[ad_1]

What’s Credit score Card Reconciliation?

Bank card reconciliation is the method of making certain that the bank card transactions match the interior basic ledger. It entails verifying the bills recorded by the corporate”s accounting system align with the statements supplied by the bank card issuer.

Bank cards have made it simpler for companies to course of funds. Within the U.S. alone, bank card balances exceeded $1 trillion through the pandemic.

Nevertheless, the rise in bank card utilization has led to monetary nightmares throughout accounting groups on the finish of the month as a result of this implies the transactions that have to be reconciled are additionally on the rise. With disparate knowledge sources and improper expense monitoring, the accounting staff can hint the proof of bills throughout a number of knowledge sources, which may be very time-consuming.

Kinds of Credit score Card Reconciliation

Accounting groups come throughout these two kinds of bank card reconciliation:

Assertion-based reconciliation:

This offers with the corporate’s bank card bills. It entails matching the bank card bills recorded by the corporate’s accounting instruments to the bank card assertion obtained by the credit score issuer. That is important to make sure the validity of the bank card prices is mirrored within the monetary books.

Service provider service reconciliation:

That is pertinent to the earnings aspect of the reconciliation, the place clients pay for the enterprise by way of bank card. The accounting staff should reconcile the bank card transactions obtained with the proofs obtained by way of the service provider service supplier or cost processor, corresponding to Paypal.

Why Is Credit score Card Reconciliation Essential?

Firm bank cards are a well-liked choice for managing enterprise bills. They promote comfort and ease of use for workers to deal with work-related prices.

The accounting groups want to trace every expense charged by the bank card. All these entries have to be current within the basic ledger, which must be matched throughout financial institution statements, receipts, and bank cards to confirm the validity of the expense declare.

When line gadgets of the final ledger do not match the bank card assertion, the transaction is escalated to the monetary controller, who identifies why the discrepancy occurred within the first place.

Bank card reconciliation is crucial because it helps companies forestall fraud, preserve monetary integrity, optimize spending, and preserve the corporate’s books audit-friendly through the monetary shut course of, usually occurring on the finish of every month.

Find out how to do Credit score Card Reconciliation?

Bank card reconciliation entails matching bank card statements to inside monetary data. However how will we go about this?

Gathering all of the Statements and Receipts or supporting paperwork:

First, we should acquire all of the bank card statements and the related receipts for the desired interval. Receipts perform as proof of expense. Every time the company bank card makes a cost, an bill is supplied, which must be recorded by the expense administration system or manually recorded in spreadsheets.

Matching the expense to the transactions:

Now, the method entails going by every transaction listed within the bank card assertion and evaluating it to the receipts. The transactions have to be verified to make sure that they’re licensed and match the aim and quantity of the expense.

Examine discrepancies:

Reconciliation is a crucial a part of the monetary shut course of to make sure the integrity of the enterprise’s funds. In case of discrepancies, the route trigger have to be recognized, the individuals concerned within the funds have to be notified, and in some circumstances, the financial institution authorities have to be knowledgeable.

Acquiring Approval:

As soon as all the information is recorded within the basic ledger, issue within the charges of the bank cards and cross-check whether or not all of the bank card bills match. After this carry within the controllers or the designated finance managers who can assessment and supply the approval for your entire course of.

Issues involving Credit score Card Reconciliation

There are a number of challenges related to bank card reconciliation.

Shared Firm Credit score Playing cards:

In lots of cases, the identical bank card is shared amongst a number of staff. This proves problematic for monetary closers as they need to determine which worker made the acquisition when receipts will not be adequately current and may show to be a fraud danger.

Lacking Receipts:

The problem of lacking receipts raises the issue of untraceable sources of reality. This leads to a spot within the documentation and invoices are concerned to fill within the hole by matching towards the bank card statements.

Service provider Account Reconciliation Points:

When funds are processed by service provider accounts, issues can come up when charges are deducted on the platform, formatting points on reporting transactions, and different issues that have to be factored in through the guide reconciliation.

Guide Knowledge Entry:

People make many errors whereas getting into knowledge manually. Issues corresponding to double entry and rounding errors may come up when reconciling bank cards. However this additionally implies that when a excessive quantity of transactions must be reconciled, probabilities of lacking human errors, duplicate submissions, and inaccurate info could show to be an issue.

