[ad_1]

Java is among the world’s hottest programming languages. Platform-independent, straightforward to study, easy to make use of and safe, the object-oriented language ranks as one of many world’s prime 4 developer languages and has discovered its method into enterprise purposes the world over.

Nevertheless, since 2019, strikes from Java Improvement Package vendor Oracle to impose a number of license modifications on new variations are inflicting organisations to concentrate to Java. Many companies in APAC are leaping ship in favour of OpenJDK choices like Azul Programs.

Gil Tene, chief know-how officer at Azul, whose Java providing helps organisations like Netflix, Mastercard, Salesforce, Workday and Adobe, stated its Java administration choices are additionally serving to clients optimise cloud prices and effectively de-risk Java vulnerabilities.

What modifications have been made to Oracle’s Java licensing and pricing?

Oracle has made various modifications to Oracle JDK licensing and pricing since 2019. These modifications have been primarily aimed toward getting enterprise customers of Oracle’s Java to pay one thing for the business use of the beforehand free open-source improvement language.

Updates in 2019 and 2021

With the replace in 2019, ranging from Oracle JDK 8, Oracle sought to get these utilizing Oracle Java in business manufacturing to buy an Oracle Java SE subscription. In 2021, a backlash brought on it to reverse course, and business manufacturing was allowed from Oracle JDK 17.

The 2021 modifications solely included updates for Lengthy Time period Assist variations of Java for at the least one full 12 months after the discharge of the subsequent LTS model, shorter than competing OpenJDK distributors. The brand new licence circumstances additionally didn’t permit redistribution for a payment.

The current 2023 replace

In 2023, Oracle introduced it will require organisations utilizing Oracle Java to buy a license for his or her whole worker inhabitants if even a single worker or server had put in a licensable model of Java.

As a result of the pricing change didn’t depend upon the precise variety of Java customers and even captured the likes of contractors working for an organisation, the change entailed vital will increase in prices for corporations selecting to proceed with Oracle Java.

What are the outcomes of Oracle’s Java licensing and pricing modifications?

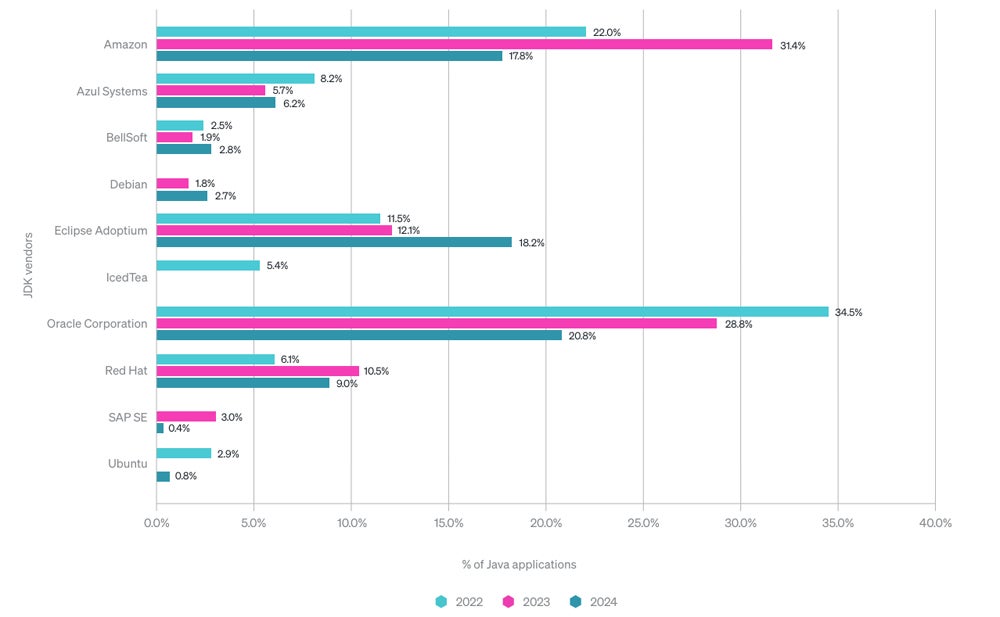

With Oracle pursuing organisations utilizing Oracle JDK, many are contemplating or are shifting to options. In response to New Relic’s 2024 State of the Java Ecosystem report, Oracle’s Java market share slipped from 75% in 2020 to 21% in 2023, together with a 29% drop in share in a single 12 months.

