[ad_1]

Final up to date

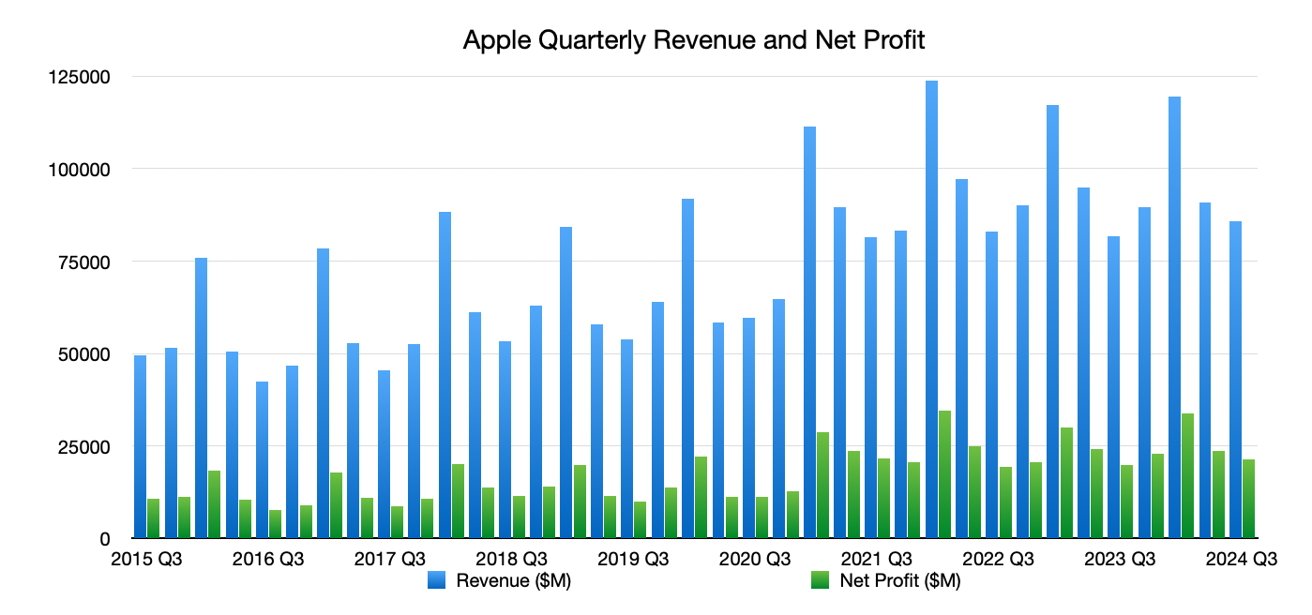

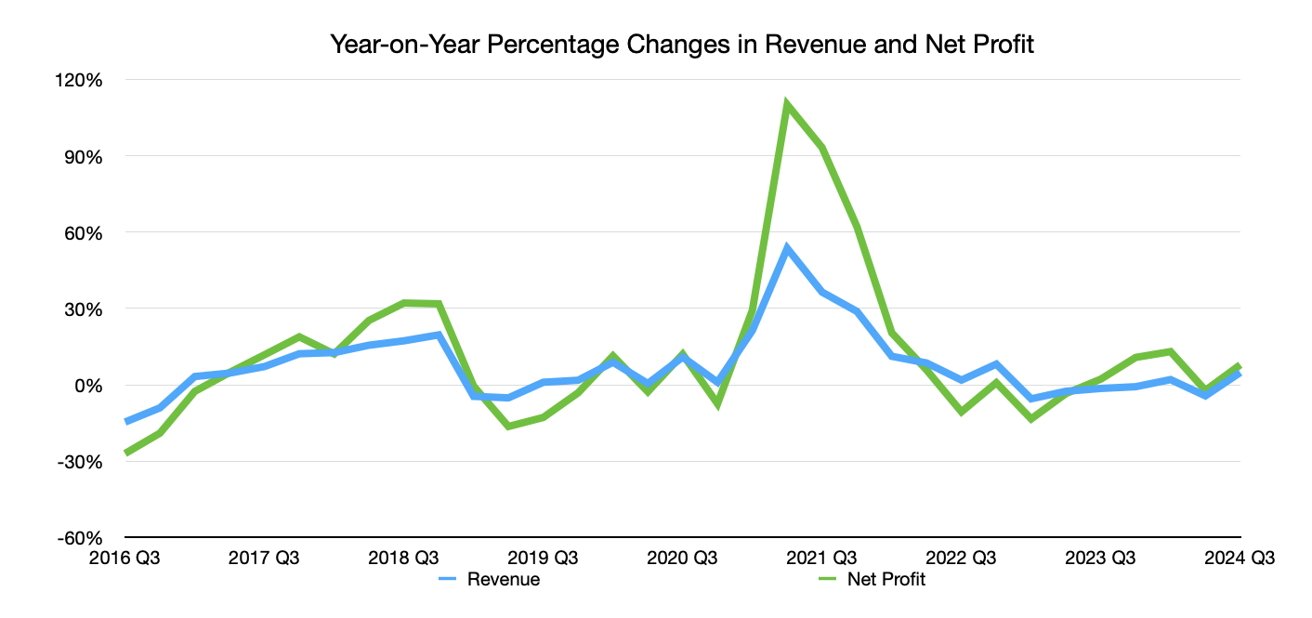

Apple’s third-quarter monetary outcomes have been a big enchancment for 2024. Here is how the figures visually break down in 1 / 4 the place Apple soundly beat Wall Road’s forecasts.

Forward of the quarterly outcomes for the third quarter of 2024, Wall Road had predictions that Apple would do higher than final yr. Nevertheless, the fact was that Apple soundly beat the forecasts in lots of areas.

