[ad_1]

What’s Stability Sheet Reconciliation?

What’s a Stability Sheet?

A steadiness sheet is a monetary assertion that gives a snapshot of an organization”s monetary place at a particular cut-off date. Stability sheet reconciliation is a important monetary course of that aligns the monetary statements with exterior documentation resembling financial institution statements, invoices, and normal ledger entries.

What’s Stability Sheet Reconciliation?

Stability sheet reconciliation resolves any discrepancies within the monetary statements with exterior documentation in order that firms adhere to accounting requirements and replicate their precise monetary place.

By doing common steadiness sheet reconciliations, monetary groups can deal with fraudulent exercise, detect errors, and resolve discrepancies promptly. Correct and well timed monetary reporting is essential in sustaining belief with stakeholders and making knowledgeable enterprise choices.

Challenges of Stability Sheet Monetary Shut

The reconciliation course of in the course of the monetary shut could be difficult for finance groups resulting from disconnected information sources, a scarcity of automation, and the sheer quantity of transactions. When confronted with points like complicated information, finance groups could make human errors and inconsistencies since guide information entry will increase errors, transposition errors, and lacking transactions. This would possibly result in potential monetary losses and incorrect reporting. It’s estimated that guide reconciliation can result in an further 5-7 enterprise work days of error rectification and bookkeeping, issues that may be solved through automated reconciliation software program like Nanonets.

Handbook reconciliation processes are extra complicated when steadiness sheet transactions require reconciliation throughout a number of normal ledgers, ERPs, invoices, and financial institution accounts. These contain an incredible quantity of labor to be managed on spreadsheets. There are particular checklists which you could, nevertheless, comply with to do guide reconciliations throughout your steadiness sheets.

Finance groups may also comply with particular templates designed to reconcile their steadiness sheets manually. These contain check-marking, the power to regulate balances, and documenting any findings in the course of the steadiness sheet reconciliation course of.

How you can Reconcile Stability Sheet Accounts

Throughout steadiness sheet reconciliation there are a number of steps that we have to guarantee out of your finish in an effort to efficiently reconcile your entries:

- Establish the accounts that have to be reconciled:

First, we have to establish which accounts have to be reconciled. These may very well be steadiness sheet accounts like money, accounts payable, accounts receivables, bank cards, and so forth. - Collect Supporting Documentation:

Gathering needed paperwork like financial institution statements, sub-ledger entries, vendor invoices, cost schedules, and different monetary data. - Examine Balances:

Examine the balances within the steadiness sheet with the supporting monetary doc. These imply matching every quantity line by line, noting down the precise date and time of the transactions. - Categorize Variances:

Be aware any variations between the steadiness sheet quantities and the supporting documentation. These variations are variances that have to be investigated additional. There can 3 main forms of variances:- Timing Variations:

These happen when transactions are recorded in numerous intervals within the steadiness sheet and supporting paperwork. For instance, a financial institution deposit recorded within the firm’s books on the finish of the month may not seem on the financial institution assertion till the subsequent month. - Errors:

These can embrace information entry errors, incorrect quantities, or misclassifications. - Unrecorded Transactions:

Transactions which have occurred however haven’t but been recorded within the steadiness sheet.

- Timing Variations:

- Resolve Points:

After you have recognized the basis reason for a discrepancy, take the mandatory steps to resolve it. This may increasingly contain adjusting the overall ledger, journal entries, or different accounting data. - Doc Findings:

Doc your findings and any modifications made to the overall ledger or journal entries. This helps controllers, auditors, and different professionals monitor down any modifications and accelerates future reconciliations by figuring out and documenting recurring points

Stability Sheet Account Reconciliation Instance

We have now added an instance of what reconciliation would possibly seem like for reconciliation between an organization’s financial institution assertion and its inside documentation or firm books:

Month Ended Might 31, 2024

| Merchandise | Quantity |

|---|---|

| Money steadiness as per financial institution assertion, 5/31/2024 | $20,000 |

| Add: Deposit in transit | $3,000 |

| Adjusted money steadiness | $23,000 |

| Deduct: Excellent checks | $1,500 |

| Adjusted money steadiness | $21,500 |

| Money Stability per books, 5/31/2024 | $21,500 |

| Add: Curiosity | $50 |

| Adjusted money steadiness | $21,550 |

| Deduction: Month-to-month service charge | $50 |

| Adjusted money steadiness | $21,500 |

The start line for the reconciliation assertion is the money steadiness as per the financial institution assertion for the interval (right here 5/31/2024) – this marks the quantity that the financial institution stories on the finish of the interval. The quantity that we notice over right here is $20,000.

