[ad_1]

Introduction to Stripe Reconciliation

Each digital buy is a posh interaction of entities—Clients, Retailers, Acquirers, and Issuing Banks—that orchestrate the circulation of funds. A Cost Service Supplier (PSP) acts as an middleman between retailers and the monetary establishments concerned in processing on-line transactions. Stripe is a PSP that gives a collection of companies to streamline cost processing and improve the web purchasing expertise.

Stripe not solely facilitates seamless cost processing but additionally simplifies the reconciliation course of by offering detailed transaction data and integrations with accounting software program, making certain accuracy and effectivity in monetary administration. On this overview, we will look into the core ideas of Stripe Reconciliation, talk about its significance and perceive its complexities to equip companies with the instruments they want for enhanced monetary transparency and operational effectivity.

What’s Stripe Reconciliation?

Stripe Reconciliation refers to using Stripe for the systematic technique of matching and verifying transactions processed via the Stripe cost gateway with corresponding entries in your accounting data. It ensuresthat the cash flowing via the Stripe account matches what what you are promoting expects, leaving no room for discrepancies or errors.

Stripe can be utilized to automate the comparability of inside data like invoices with exterior knowledge equivalent to settlement recordsdata and financial institution statements, lowering guide effort and errors. Day by day money monitoring supplies real-time insights into money positions, very important for efficient monetary administration. Swift identification of discrepancies prevents income leaks, whereas transaction life cycle visibility ensures thorough monitoring. Sturdy monetary controls are carried out via automated reconciliation and detailed transaction monitoring, safeguarding towards errors and fraud. Stripe’s scalable options accommodate rising transaction volumes and complexities, making it invaluable for companies with dynamic monetary wants.

How are transactions processed via Stripe?