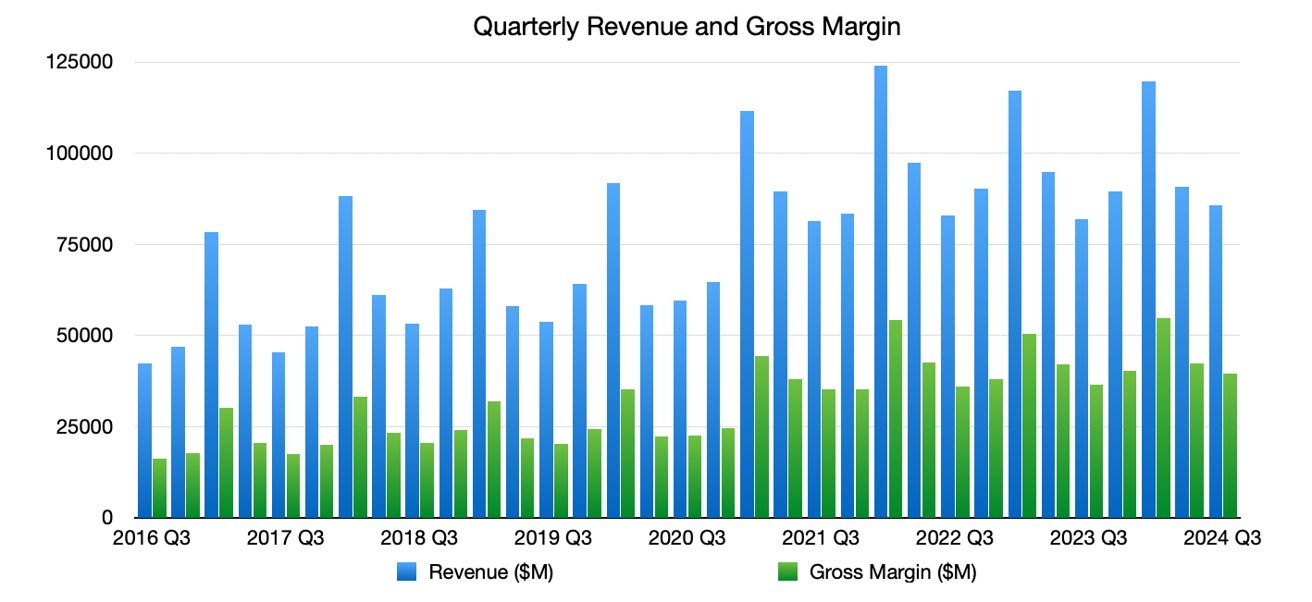

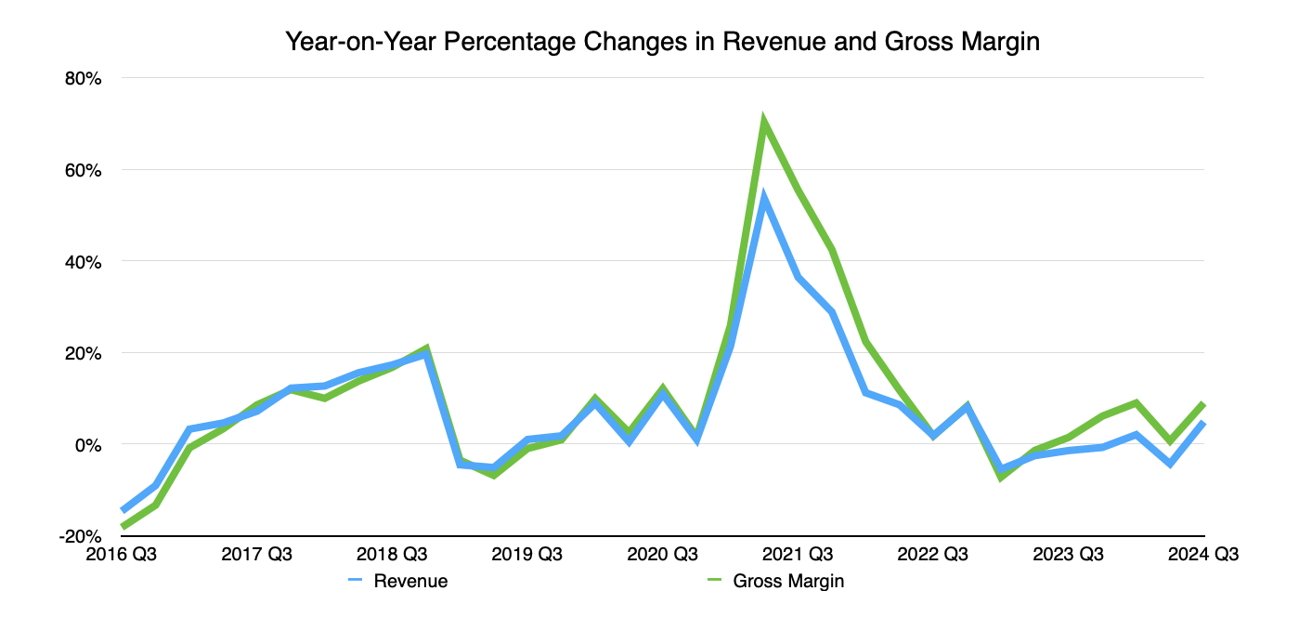

That is the breakdown of Apple’s figures for the interval in comparison with earlier quarters, offering a fuller image of Apple’s monetary journey.

Apple’s major monetary figures for Q3 2024

The headline quantity for Apple is its income, which hit $85.78 billion for the quarter. That is up from the $81.8 billion reported one yr prior, representing an increase of 4.9%.

The online revenue can also be as much as $21.4 billion, which is an increase of seven.9% over Q3 2023’s numbers.

The gross margin of $39.7 billion is a sound 9% increased than the determine from Q3 2023.

At 46.26, the gross margin is a better share of income than the 44.52% seen one yr prior. It has been above 40% since Q2 2021.