Be aware the steadiness as per the books recorded by your organization on the finish of the interval. Profitable reconciliation signifies that your organization’s books and the financial institution assertion report the identical quantity. We notice this to be $21,500 as of 5/31/2024.

Deposits in transit file entries which were marked as acquired by the corporate however have not been recorded within the financial institution but. Since these deposits are sometimes made close to the tip of the interval, they’re sometimes mirrored within the subsequent interval. The adjusted financial institution steadiness right here turns into $23,000.

Excellent checks are entries issued by your organization however haven’t been deducted by the financial institution but. Because the financial institution has not but recorded them, we should subtract these entries. $23,000 – $1,500 = $21,500.

Any curiosity that your organization earns contained in the financial institution won’t be recorded by your books. We might want to add the curiosity to the steadiness as per the books, which comes out to $22,000.

The financial institution prices Month-to-month service charges for sustaining the account, which can not have been recorded by the corporate but. The service charge must be deducted from the steadiness per the books. So remaining adjusted money steadiness is $21,500, which implies a profitable reconciliation!

Challenges with Handbook Stability Sheet Reconciliations

Finance groups are confronted with a number of challenges once they select to manually reconcile their steadiness sheets. These result in inaccuracies and hinder the effectivity of the over reconciliation course of and poor monetary reporting. Particularly these are the problems which you could come throughout:

- Human Error:

Handbook reconciliations are error inclined resulting from to excessive information volumes, time constraints and unintentional errors. - Scalability Points:

As your organisation grows, the volumes and complexities which contain guide decision will increase quickly. This would possibly result in higher potential points. - Time Consumption:

Handbook reconciliation includes compiling, validating and processing information throughout spreadsheets which might delay fast and well timed reconciliations. - Disconnected Information sources:

When confronted with a number of information sources like ERPs, financial institution statements, vendor invoices and sub-ledger entries, consolidating all the info at one place may also show to be main hindrance. - Inadequate Documentation:

If the reconciliation course of lacks complete and well-documented explanations, auditors could battle to understand the intricacies of the method, doubtlessly elevating doubts in regards to the accuracy of reported figures - Time Consumption:

Handbook reconciliation includes intensive time spent on compiling, validating, and processing information by way of spreadsheets, which might delay fast duties and hinder forward-looking enterprise planning - Spreadsheets throughout stakeholders:

Whereas your finance group would possibly contain prime tier spreadsheet wizards, they’re error inclined and might result in inaccurate monetary information. Based on a research by IBM, 88% of all spreadsheets comprise at the least one error.

