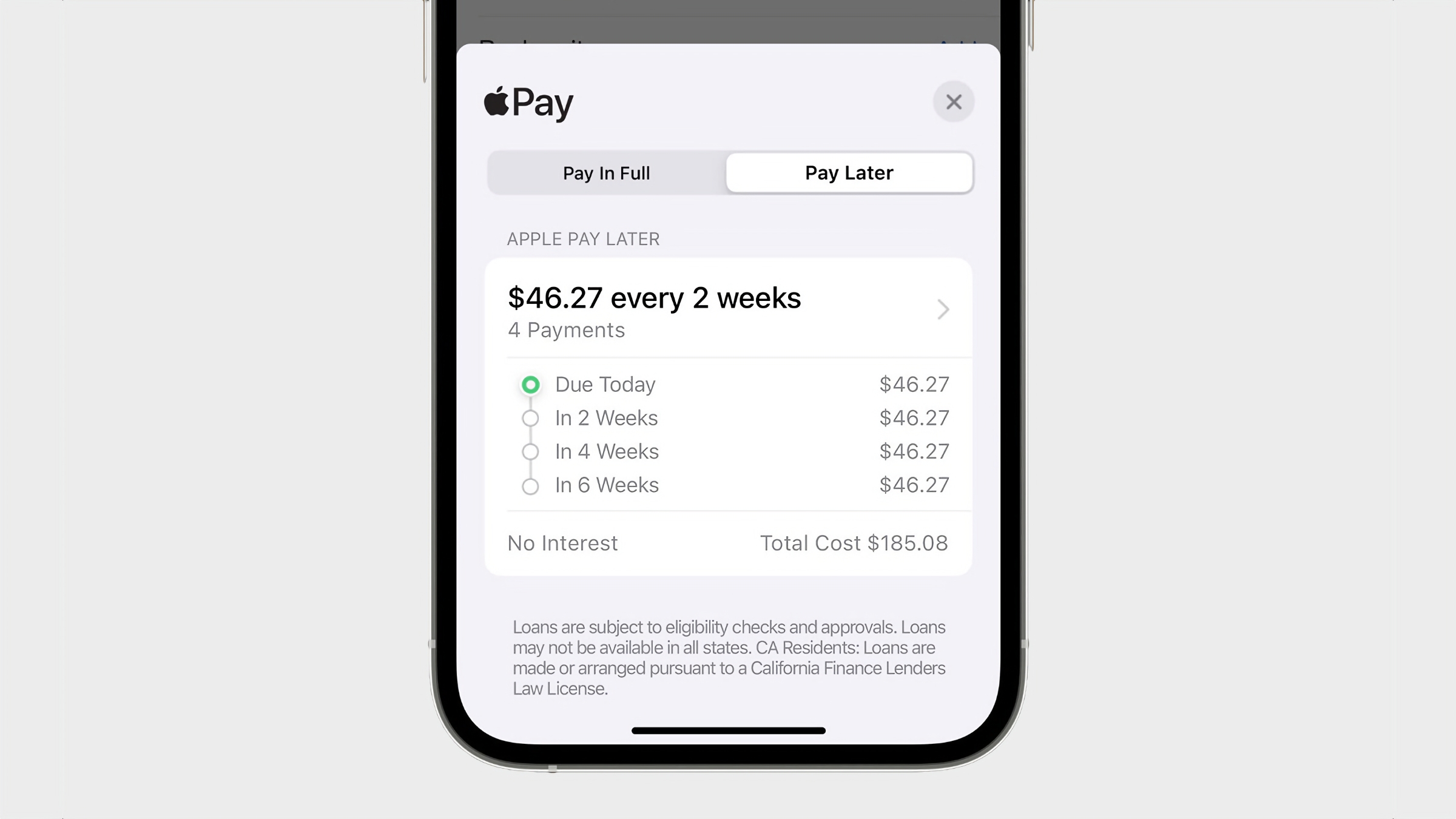

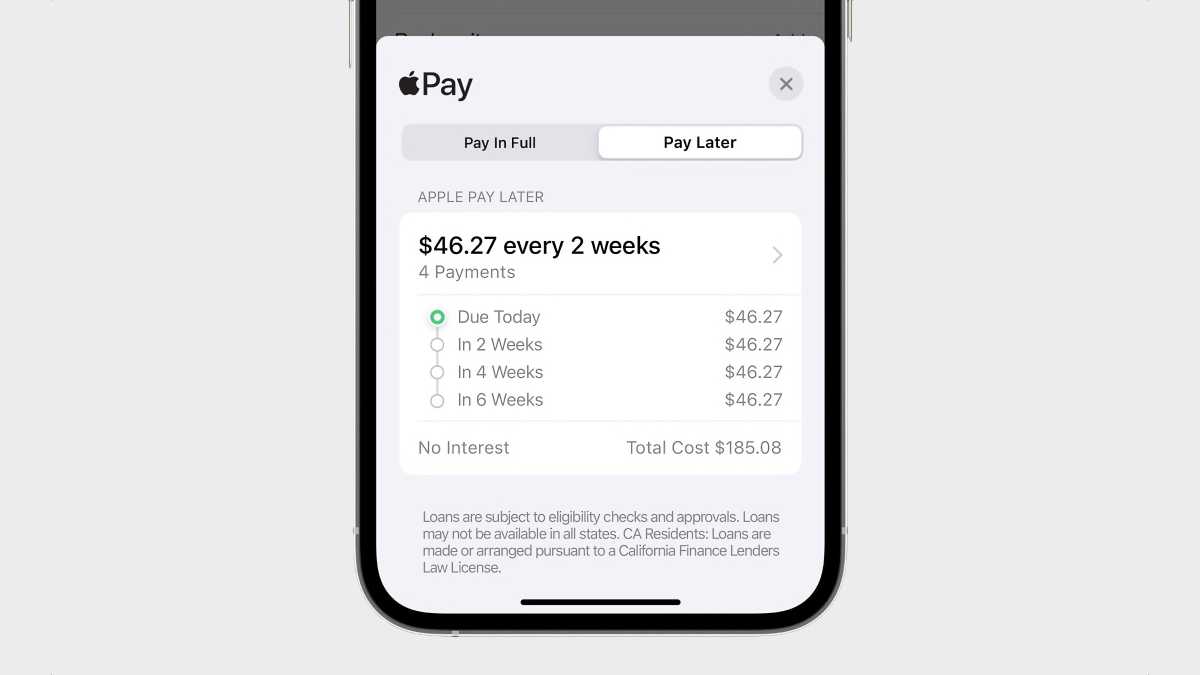

Apple is giving up on Apple Pay Later, a split-payment service that it introduced two years in the past and launched within the spring of 2023. It was a mortgage service backed by an Apple-owned monetary entity, Apple Financing LLC.

But it seems that regardless of Apple’s ambitions, which have been so nice that the corporate principally arrange its personal financial institution, the entire thing was a flop. Apple says it is going to recalibrate this fall with buy-now-pay-later schemes utilizing companions.

These occasions shouldn’t actually be shocking, although. Regardless of its general success with Apple Pay, Apple has proven that it will get slowed down when it wades into deeper monetary waters.

Apple Card was an try to innovate bank cards, with distinctive options and Apple Pockets integration. However for years now, tales have abounded that Goldman Sachs is making an attempt to get out of its deal and that Apple is amenable to the breakup. Apple Card can also be arising on its fifth anniversary and has nonetheless by no means prolonged past the USA.

Talking of worldwide rollouts, Apple Money–a simple digital money switch system that was presumably constructed to rival Venmo and Zelle–can also be solely accessible within the U.S., the place it feels extra like a bizarre vestige of the Apple Card than a much bigger, extra helpful function. I do ship individuals cash with Apple Money, however each time I wish to accomplish that with my mates within the U.Okay., I’m reminded that they simply don’t have it.

Apple Pay Later will probably be changed by third-party cost plans.

Apple

A couple of years in the past, Apple appeared to have some critical monetary ambitions and the will to do extra of it inside the corporate itself. Now it’s shuttering its mortgage service, its Apple Card associate is bailing, and plenty of companies stay locked to a single market.

Apple appears to have found that having all the cash isn’t the identical factor as being a financial institution.

Auto ambitions

Contemplate the auto business. As soon as ripe for disruption, lately, many of the automakers are absolutely invested in electrical autos and laptop console dashboards with automated driving options. That in all probability explains why Apple’s personal automotive undertaking, which price billions and spanned a decade, was lastly killed this yr. There was a time when Apple might need introduced one thing dramatic and disruptive to vehicles, nevertheless it seems like time has handed.