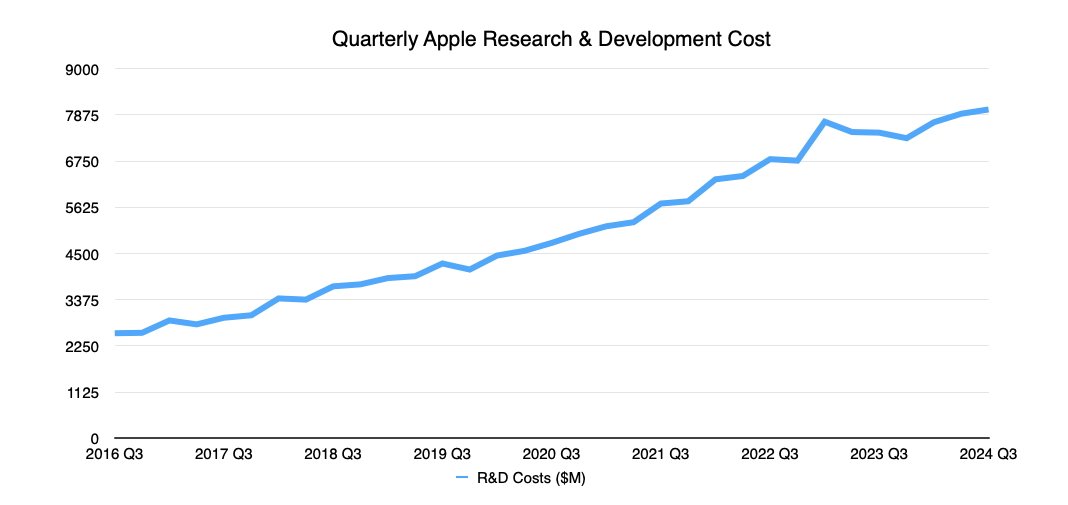

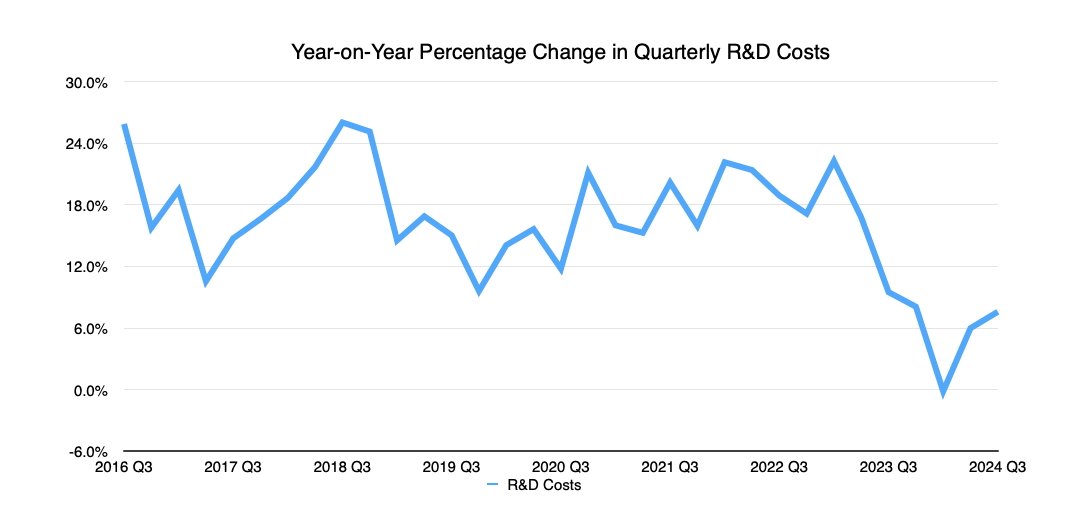

Apple’s analysis and growth spending is a phenomenally excessive worth for any firm, and it would not appear that Apple shall be altering its habits anytime quickly.

For Q3 2024, Apple spent over $8 billion on R&D. This worth