[ad_1]

Why it issues: A lot of Nvidia’s rivals wish to steal a few of its market dominance. One identify that retains arising is Broadcom. A more in-depth look tells us why. Its XPUs devour lower than 600 watts, making them one of the power-efficient accelerators within the business.

In a word to buyers this week, Financial institution of America mentioned, “Think about it a prime AI decide.” It wasn’t speaking about Nvidia, although BofA considers Inexperienced Group the undisputed winner of the GPU wars. It was referring to Broadcom, which not too long ago introduced a 10-to-1 inventory cut up and better-than-expected income in its second-quarter earnings report. The corporate projected a higher-than-anticipated $51 billion in gross sales for the 2024 fiscal yr.

Financial institution of America’s analysts mission the corporate’s 2025 fiscal yr gross sales to be $59.9 billion, for a 16-percent year-over-year acquire. Analysts level to effectivity positive aspects from Broadcom’s VMWare acquisition final yr, upsells, and its potential development in customized chips as key indicators for its 2025 predictions. If BofA is true, Broadcom’s market cap might put it into the Trillion Greenback Membership with a handful of different tech luminaries, together with Microsoft, Apple, Nvidia, Amazon, Alphabet, and Meta.

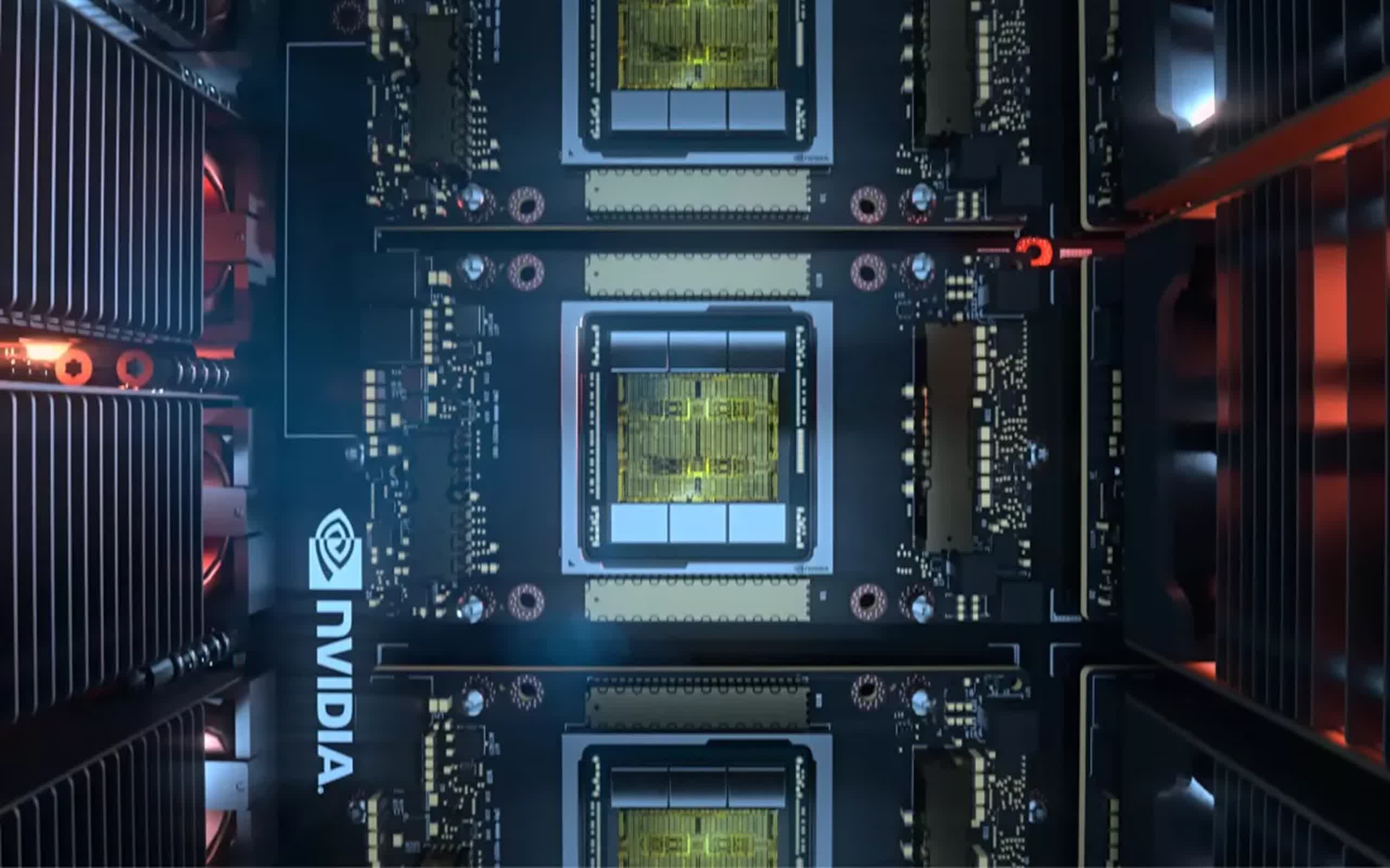

For this to occur, it must butt heads with Nvidia, which at present has a market cap lead of $3.4 trillion to Broadcom’s $804 billion. Furthermore, Nvidia’s CUDA structure has gained a near-monopoly in AI workloads for hyperscalers like Meta, Microsoft, Google, and Amazon, its largest prospects. It has an unlimited ecosystem of software program, instruments, and libraries constructed round it that has additional locked in prospects and created a excessive barrier to entry for rivals like Broadcom.

Every of these corporations would like to cut back their reliance on Nvidia, so Broadcom is positioning itself as a substitute by providing customized AI accelerator chips, often known as XPUs, to cloud and AI corporations. At a current occasion, Broadcom famous that demand for its merchandise is snowballing, declaring {that a} state-of-the-art cluster two years in the past had 4,096 XPUs. In 2023, it constructed a cluster with over 10,000 XPU nodes that required two layers of Tomahawk or Jericho switches. The corporate’s roadmap is to increase this to over 30,000 and ultimately a million.

A bonus that Broadcom emphasizes is the ability effectivity of its XPUs. At lower than 600 watts, they’re among the many lowest-power AI accelerators within the business.

It additionally has a unique worldview of the chip market, which it says is transferring from CPU-centric to connectivity-centric. The emergence of other processors past the CPU, such because the GPU, NPU, and LPU, requires high-speed connections, which is Broadcom’s specialty.

[ad_2]