Various Knowledge Factors:

A single bank card transaction can generate a number of knowledge factors that have to be matched—the bank card assertion, the receipt, and doubtlessly an bill within the accounting system. Preserving monitor of all these knowledge sources and making certain they align is liable to errors, particularly with out a centralized storage system.

Paper receipts:

With out capturing or digitizing receipts and invoices, storing and recording knowledge from paper receipts may be error-prone and straightforward to misplace such that your entire course of, when performed on the month’s finish, is inefficient.

Credit score Card Reconciliation Software program as a Answer:

Automating the method of bank card reconciliation can assist leverage accuracy and effectivity and preserve the monetary integrity of bookkeeping.

Bank card reconciliation software program provides a spread of options and advantages that may assist curb the challenges listed above and let accounting groups facilitate monetary closing with automation.

Key options of bank card reconciliation software program:

Automated knowledge import:

Bank card reconciliation software program can combine with banks and monetary establishments to import knowledge robotically; this eliminates the necessity for guide knowledge entry and scales with increased volumes of transactions that are in have to be reconciled.

Automated Transaction Matching:

Reconciliation or Matching logic is a speciality for bank card reconciliations. The superior transaction matching algorithms are able to matching the bank card transactions with the corresponding entries within the accounting system.

Integration with Accounting techniques:

With disparate knowledge sources being concerned in B2B transactions, bank card reconciliation software program can bridge the hole, which could in any other case depart accounting groups with strands filled with hairs on their palms whereas they attempt to acquire the bill handed over by the provider, tracing the transaction again to the accounts payable ledger and accumulating the receipt.

How Nanonets Solves Credit score Card Reconciliation:

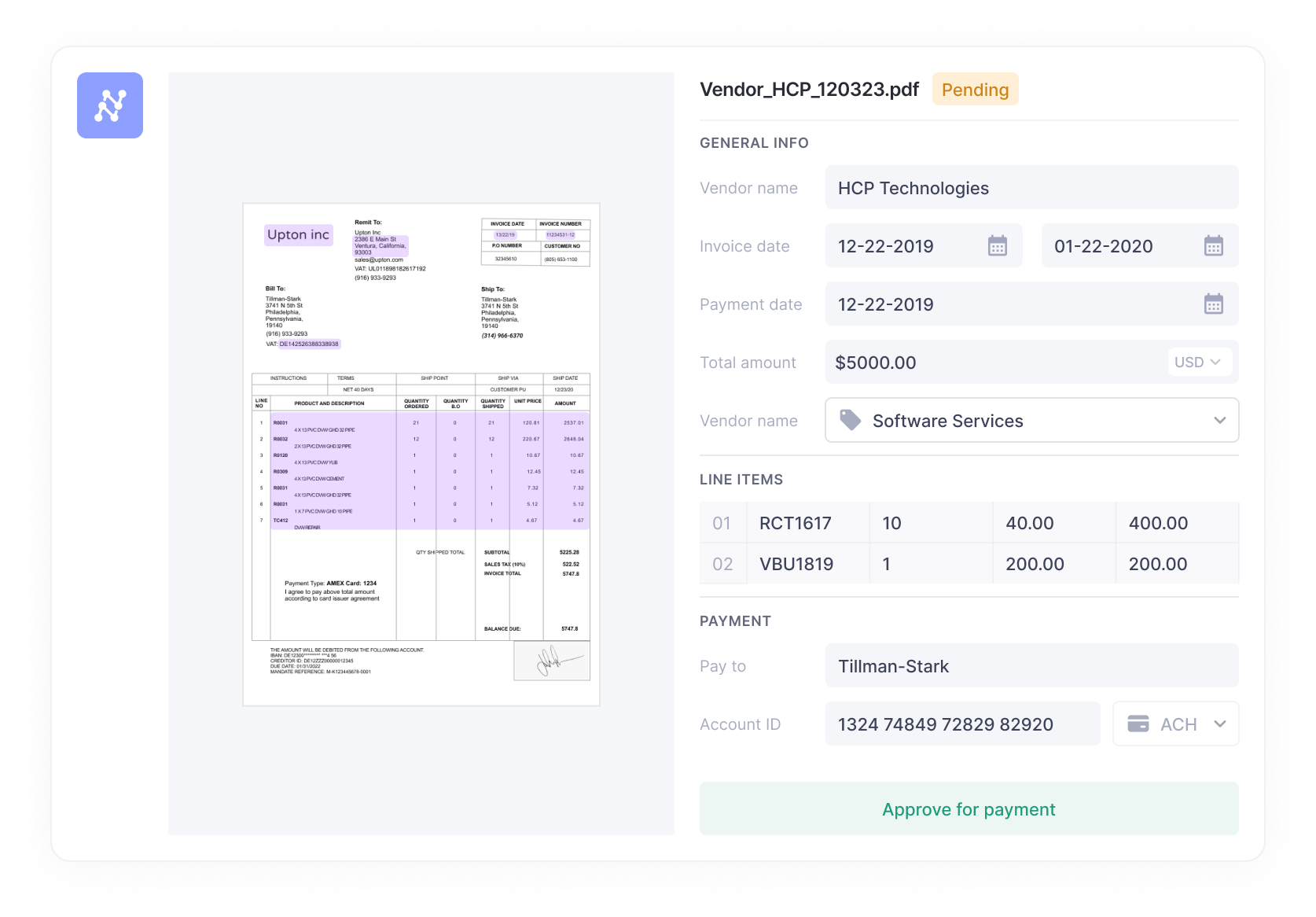

Nanonets is an Clever Monetary Workflow automation platform. Nanonets focuses on knowledge extraction from paperwork, turning unstructured knowledge into structured knowledge studies, boasting an accuracy of 99% whereas doing so. Nanonets is a key platform for accounting groups that face a excessive quantity of transactions that want reconciling on the finish of the month.

For instance, for example you get charged for a software program subscription. The paperwork or knowledge factors that you should consolidate in (real-time) order to carry out bank card reconciliation are:

- The bill will get generated by way of the software program supplier.

- Importing the bill into your accounts payable system or your basic ledger

- When the cost is available in by way of the bank card, acquire the receipt to carry out the match.

The reconciliation course of entails matching the bill, the cost made with the bank card, and the receipt to make sure that all paperwork are constant and that the cost was appropriately recorded.