has gone up 7.6% because the identical quarter in 2023, indicating a rise in spending for the interval.

Apple’s per-unit income and earnings

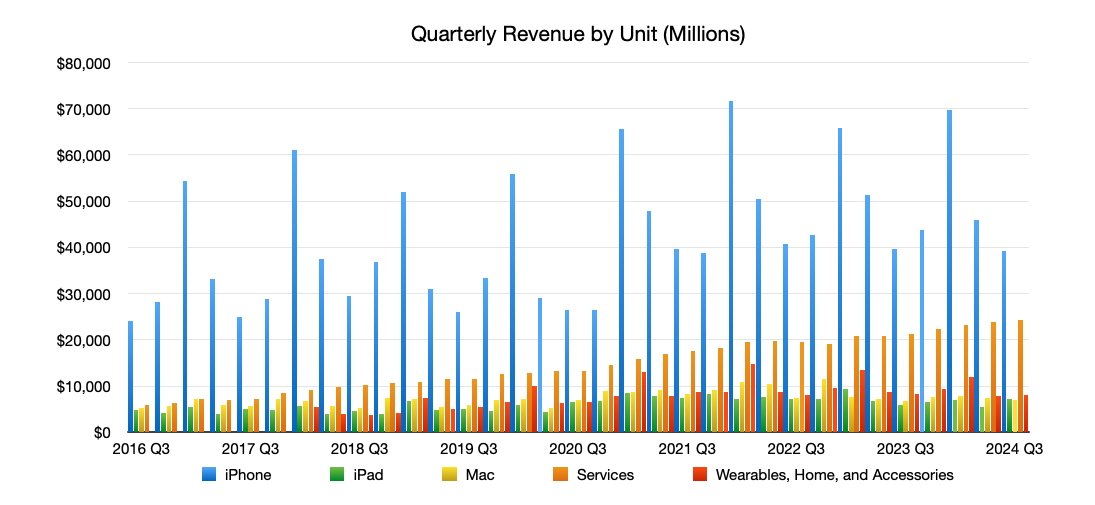

These first two graphs present Apple’s particular person unit income, to extra instantly examine them towards one another.