Automated Stability Sheet Reconciliation with Nanonets

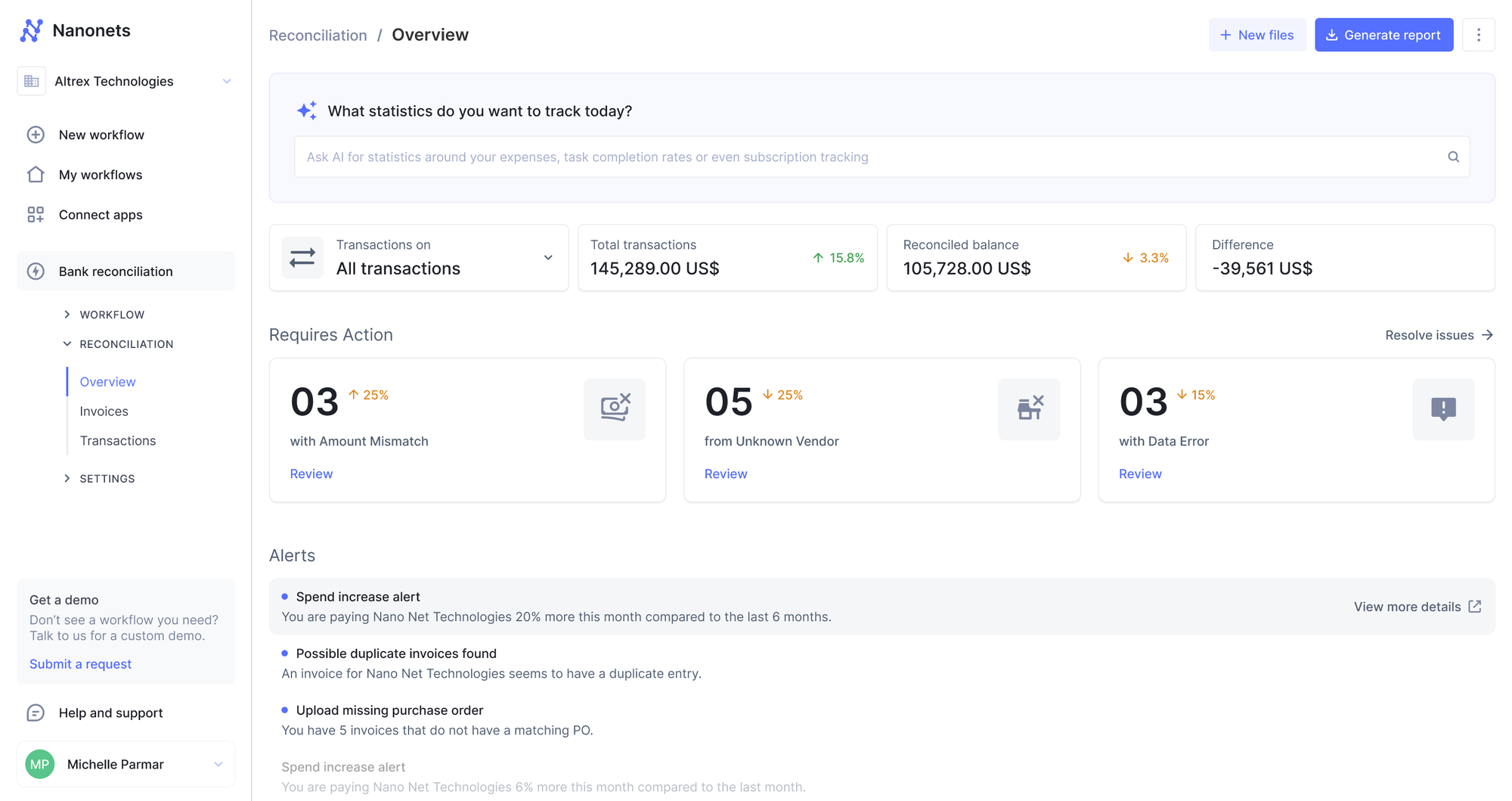

Automated Reconciliation software program like Nanonets will help seamlessly clear up the account reconciliation drawback involving steadiness sheets. Nanonets provides quite a few advantages for steadiness sheet reconciliation, making the method extra environment friendly, correct, and streamlined. Listed here are some key benefits:

Elevated Effectivity and Velocity

Nanonets can course of giant volumes of transactions rapidly, considerably lowering the time spent on manually reconciling every transaction entry individually.

Organizations have reported that AI information entry can automate as much as 95% of repetitive information duties. This frees up worker time for higher-value work.

So even when your transaction data should not imported into spreadsheets, you may instantly add them on Nanonets for information extraction and consolidation.

