[ad_1]

With Apple Card approaching 5 years previous, I believe it’s about time that we see some modifications with Apple’s first bank card. In spite of everything, Goldman Sachs is about to exit the Apple Card partnership throughout the subsequent yr, so Apple should discover a new companion financial institution. In that course of, it’s probably that we’ll see a pair modifications with the bank card.

Apple Card because it stands right now

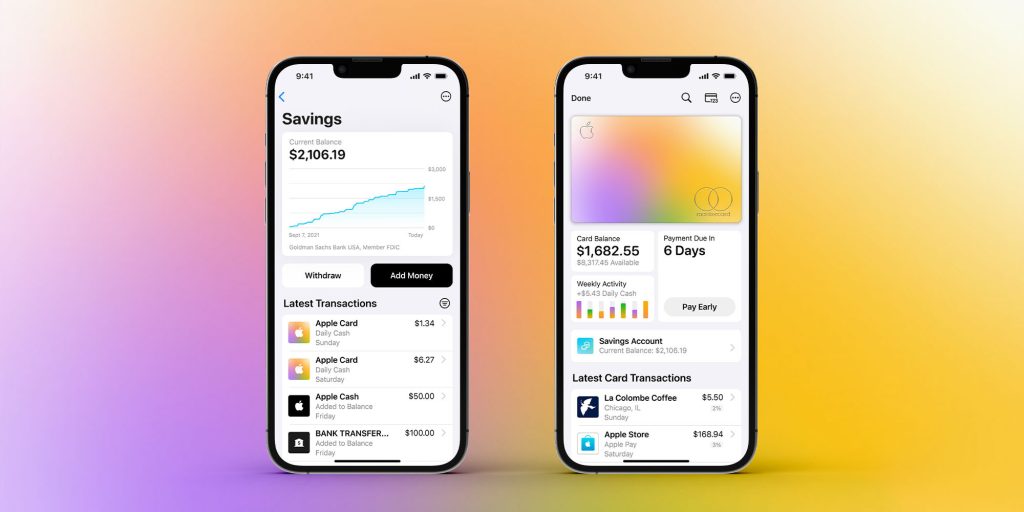

Apple Card launched in 2019, and on the time, it was a reasonably respectable bank card. It supplied 2% money again on all purchases with Apple Pay, and three% money again on Apple purchases. Apple offered a clear interface, making it simple for folks to grasp how their bank card really works. The cardboard additionally supplied no late charges or international transaction charges, which remains to be unusual for no annual payment playing cards, even right now.

Over time, Apple has added a pair issues to make the cardboard extra interesting, akin to 0% APR financing on Apple merchandise, in addition to increasing 3% money again to some companion retailers. They’ve additionally had varied promos infrequently, akin to one offering 6% again on EV charging for a restricted time. Nevertheless, with the quickly evolving bank card panorama, I believe Apple ought to add much more to the cardboard.

Growth of three% Every day Money

Proper now, Apple Card presents 3% again at Apple, Ace {Hardware}, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Cell, Uber, Uber Eats, and Walgreens. Whereas these companion retailers do aid you make more money again on some on a regular basis purchases, there’s so much to be desired with this record.

For one, Apple has no form of grocery retailer companions. Given the truth that the Apple Card has been liable for over $1 billion in losses for Goldman Sachs, I don’t anticipate Apple so as to add any form of widespread classes that cowl all grocery shops. Nevertheless, it’d be good to see some form of protection on this subject. They might companion with a nationwide retailer like Entire Meals or Dealer Joes, and even throw in one thing like Instacart for individuals who want getting their groceries delivered.

Quite a few standard bank cards provide rewards in your groceries, so it’d be good for Apple to supply one thing to compete, particularly since groceries are an enormous class of spend for most individuals.

Uber Eats is a pleasant companion to symbolize eating, since you possibly can set the app to pickup and successfully order any meals at regular restaurant pricing. If Apple might get some further companion eating places included on the record that’d be nice, though I wouldn’t anticipate a lot.

4% Every day Money at Apple

For the reason that Apple Card launched in 2019, some bank cards from American Categorical, Financial institution of America, and U.S. Financial institution have added 3% again (or extra) for on-line retail purchases, permitting you to earn the identical 3% at Apple; in addition to many different on-line shops, akin to Greatest Purchase and Amazon.

For that cause, I believe it’d be nice if Apple gave clients greater than 3% again on Apple. In spite of everything, different retailer playing cards present 5% money again on their purchases, such because the Amazon Prime Visa. I believe 4% can be a decent fee, particularly given how costly some Apple merchandise are.

Higher rewards with the Titanium card

Apple went out of their option to create one of the crucial premium bodily playing cards in the marketplace. They made it out of strong titanium, and it seems very clear – with no numbers or pointless textual content on the cardboard. It simply has your identify, alongside the Apple, Mastercard, and Goldman Sachs logos. Regardless of this reality, you aren’t actually incentivized to make use of this bodily card.

Apple Card earns 2% money again with Apple Pay, and only one% money again when utilizing the bodily card, which is just about backside of the barrel with regards to rewards bank cards. I’d nonetheless anticipate Apple to wish to incentivize folks to make use of Apple Pay, however it might be good if the bodily card earned 1.5% money again whenever you use it. It’s not the perfect within the recreation, but it surely’d undoubtedly make the cardboard extra interesting, particularly in case you typically go to locations that don’t settle for Apple Pay, like Walmart.

Higher approval course of for freshmen

It’s typically said that Apple Card is a superb bank card for these beginning off, primarily due to the clear design within the Pockets app. Apple Card makes it simple to grasp precisely how a lot curiosity you’ll be paying, and types your spending into totally different classes to assist with budgeting. In idea, this is able to stop bank card freshmen from getting themselves into unhealthy debt. Nevertheless, it doesn’t really work like that in apply.

In actuality, it’s fairly onerous to get accredited in case you’re youthful, even when you’ve got good earnings. More than likely, in case you’re a university scholar, you’ll find yourself getting denied for the cardboard.

Goldman Sachs clearly needs folks with an honest quantity of established credit score, however I believe that’s form of counterintuitive to all the pieces concerning the Apple Card. Individuals with established credit score already probably perceive the way to keep away from curiosity costs and to pay their playing cards on time.

Even when Apple Card solely gave smaller $200-1000 limits to youthful customers with a scarcity of credit score historical past, it might be nice to see the cardboard develop into newbie pleasant. That manner, teenagers and younger adults would be capable to construct their credit score by way of Apple.

How do you are feeling concerning the Apple Card? Are there every other modifications you’d prefer to see? Tell us within the feedback beneath.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.

[ad_2]