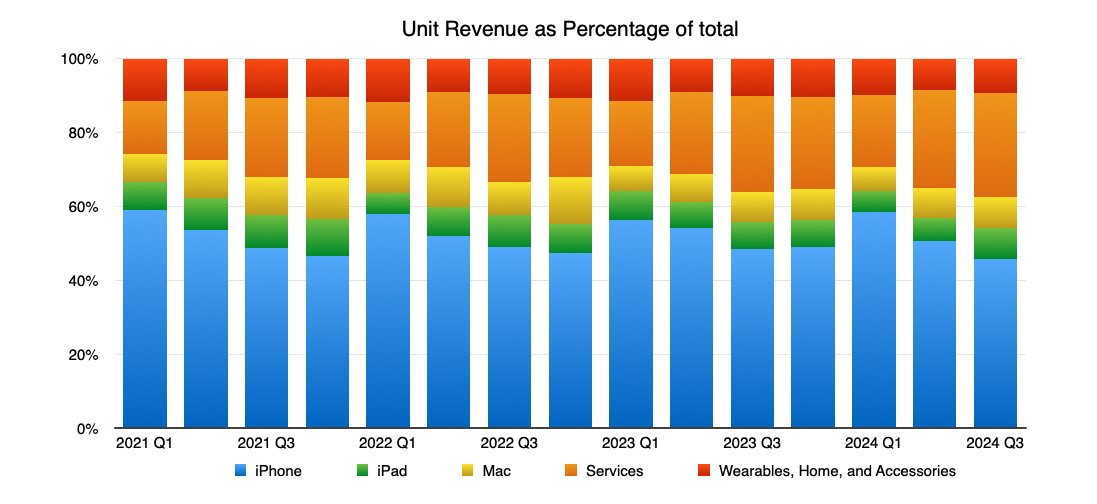

This primary one displaying the income instantly additionally exhibits that iPhone has been the principle income generator for Apple over a few years. Nevertheless, that dominance is slowly beginning to dissipate.

When checked out by how a lot income every unit brings in, we will see that the blue iPhone part continues to be main. Additionally, that orange Providers aspect is regularly changing into a juggernaut in its personal proper.

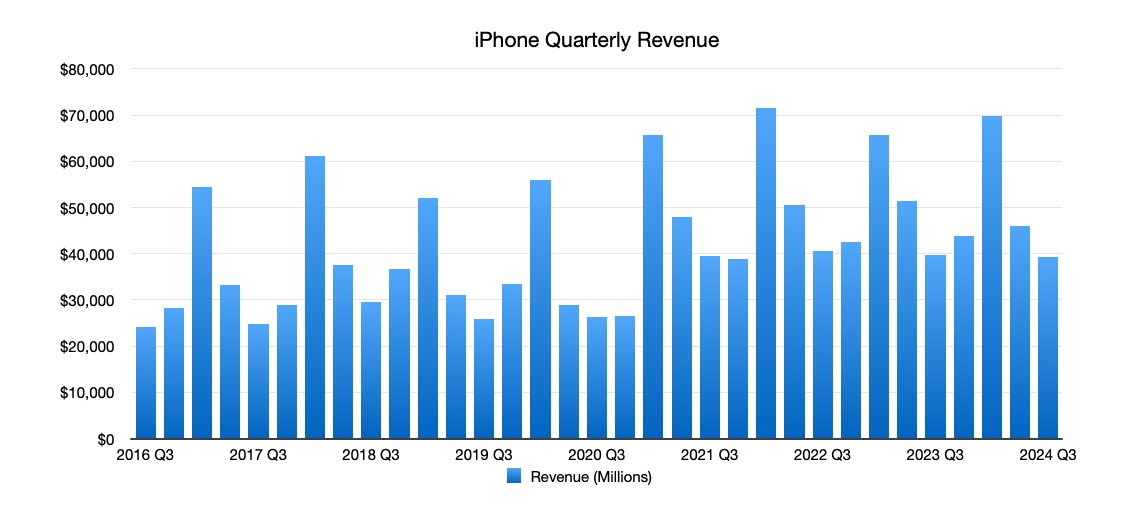

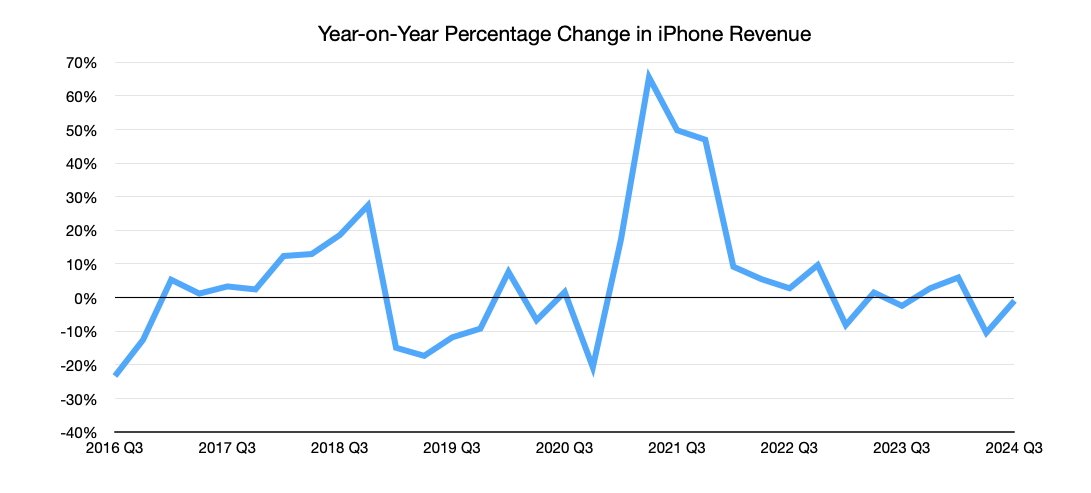

Income from iPhone was marginally down from Q3 2023, going from $39.67 then to $39.3 billion now. Even so, that is nonetheless higher than the $38.81 Wall Road forecasted.