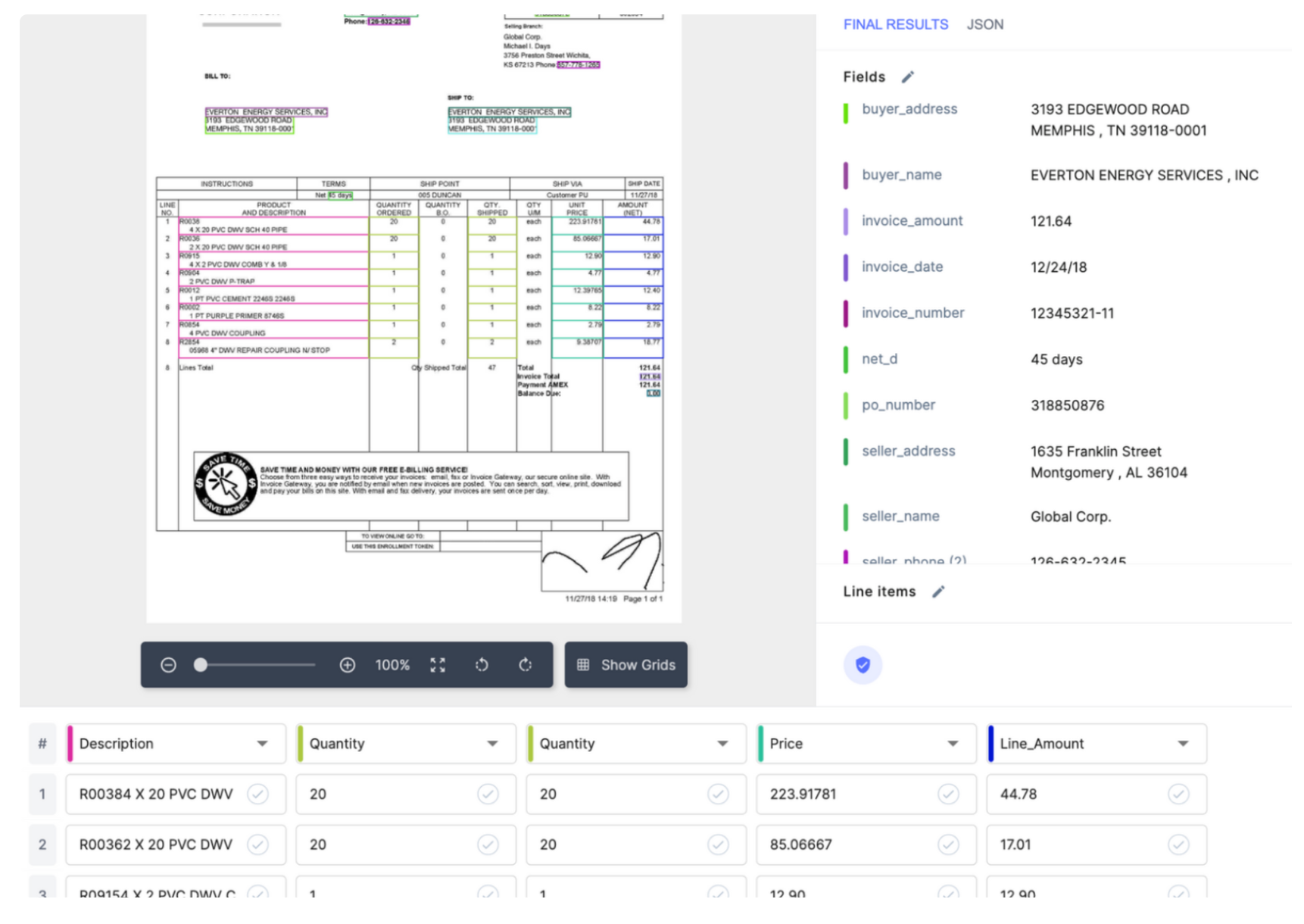

On Nanonets, you possibly can add all of your invoices in a single go; this may be within the vary of 1000-10,000 paperwork (it does not matter). Nanonets’ Bill OCR robotically extracts all the information from the invoices into structured knowledge for the desired interval and shops and converts them into tabular knowledge, which is a predefined template that’s a lot simpler to eat. Generally invoices have totally different codecs and languages, however they do not matter; on Nanonets, organizations can obtain as much as 99% accuracy by automating guide knowledge entry and saving time within the course of.

Now, obtain the bank card assertion that your bank card issuer has supplied you for the desired time interval. As soon as uploaded to Nanonets, once more the information seize course of begins and utilizing superior matching algorithms Nanonets is in a position to make sure that every entry within the bank card assertion corresponds to an bill and a cost report within the accounts payable system.

This helps accountants save a bunch of time and guarantee accuracy on the finish of the month when confronted with a large load of transactions that have to be reconciled.