SEE: Our information to navigating directories in Java like a professional

“There was a noticeable motion away from Oracle binaries after the extra restrictive licensing of its JDK 11 distribution (earlier than the return to a extra open stance with Java 17), and we’ve seen a gentle decline year-over-year ever since then,” New Relic wrote.

Azul’s State of Java Survey and Report from 2023, which surveyed 2,000 companies utilizing Java, discovered Oracle’s market share dropped from 75% for Java Improvement Package distributions in 2020 to 42% utilizing at the least one occasion of Oracle Java in 2023.

Within the report, Azul discovered Oracle’s most up-to-date 2023 licence and pricing replace had sparked “widespread apprehension.” It stated 82% of companies expressed concern over the change, and practically three-fourths (72%) have been actively exploring options to Oracle Java.

Stepping in to choose up Java customers was Amazon, whose Coretto elevated to 31% of the market in 2023, although this had dropped to 18% once more by 2024. A variety of different distributors, equivalent to group maintained Eclipse Adoptium and Azul Programs, have been capturing curiosity too.

The search for different JDK distributors in APAC fits Azul Programs

Azul’s APAC enterprise is benefiting from the shift away from Oracle JDK. The enterprise provides each a trusted OracleJDK alternative, which it calls Azul Platform Core, in addition to a premium providing, Azul Platform Prime, designed for top efficiency, consistency and effectivity.

Azul Vice President APAC Dean Vaughan informed TechRepublic that since Oracle’s most up-to-date 2023 licensing change, the enterprise has seen a surge in progress in Australia, Malaysia, India, Taiwan and The Philippines. Extra lately, it has additionally picked up Japanese international multinationals.

Three advantages of taking a better take a look at Java utilization

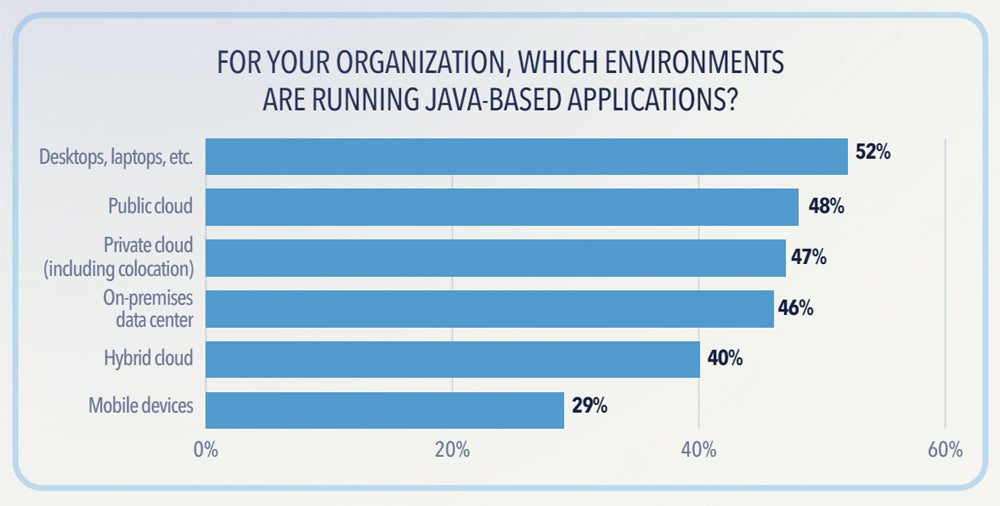

Java’s widespread use in enterprises is what has made Oracle’s licensing modifications so regarding for a lot of. Nevertheless, organisations compelled to look carefully at how they’re utilizing Java may profit from cloud price optimisation, improved safety and making their organisations extra aggressive of their trade in addition to within the competitors for developer expertise.