On a share foundation, that is a negligible 0.9% year-on-year shrink in iPhone income. Given Q3 is the seasonally quietest quarter, it isn’t one thing Apple will actually fear about an excessive amount of.

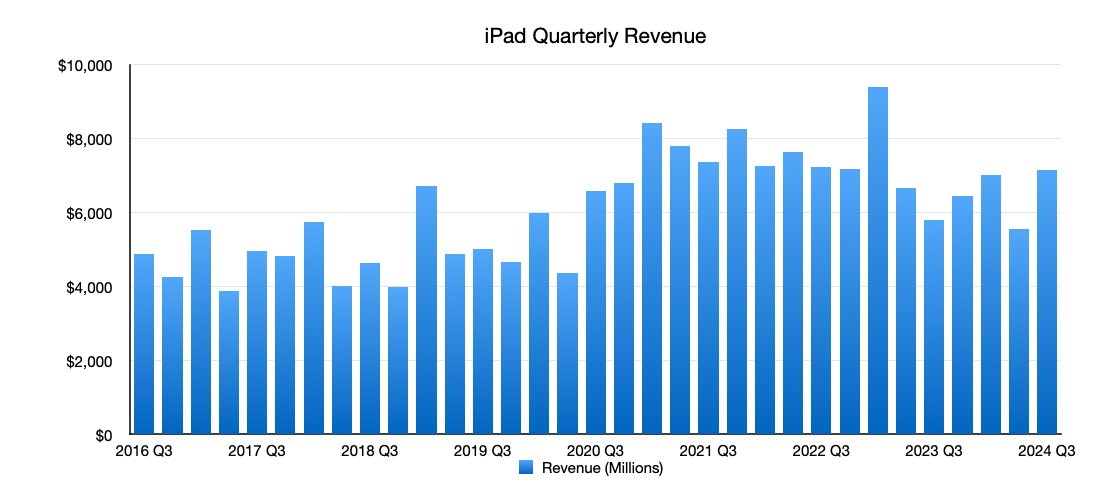

iPad income has loved a rebound, going from $5.79 billion in Q3 2023 to $7.16 billion. That 23.7% year-on-year improve soundly beat Wall Road’s forecast of $6.61 billion.

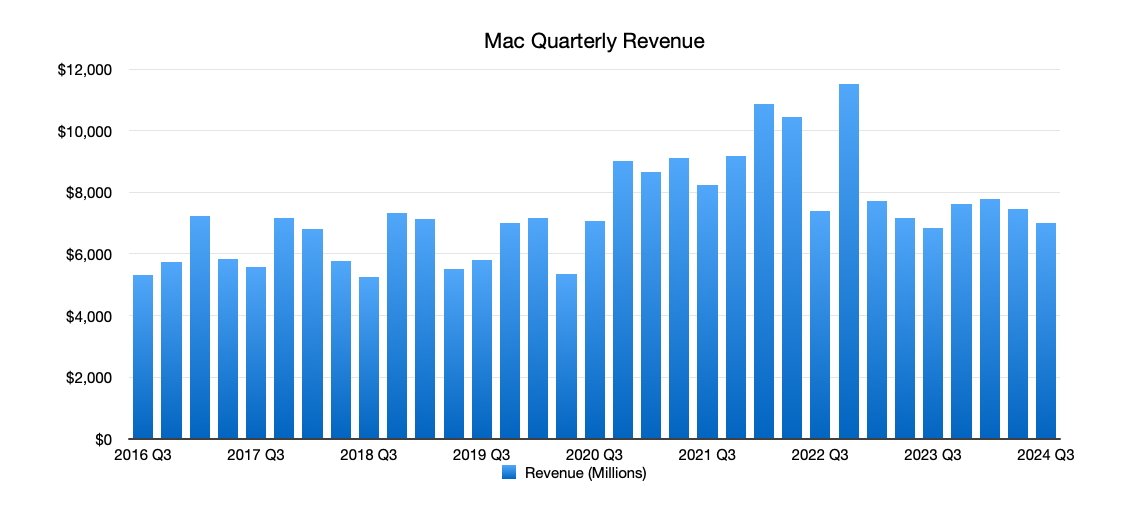

Mac additionally noticed an enchancment from $6.84 billion within the year-ago quarter to $7.01 billion now. That is a 2.5% improve, which is not a lot, however nonetheless marginally below Wall Road’s prediction of $7.02 billion.