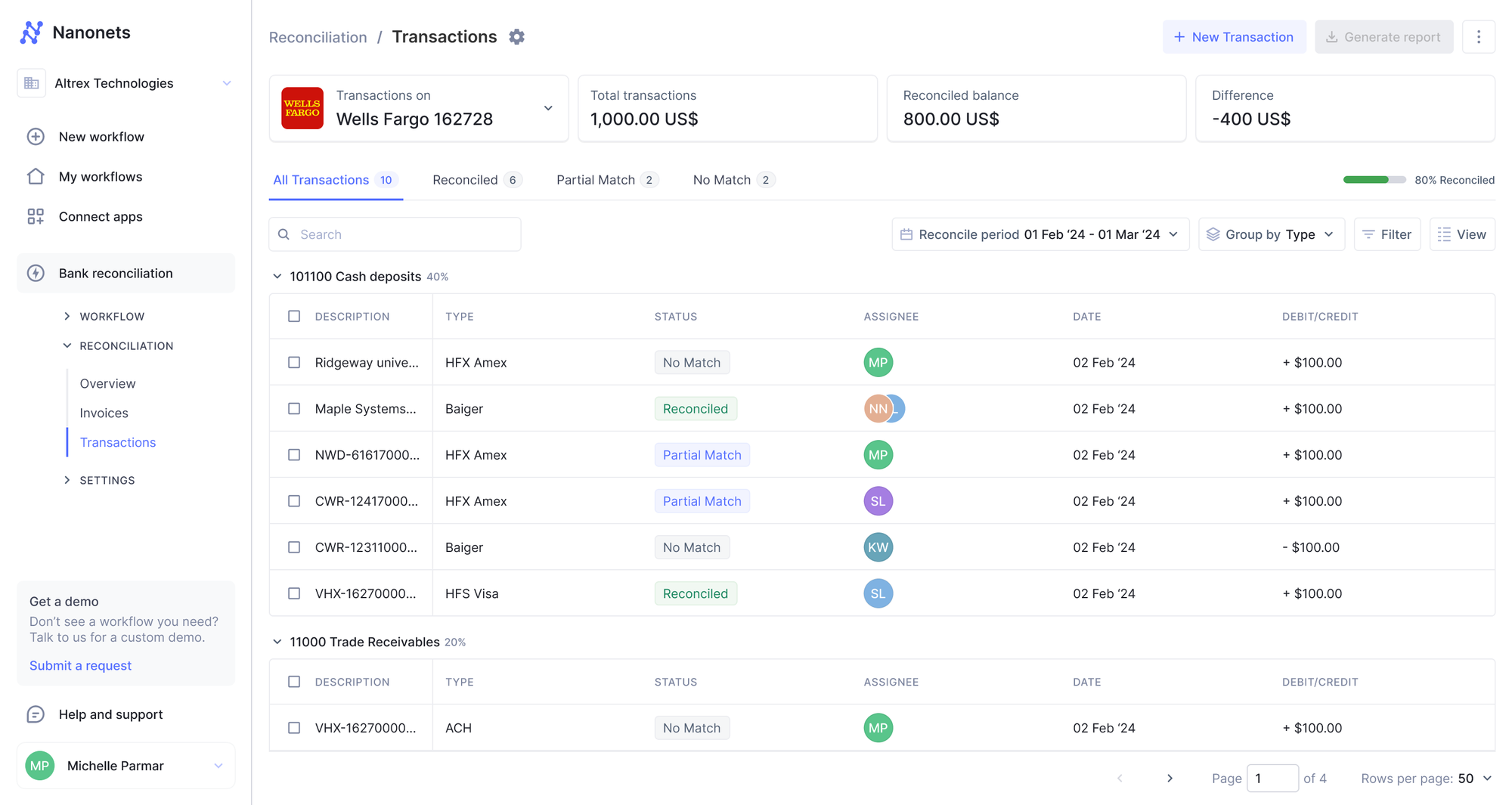

Nanonets Actual-Time Answer:

For instance as a substitute of reconciling your bank card transactions on the finish of the month; you want to obtain doing this in real-time. That is how the method may be achieved on Nanonets.

Combine your company bank card on Nanonets utilizing workflow automation. So as soon as an worker prices your bank card, they obtain automation on their textual content message or their office like Slack to connect a receipt for the bank card expense.

As soon as that is performed, Nanonets’ Receipt OCR can extract knowledge from these receipts and consolidate them within the dashboard. Nanonets then pull knowledge from the bank card assertion issuer (both by importing the bank card assertion manually or requesting a customized integration on the platform).

After getting each databases prepared, Nanonet’s superior matching algorithm can carry out automated matching and set off workflow and alerts wherever there’s a discrepancy, and the related individuals are flagged to look into it.

Conclusion

Bank card reconciliation is a vital course of in monetary administration, particularly for companies engaged in B2B transactions. It ensures that each one transactions recorded within the accounts payable system align with the precise funds made by way of the bank card and the corresponding documentation corresponding to invoices and receipts.

By incorporating an automatic answer like Nanonets, companies can streamline the reconciliation course of, decreasing the guide effort required and minimizing the chance of errors. This not solely enhances effectivity but additionally ensures that monetary data are correct and up-to-date, in the end supporting higher monetary decision-making and compliance.

[ad_2]