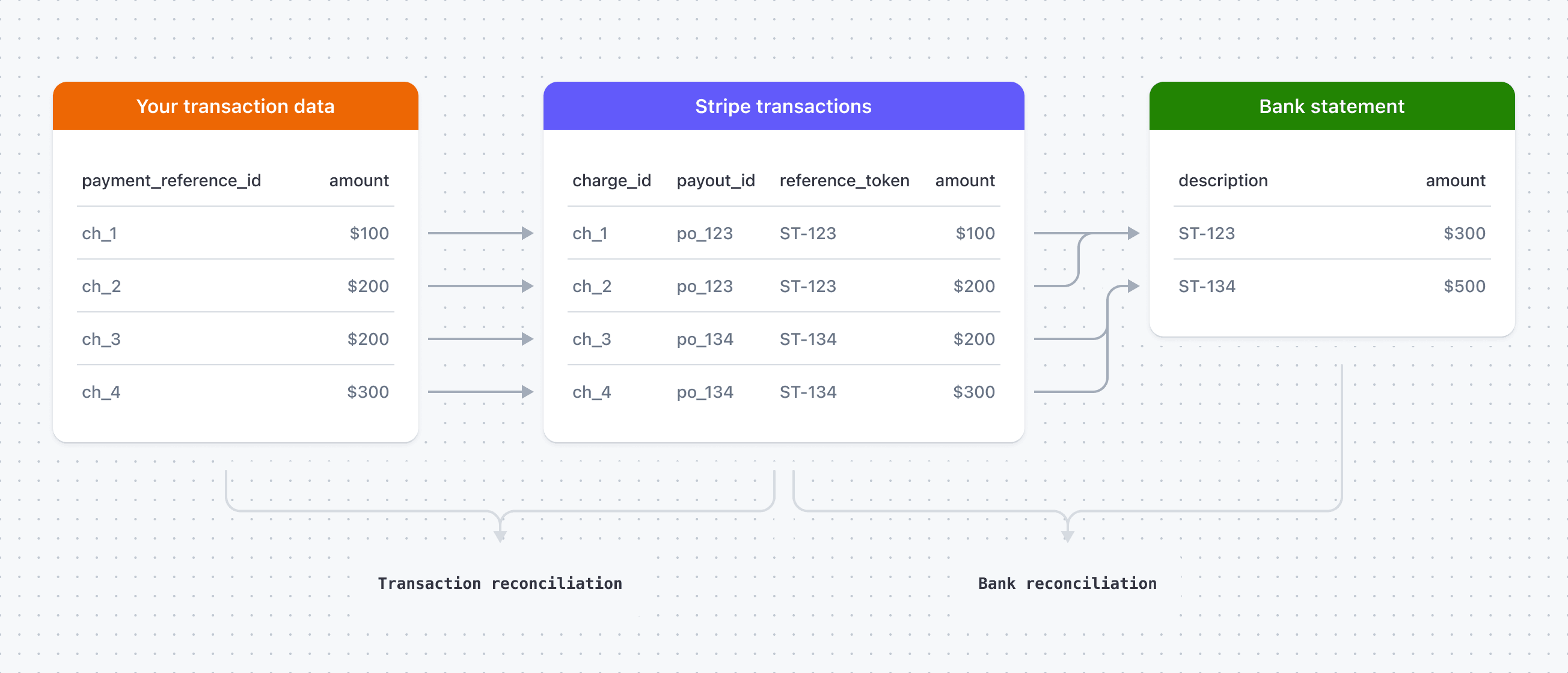

Stripe harnesses three major datasets in its reconciliation efforts:

- The corporate’s transaction knowledge: This encompasses inside data of funds, equivalent to gross sales data or invoices, reflecting the gross quantity for every transaction saved inside your system. Stripe makes use of this knowledge to estimate anticipated gross quantities for transactions and to create cost expectations.

- Stripe transactions: These are confirmations of cash motion generated by Stripe, encompassing expenses, refunds, or payouts processed via the platform. This knowledge is robotically fetched into the reconciliation workspace each 12 hours, offering real-time insights into transactional exercise.

- Financial institution statements: These statements validate the cash motion claimed by Stripe in your checking account. Stripe immediately fetches this knowledge via Monetary Connections every day, making certain alignment between Stripe’s data and precise financial institution deposits.

Stripe reconciliation facilitates three kinds of reconciliations:

- Financial institution reconciliation: Aligns payouts made by Stripe with money deposits in your checking account, requiring entry to your financial institution assertion via Monetary Connections.

- Transaction reconciliation: Allows reconciliation of particular person Stripe transactions with inside data, making certain consistency and figuring out any discrepancies between the 2 datasets.

- Mixture of transaction and financial institution reconciliation: Tracks the whole lifecycle of transactions from initiation to financial institution deposit, offering a complete overview of monetary operations.

By establishing this three-way reconciliation course of, companies can meticulously monitor data throughout methods, validate knowledge accuracy, and guarantee monetary integrity earlier than updating their books, empowering them with enhanced transparency and effectivity in managing on-line transactions.

Sorts of transactions supported by Stripe

From conventional card funds to rising cost strategies, Stripe’s versatility allows companies to streamline income streams, automate monetary processes, and embrace unified commerce fashions.

- Card Funds: Stripe helps a variety of card funds, together with credit score and debit playing cards, permitting companies to simply accept funds from prospects worldwide securely.

- ACH Debits: Ideally suited for recurring funds or subscription-based fashions, ACH debits allow companies to withdraw funds immediately from prospects’ financial institution accounts.

- Financial institution Transfers: Stripe facilitates Euro financial institution transfers, offering prospects with the flexibleness to pay immediately from their financial institution accounts, enhancing comfort and lowering transaction prices.

- Various Cost Strategies: Stripe integrates with a plethora of other cost strategies equivalent to Alipay, Apple Pay, and Blik, catering to the preferences of various buyer demographics and enhancing checkout experiences.

- Clearpay and Affirm: With Clearpay for purchase now pay later choices and Affirm for versatile financing options, Stripe empowers companies to supply versatile cost phrases, driving conversion charges and buyer satisfaction.