However it’s not simply Apple’s consideration of creating its personal automotive that reveals that Apple’s had a troublesome time of it within the auto area. Sure, the iPhone’s reputation has led to broad adoption of CarPlay–as a result of regardless of the auto business’s finest efforts, individuals will at all times be extra loyal to their smartphone than their automotive’s personal software program–however Apple has tried and didn’t make extra of that benefit.

Two years in the past, Apple introduced a “next-generation CarPlay” expertise that concerned CarPlay taking on the whole sprint of suitable vehicles. It stated it was working with some high-end companions, however principally, nothing has come of that announcement. This yr’s WWDC options some new periods about CarPlay, however plainly Apple is extra considering “educating” carmakers about why Apple is correct, truly, than in listening to carmakers and understanding why they’re immune to Apple’s makes an attempt to override their very own interfaces.

Prediction: It’s gonna be a bumpy trip, and Apple may wish to begin specializing in providing its ecosystem apps to CarPlay-resistant carmakers. (It lately launched Apple Music and Podcasts assist within the non-CarPlay Tesla interface, as an example.)

Massive as a authorities, perhaps

After which there’s regulation. Apple’s had a really aggressive method to authorities and regulation. Daring transfer–let’s see the way it works out for them.

To date, the reply is… not nice? Apple had to spend so much of final yr’s iOS cycle constructing new options only for the European Union, and can undoubtedly spend a few of this yr’s cycle addressing all of the ways in which final yr’s “fixes” didn’t truly meet the phrases of the Digital Markets Act.

In the meantime, right here comes Japan, passing its personal tackle the DMA that may in all probability open up competitors to the App Retailer in that nation on the finish of subsequent yr.

Might all of this have been averted? Maybe, however Apple’s method has virtually welcomed the battle–and it’s discovering out that if the regulators of a invaluable market don’t like the sport you’re enjoying, you’ll want to spend so much of money and time to please them.

Perhaps a extra political stance would’ve helped. However perhaps that’s simply not Apple’s approach.

Typically it really works

Look, I’m not saying that Apple ought to stick with its knitting. Typically it may be spectacularly profitable for Apple to transcend its consolation zone and check out new issues–witness the iPod and iPhone!

I’m additionally not saying we must always level and giggle at Apple’s failures. However I do suppose it’s instructive to watch the locations the place the corporate steps on a rake, as a result of it says one thing about its blind spots. To grasp Apple is to grasp what it’s good at–and what it’s not.

[ad_2]