[ad_1]

The large image: Intel CEO Pat Gelsinger could be feeling just like the captain of the Titanic proper now, desperately attempting to cease Chipzilla from sinking any additional because it lurches from one disaster to a different. The problems with the Raptor Lake CPUs are simply the tip of the iceberg as Intel offers with a declining share in CPU markets, a category motion lawsuit, poor monetary outcomes, mass layoffs, and Moody’s downgrading its senior unsecured score. It is all led to Group Blue suspending its September Innovation occasion till 2025.

The most recent piece of reports Intel may have finished with out comes from Mercury Analysis (by way of PC Gamer). The PC part market analysis group’s most up-to-date report reveals that AMD’s share of the desktop x86 CPU market reached 23% within the newest quarter, leaping 3.6% year-on-year, whereas Intel fell from 80.6% to 77%.

It was a good higher yearly efficiency within the laptop computer marketplace for AMD, the place its share jumped from 16.5% in 2023 to twenty.3%. However the largest enchancment was in servers, the place Group Pink’s share went up from 18.6% to 24.1%.

Mercury does observe that Intel’s complete x86 chip market share has elevated, however that is solely as a consequence of AMD offering its SoCs for gaming consoles, which have seen their gross sales, particularly Xbox ones, decline as they draw close to the tip of their present lifecycle and upgrades such because the PS5 Professional are on the horizon.

It is possible that AMD will proceed to erode extra of Intel’s market share within the shopper desktop enviornment. The points with the Thirteenth- and 14th-gen Raptor Lake chips have been a catastrophe for the agency, and we’re more likely to see this mirrored in future gross sales – regardless of the prolonged warranties. Intel continues to be the dominant drive on the subject of desktop, laptop computer, and server CPUS, however its lead is shrinking on a regular basis.

Earlier this week, shareholders launched a class-action lawsuit towards Intel for allegedly concealing issues inside its foundry enterprise, which resulted within the firm posting weak outcomes, shedding 15,000 folks, suspending its dividend, and inflicting its market cap to fall by $32 billion.

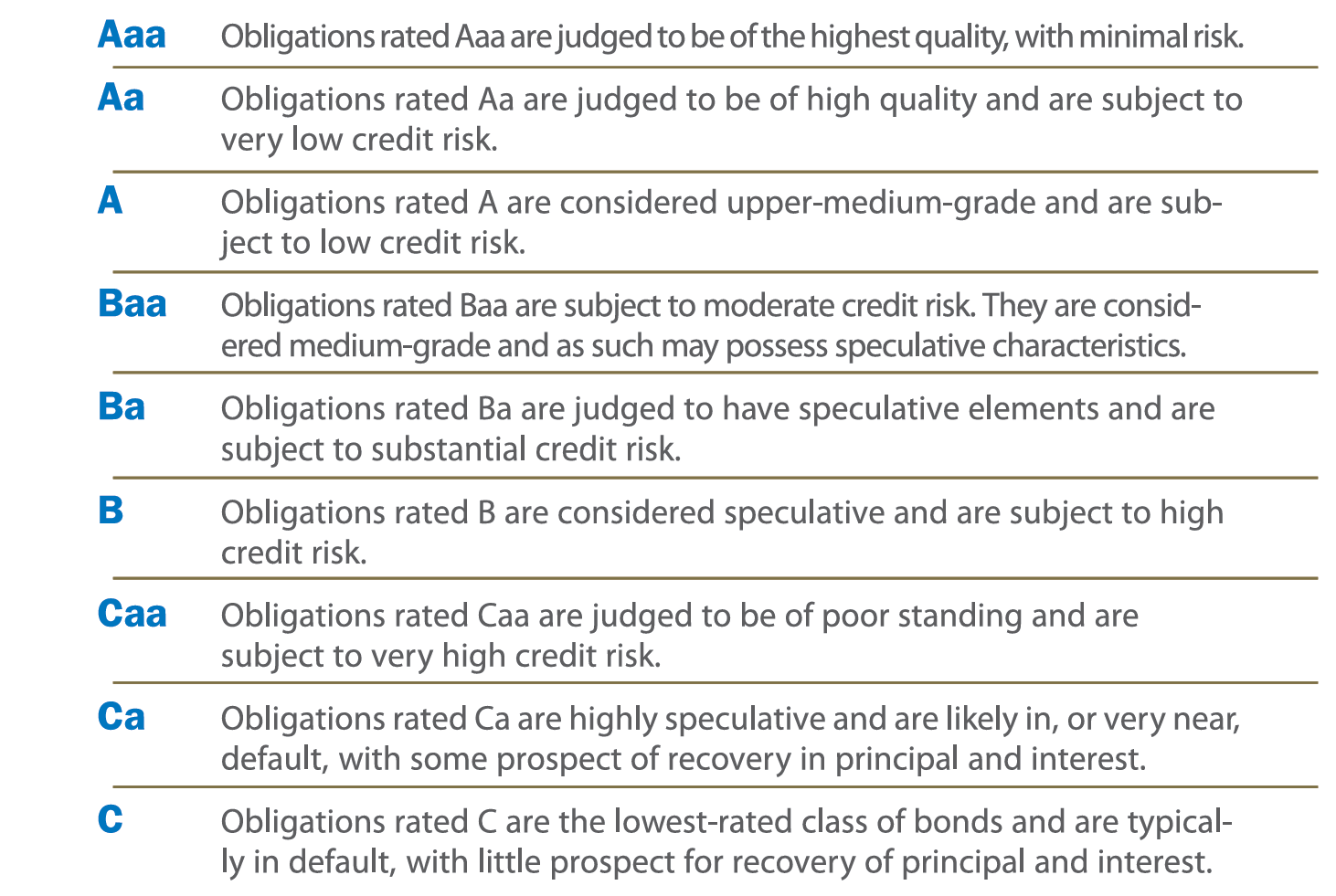

Considerations over Intel’s profitability have seen credit standing company Moody’s downgrade the corporate’s senior unsecured score to BAA1 from its earlier A3 score. The unsecured rankings outlook has been modified to unfavourable from secure. “The downgrade of the rankings displays our expectations for Intel’s considerably weaker profitability over the following 12 to 18 months,” Moody’s mentioned.

Intel is undoubtedly feeling the strain. The corporate has simply introduced that its Innovation occasion has been postponed from September till 2025. In an announcement, Intel instructed PCMag: “Given our monetary outcomes and outlook for the second half of 2024, which is more durable than beforehand anticipated, we’re having to make some powerful selections as we proceed to align our value construction and look to evaluate how we rebuild a sustainable engine of course of expertise management. We categorical honest appreciation to our companions, sponsors, exhibitors, developer communities and our bigger crew who had dedicated to assist and attend the occasion.”

[ad_2]