- Dispute Dealing with: Stripe supplies sturdy dispute dealing with mechanisms, enabling companies to effectively handle and resolve cost disputes, safeguarding income and sustaining buyer belief.

- Income and Finance Automation: Stripe’s suite of income and finance automation instruments streamlines processes equivalent to invoicing, billing, and income recognition, empowering companies to optimize money circulation and monetary operations.

- Unified Commerce: Whether or not for skilled companies, SaaS, or subscription-based companies, Stripe gives unified commerce options that seamlessly combine with present workflows, enabling companies to handle all points of their operations from a single platform.

How one can Arrange Stripe Reconciliation?

Establishing of the Stripe Reconciliation course of usually includes the next steps:

- Add Transaction Information:

- Go to the Stripe Dashboard’s reconciliation overview web page.

- Click on on “Import knowledge”.

- Choose your file

- Click on “Import CSV”.

- Observe Progress:

- Monitor the progress of the import by clicking “View knowledge administration”.

- Perceive Reconciliation Information Schema:

- Make sure that the transaction knowledge meets Stripe’s required fields to transform it to the canonical reconciliation schema.

- Automated Reconciliation:

- As soon as knowledge is imported, reconciliation begins robotically.

- Every transaction receives a reconciliation standing based mostly on its alignment with Stripe data and financial institution statements.

- Configure Thresholds:

- Configure reconciliation thresholds for settlement and transaction reconciliation in accordance with your particular necessities.

- Monitor Reconciliation Statuses:

- Recurrently examine reconciliation statuses for each settlement and transaction reconciliation.

- Perceive the implications of various reconciliation statuses, equivalent to “Utterly matched”, “Partially matched”, “Unmatched”, “Settled”, “In course of”, “Open”, and “Overseas”.

- View Analytics:

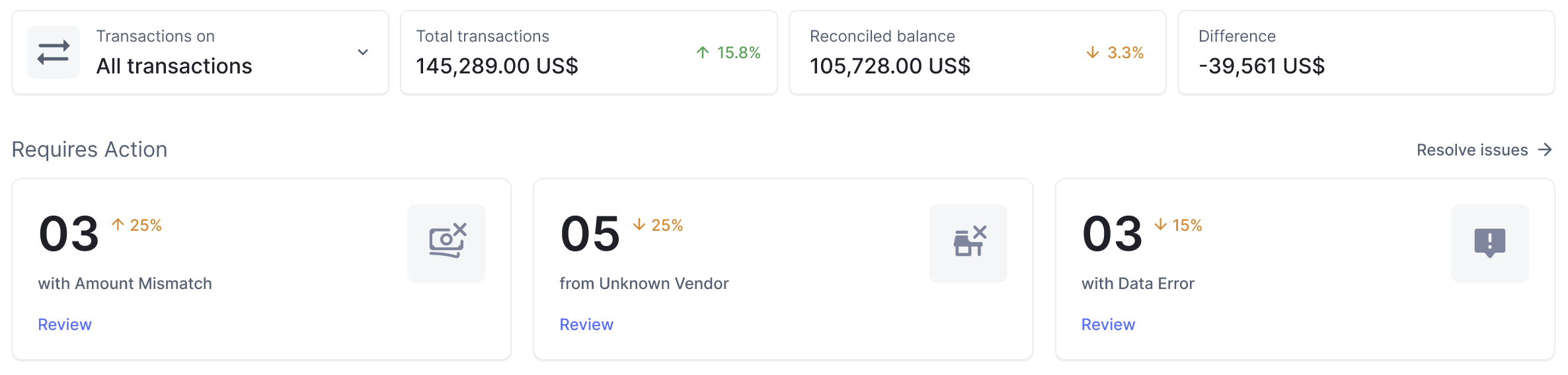

- Make the most of the reconciliation analytics web page to realize high-level insights into what you are promoting’s cash motion.

- Analyze charts for reconciliation standing and growing older summaries to trace fund disbursement and adherence to service stage agreements (SLAs).