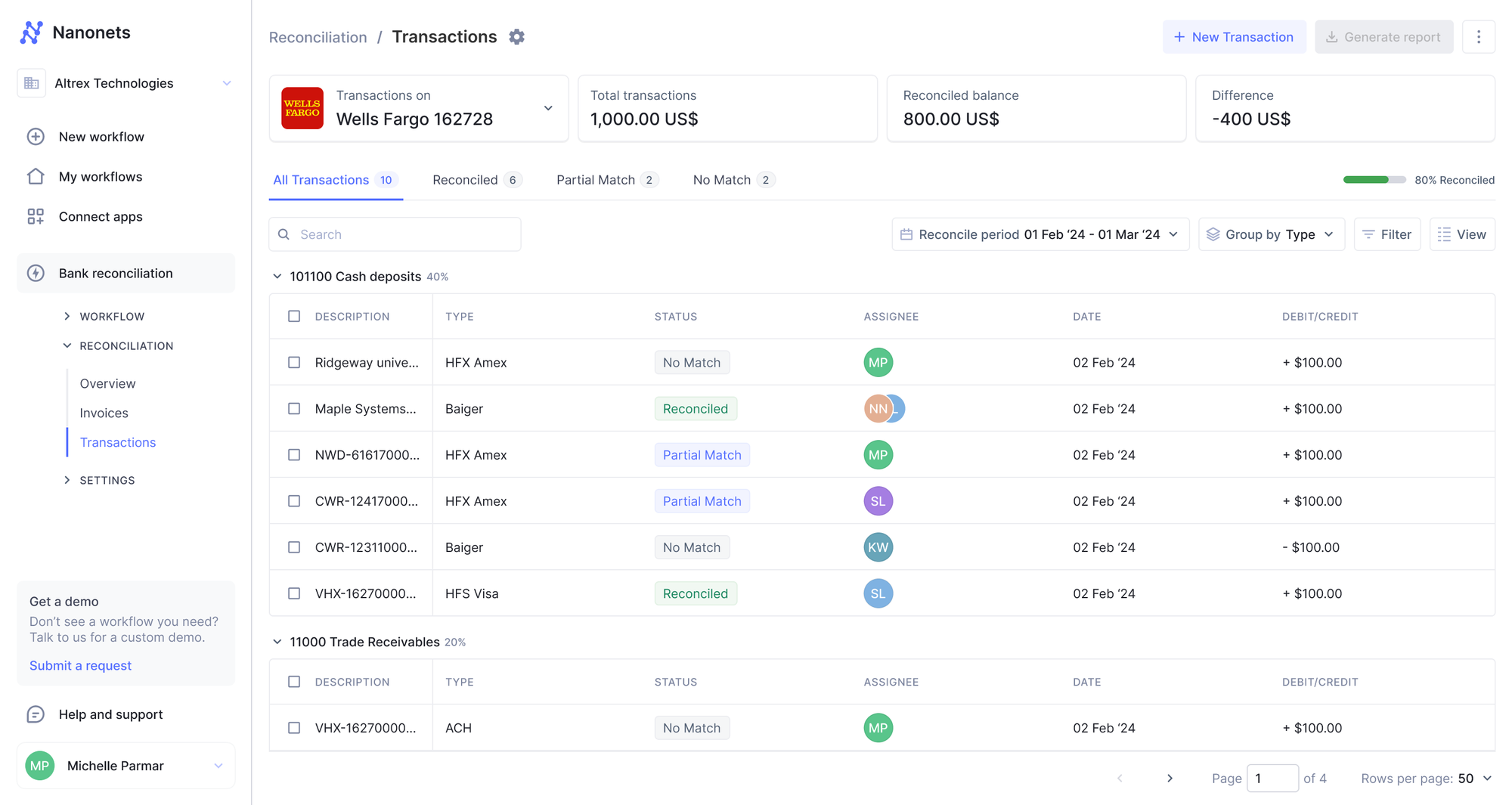

Streamlined Workflows

Since Nanonets is a workflow automation platform, repetitive duties are automated and accounting instruments are built-in cohesively throughout the Nanonets platform. This solves the problems of disconnected information sources and time wasted guide duties.

By automating the reconciliation course of end-to-end, automated reconciliation software program like Nanonets improves accuracy, reduces errors, and supplies helpful insights into an organization’s monetary well being