1. Price optimisation of Java estates within the cloud

Azul’s Vaughan stated organisations which have expanded within the cloud in APAC are seeing dramatic cloud price will increase by way of the utilization of hyperscalers like AWS or Azure or regional gamers like Tencent or Alibaba. Whereas some cloud suppliers work exhausting to assist clients rationalise workloads to scale back price, he stated they don’t spend time “trying on the stack.”

Azul is seeing progress from cloud-native corporations in markets like ASEAN, India and China. He stated these nations have grown their very own predominantly native tech industries, and that, as compared, to international corporations, are keen to suppose outdoors the field in relation to OpenJDK distributors or optimising Java to “dramatically scale back” the cloud prices they’re incurring.

2. Coping with vulnerabilities in older Java variations

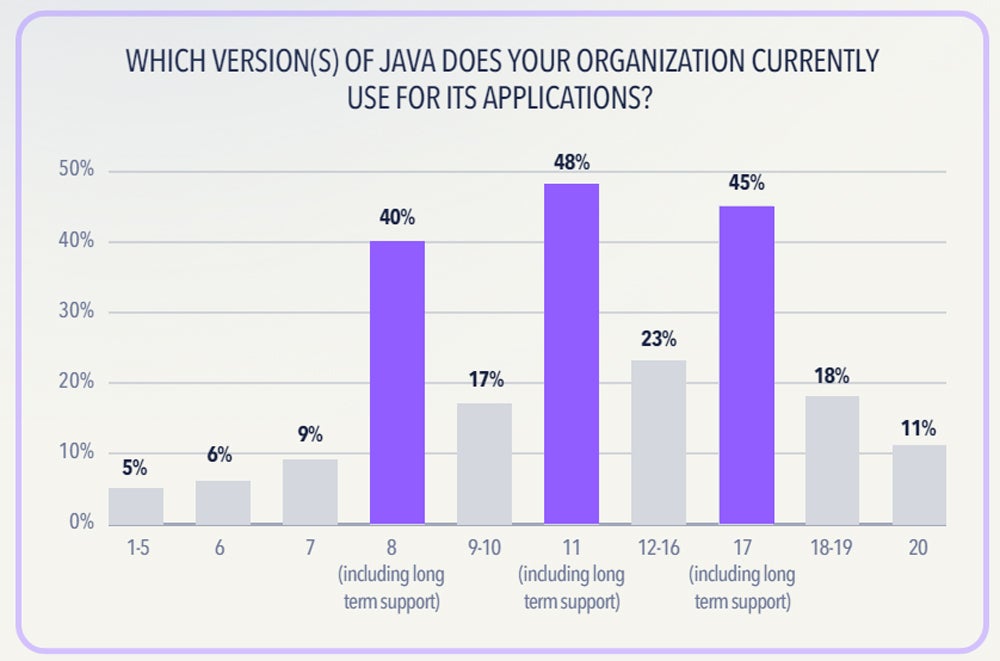

Safety, compliance and governance are one other key driver of paying extra consideration to Java. With the danger of frequent vulnerabilities and exposures in older variations of Java and up to date occasions just like the Log4Shell vulnerability that impacted 80% of Java customers, organisations wish to guarantee they practise good hygiene by updating to more moderen variations of Java, in line with Azul.

One characteristic of Azul’s Intelligence Cloud providing, which sits on prime of its Platform Core and Prime Java choices, is the power to establish and triage any vulnerabilities recognized in Java variations. By establishing which recognized vulnerabilities have really been put into manufacturing, an organisation can guarantee DevOps groups spend time on the fitting issues.

3. Enhance competitiveness with newer or premium Java variations

Many organisations wish to modernise by shifting to newer variations of Java. This will have benefits like attracting youthful, proficient builders and equipping improvement groups with the newest Java developments. “Java has developed in thrilling methods previously decade, so for some it could be price investing in for the enterprise,” Tene stated.

Azul’s premium model of Java known as Java Prime has attracted a following in industries like monetary providers in APAC. Tene stated these companies are being interested in an enhanced model of Java that’s quicker, extra constant and may “deal with large workloads.” This ensures they can keep competitiveness with their friends of their market vertical.

[ad_2]