- Generate Reviews:

- Entry commonplace studies from the Stripe Dashboard, together with reconciliation end result studies, settlement stage studies, and transaction-level search studies.

- Customise report varieties and filters to acquire particular insights into transaction reconciliation, pay-in reconciliation, and settlement reconciliation.

- Obtain Reviews:

- Generate and obtain studies to evaluate transaction reconciliation statuses, pay-in reconciliation outcomes, and settlement particulars.

- Use these studies to validate monetary transactions, determine discrepancies, and optimize monetary processes.

Finest Practices for Stripe Reconciliation

To harness the complete potential of Stripe Reconciliation, companies ought to adhere to a set of finest practices aimed toward optimizing effectivity and mitigating dangers.

- Constant Reconciliation: Routine cost reconciliation ensures a daily cadence. This proactive method empowers companies to swiftly determine and rectify errors or inconsistencies, sustaining the integrity of monetary knowledge.

- Division of duties: Errors and fraud could be mitigated by dividing duties. Transaction recording and account reconciliation could be segregatedd to determine a sturdy system of checks and balances inside the organizational framework.

- Standardize Operations: The design of standardized procedures for reconciliation fosters uniformity and precision. It helps to doc these protocols and guarantee adherence throughout the organizational spectrum.

- Thorough Documentation: Full data of the reconciliation course of present complete insights and facilitate audits. These detailed accounts function invaluable references, providing historic context and aiding in error decision.

- Swift Response to Discrepancies: Discrepancies have to be promptly addressed, errors rectified and funds recuperated when essential. Speedy intervention is essential to upholding monetary accuracy and trustworthiness.

- Worker Empowerment: All stakeholders have to be skilled to make use of the system. Familiarizing them with accounting ideas, rules, and the operation of Stripe, ensures proficiency and efficacy of their roles.

- Implement Oversight Mechanisms: A sturdy evaluate and approval course of is important for reconciliation studies, instilling a further layer of scrutiny and making certain thoroughness.

- Fortify Safety Measures: Monetary data and methods have to be secured by proscribing entry to approved personnel and instituting stringent safety protocols. Delicate data have to be protected against unauthorized entry.

- Steady analysis and testing: Steady analysis and refinement of the reconciliation course of, benchmarking towards trade requirements and searching for avenues for enchancment fosters continuous progress and operational excellence.

- Open Channels of Communication: Clear communication channels have to be maintained with pertinent stakeholders, together with banks and distributors. This facilitates seamless concern decision and ensures entry to important data for knowledgeable decision-making.