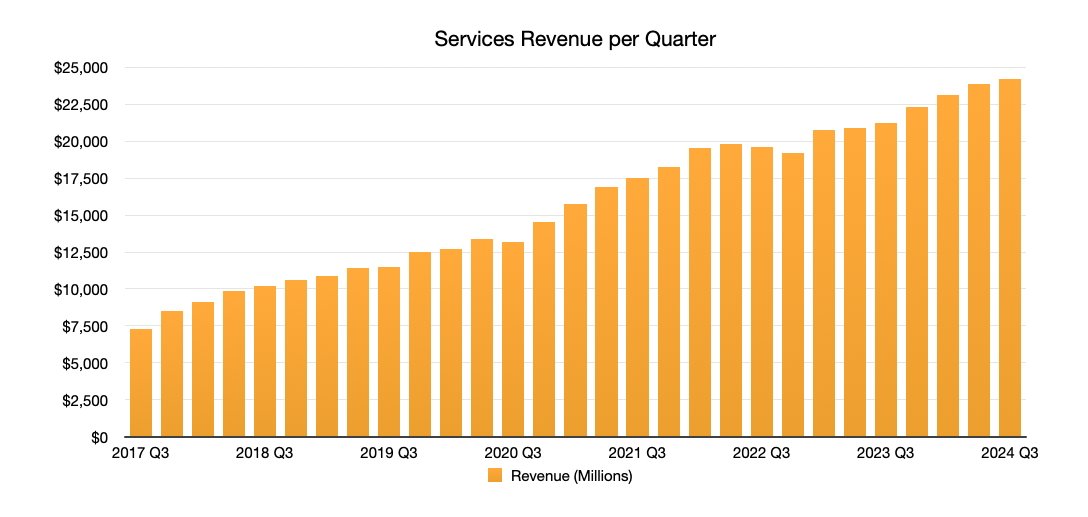

The ever-reliable Providers enterprise continued to show its flywheel, rising from $21.21 billion in Q3 2023 to $24.2 billion. That represents a 14.1% year-on-year improve, and in addition one other beat of Wall Road’s $24.01 billion guess.

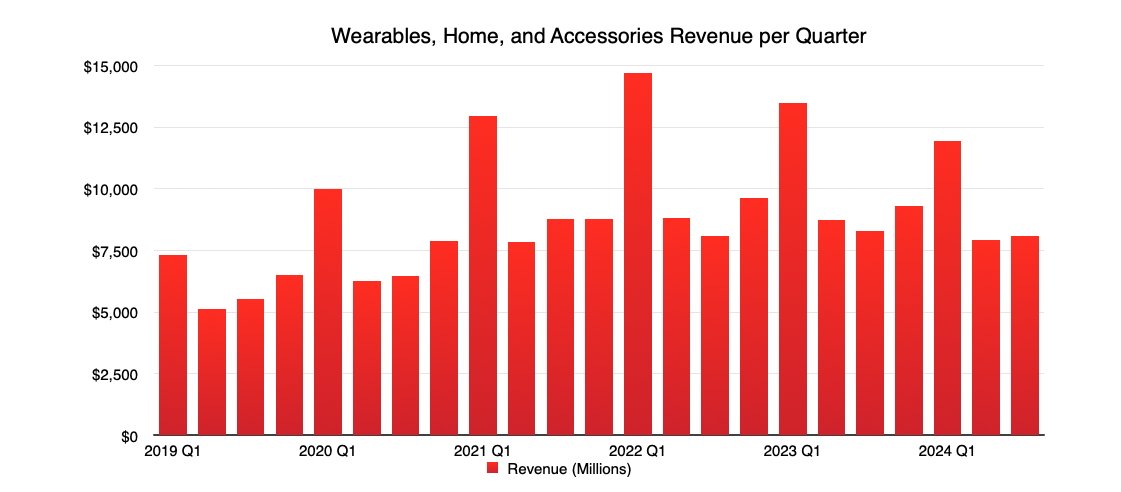

Wearables, Dwelling, and Equipment, protecting a number of product classes, noticed a small dip from $8.28 billion final yr to $8.09 billion this quarter. That works out to be a 2.3% drop.