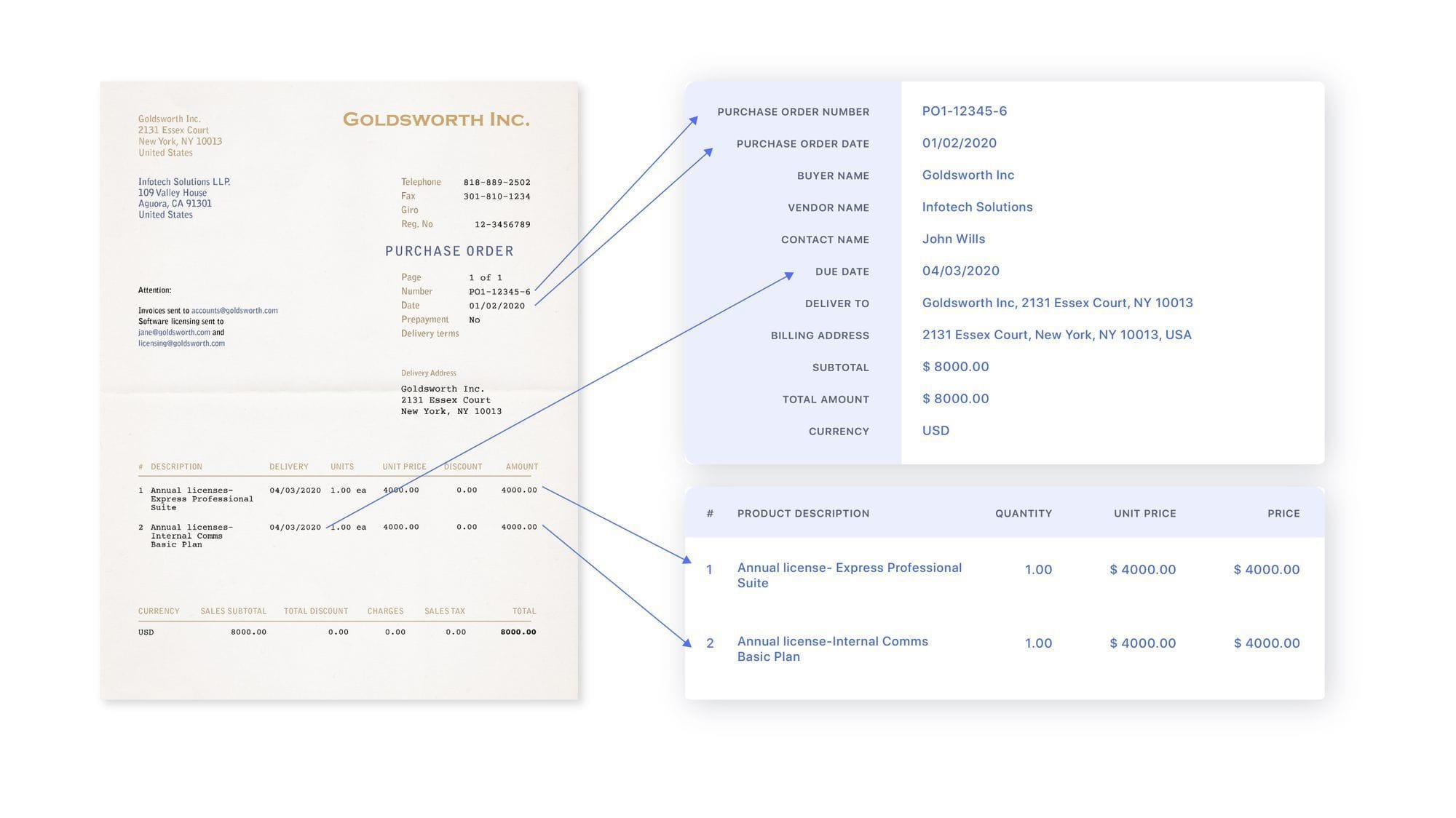

Automated Transaction Matching

Nanonets’ Clever Doc Processing is skilled on 1M+ paperwork to leverage automated matching of transaction entries. This imply these transactions are recognized as the perfect match primarily based on column names, date, quantity and so forth making certain 95% accuracy. When these algorithms fail Nanonets tries to make a match utilizing fuzzy matching capabilities as a failsafe.

Enhanced Visibility and Management

Fixing the issue of conserving monitor between a number of spreadsheets, Nanonets’ platform supplies a consolidated report of all of your account reconciliation statements in a single place. This implies one report back to abstract a number of monetary paperwork like ERP’s, financial institution statements, vendor invoices and sub ledger entries.

In abstract, automated reconciliation software program like Nanonets enhances the effectivity, accuracy, and total effectiveness of the steadiness sheet reconciliation course of, offering vital benefits over guide strategies.

FAQs

Why Do We Solely Reconcile Stability Sheet Accounts?

Stability sheet accounts are reconciled extra often as a result of they’re thought-about everlasting (or steady) accounts, that means they carry balances over from one accounting interval to the subsequent.

How Typically Ought to We Reconcile Stability Sheet Accounts?

Stability sheet accounts are normally reconciled on a timeline that coincides with both the month-end shut or much less frequent monetary shut. This implies they are often achieved as typically as month-to-month however are normally achieved quarterly or yearly

What Is the Position of Stability Sheet Reconciliation within the Monetary Shut Course of?

Stability sheet reconciliation is an important a part of closing the books as a result of it ensures that the Workplace of the CFO is working with correct information. In any other case, you would possibly finalize your monetary statements with out accounting for essential errors that might skew the outcomes considerably

[ad_2]