Automate Reconciliation with Stripe and Nanonets

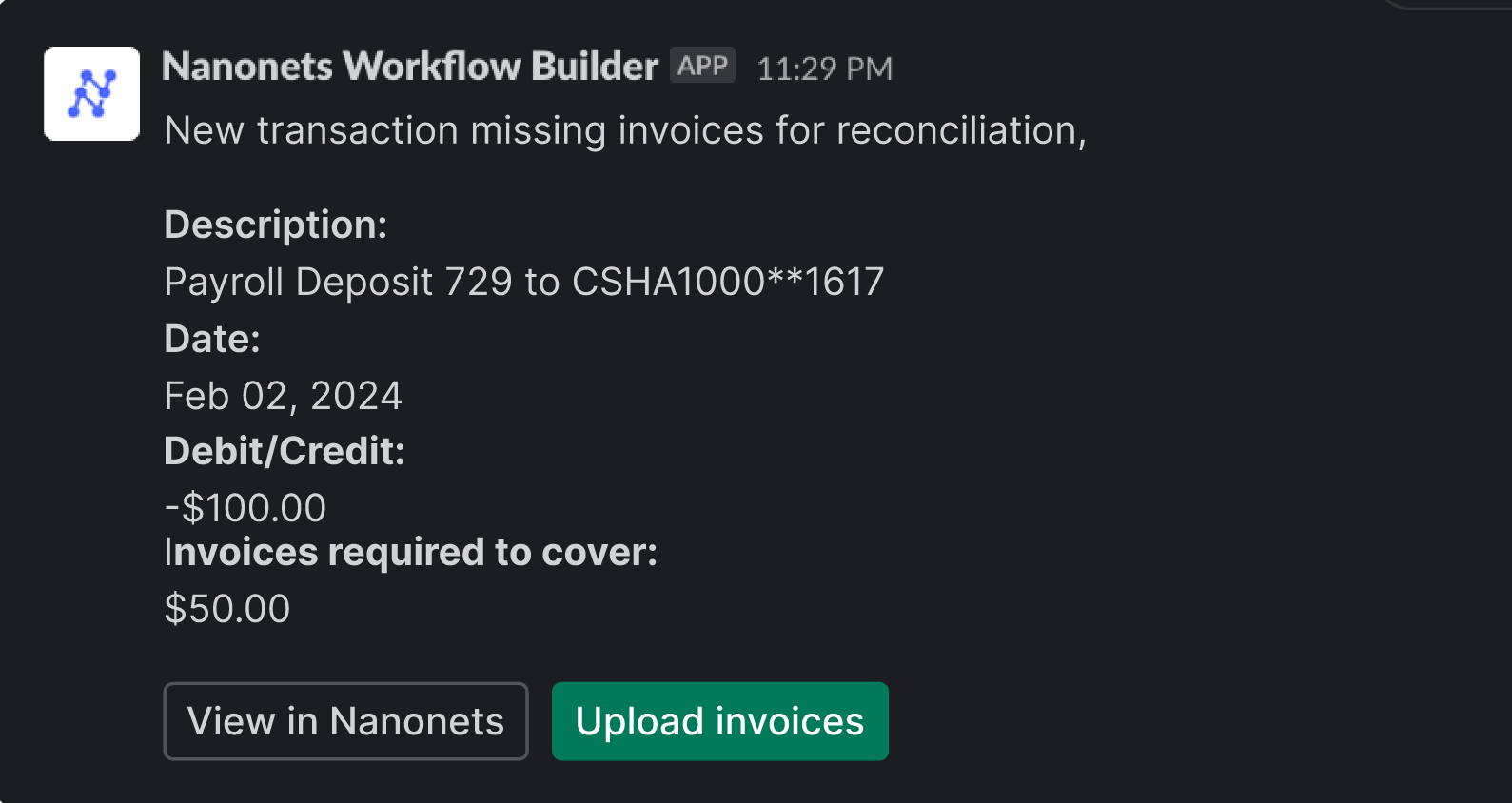

Nanonets (as talked about above) gives AI-powered options for automating account reconciliation processes, enabling companies to streamline operations, scale back guide effort, and enhance accuracy. Moreover, Nanonets integrates seamlessly with Stripe, offering companies with a complete resolution for monetary administration and account reconciliation.

Key advantages of Nanonets for automated account reconciliation:

- Automated Information Extraction: Nanonets leverages superior Optical Character Recognition (OCR) know-how to robotically extract related knowledge from invoices, financial institution statements, receipts, and different monetary paperwork. This eliminates the necessity for guide knowledge entry and reduces the danger of errors, making certain correct reconciliation.