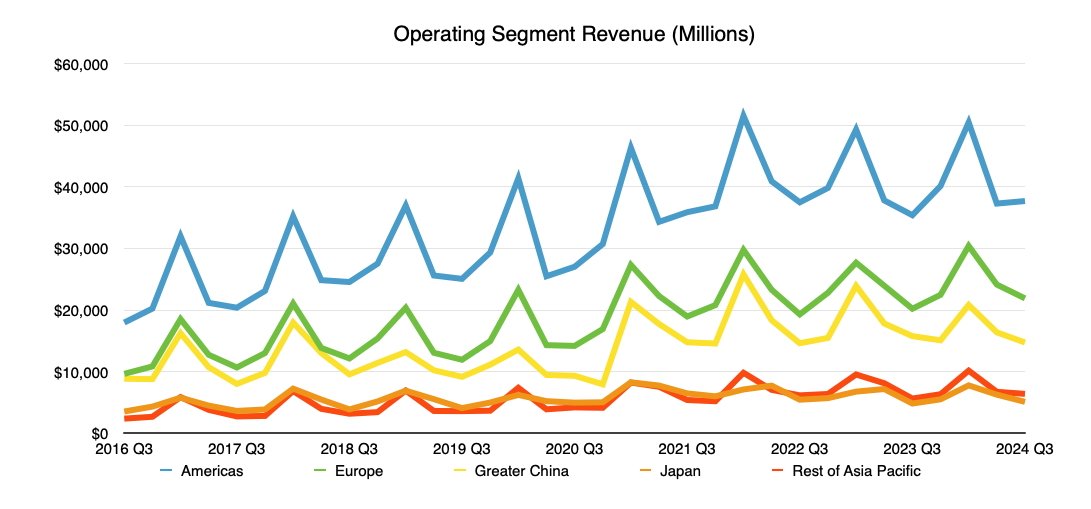

Apple’s working phase income

On a regional foundation, The Americas brings in probably the most income at $37.6 billion, a 6.5% year-on-year rise. Europe’s $21.9 billion is an 8.3% acquire.

Japan managed $5.09 billion, a 5.7% year-on-year improve, whereas Remainder of Asia Pacific hauled in $6.4 billion, up 13.5%.

China is the outlier of the group, being the one one to see a year-on-year shrink in income. Whereas Apple managed $15.75 billion within the year-ago quarter, China’s income has dipped all the way down to $14.7 billion, down 6.5%.

What the analysts say

As you’d anticipate, the opinions on the earnings are everywhere. Most are bullish, with nonetheless some concern about iPhone gross sales.

The outcomes have been “broadly in line” for TD Cowen, however the December quarter “could possibly be the early learn on AI-driven upgrades resulting in a powerful iPhone cycle in CY25.” It views “broadly secure iPhone and wearables developments coupled with iPad and Mac development as encouraging”

“Regardless of the macro and China weak point, demand for iPhone and different {hardware} merchandise stays secure,” the notice concludes. “Providers momentum is a optimistic and underpins FCF development. Subsequent iPhone launch occasion in Sep could possibly be a catalyst.”

TD Cowen’s worth goal for Apple is $250.

Piper Sandler says Apple’s outcomes have been forward of expectations “largely on the again of sturdy development in iPad and providers.” China’s income “confirmed additional indicators of enchancment” for the iPhone maker.

Whereas noting administration as being “very excited” about Apple Intelligence, the analysts are involved about it rolling out in levels globally, and it is usually “cautious concerning the client getting into the second half.”

It reiterates a Impartial ranking and a $225 worth goal.

Gene Munster of Deepwater calls it a “strong quarter” for Apple in a YouTube video, one which insists traders are eager to understand how AI will influence the following quarter. To Munster, iPhone, iPad, and Mac shall be “accelerating income development.”

In idea, Munster believes this shall be round 5% development for the items in This autumn, rising to six% and seven% over time, and probably to eight% in the course of the 2025 fiscal yr. Apple’s steerage for the following quarter was “successfully in line” with Wall Road expectations, however Munster cautions it is within the face of a “stronger than typical Osborne impact.”

Whereas Munster muses that Apple’s steerage normally softens earlier than a serious launch, Apple did not try this this time round. The analyst believes this speaks to Apple considering the iPhone is a necessity and an indication of the energy of the product line.

In J.P.Morgan’s assessment of the outcomes, it discusses how Apple’s outcomes and execution “stood out in its non-eventful nature” with most product classes beating consensus expectations. This “is strictly what’s desired as we sit up for the AI improve cycle.”

With Apple planning a roll-out of Apple Intelligence to English-speaking areas first then a wider launch, J.P.Morgan warns it “would proceed to observe for timing of the releases, which has the potential of shifting the timing of the quantity improve.” Specifically, it thinks the upper ranges of improve will happen when Apple Intelligence is out there in additional areas.

“In some sense, the magnitude of AI-led alternative will possible be broader for Apple even relative to the 5G cycle on condition that the improve cycle alternative extends throughout all gadgets.”

J.P.Morgan has a worth goal of $265.

Morgan Stanley’s view is that the outcomes will “do little to shift the investor narrative” of an “Apple Intelligence-driven, multi-year product refresh cycle thesis.” The outcomes “largely performed out as anticipated.”

There aren’t many catalysts on the horizon till the iPhone 16 launch and the rollout of iOS 18 with Apple Intelligence, adopted by pre-order and sell-through knowledge in early October. Besides, Morgan Stanley feels institutional managers nonetheless view Apple as “underweight” resulting in a perception Apple will “proceed to outperform.”

Morgan Stanley has a worth goal for Apple of $273.

[ad_2]