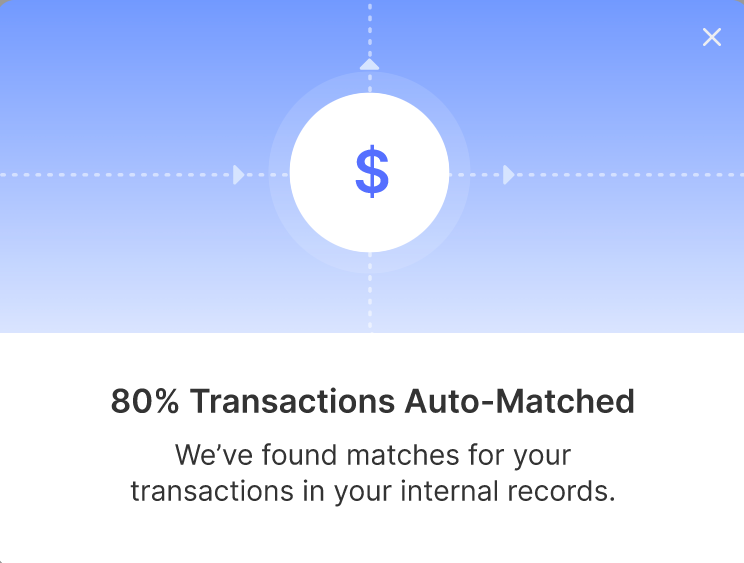

- Clever Information Matching: With Nanonets’ AI algorithms, you’ll be able to match transactions throughout completely different methods and determine discrepancies with precision. The system intelligently analyses transaction knowledge, identifies patterns, and reconciles accounts effectively, saving beneficial time and sources.

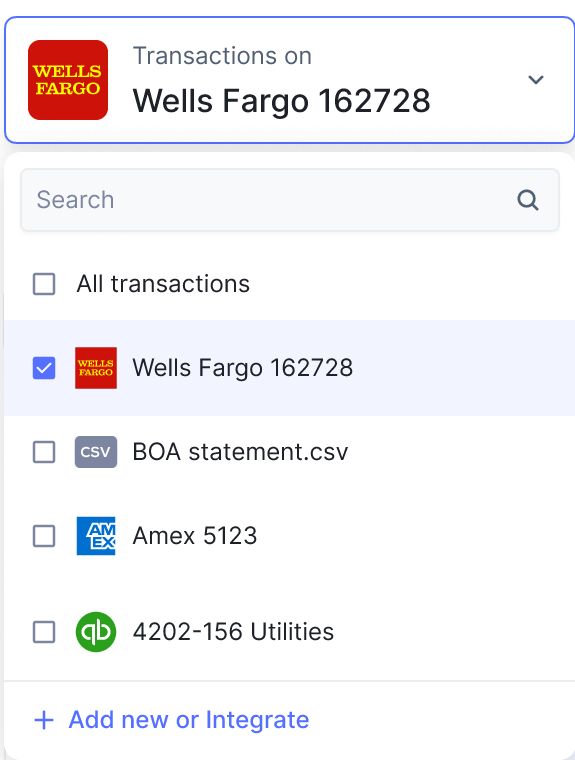

- Seamless Integration: Nanonets simply integrates with Stripe and different accounting software program, permitting for seamless knowledge trade and synchronisation. This integration streamlines the reconciliation course of, enhances knowledge accuracy, and ensures consistency throughout monetary methods.

- Customizable Workflows: Nanonets gives customizable workflows that may be tailor-made to your particular reconciliation necessities. Whether or not it’s good to reconcile massive volumes of transactions or handle advanced accounts, Nanonets’ versatile workflow automation capabilities can adapt to your distinctive enterprise wants.

- Actual-Time Reporting: Nanonets supplies real-time visibility into the reconciliation course of, permitting you to observe progress, monitor discrepancies, and generate complete studies. This real-time perception allows proactive decision-making, improves monetary transparency, and enhances compliance.

With Nanonets, companies can obtain higher effectivity, accuracy, and compliance of their reconciliation processes.

Conclusion

Leveraging Stripe reconciliation empowers companies to keep up a agency grip on their monetary operations. With this software, companies can monitor each day money flows, swiftly determine and rectify discrepancies to stop income leakages, and acquire complete visibility into your complete lifecycle of every transaction. Stripe reconciliation facilitates the implementation of sturdy monetary controls, safeguarding companies towards errors and fraud. Its scalability ensures that companies can set up processes that develop with their increasing operations, providing flexibility and adaptableness to satisfy evolving wants. Stripe reconciliation can present companies with the instruments they should optimize effectivity, accuracy, and resilience of their monetary operations.

[ad_2]